Blank Wv Tax Exempt PDF Template

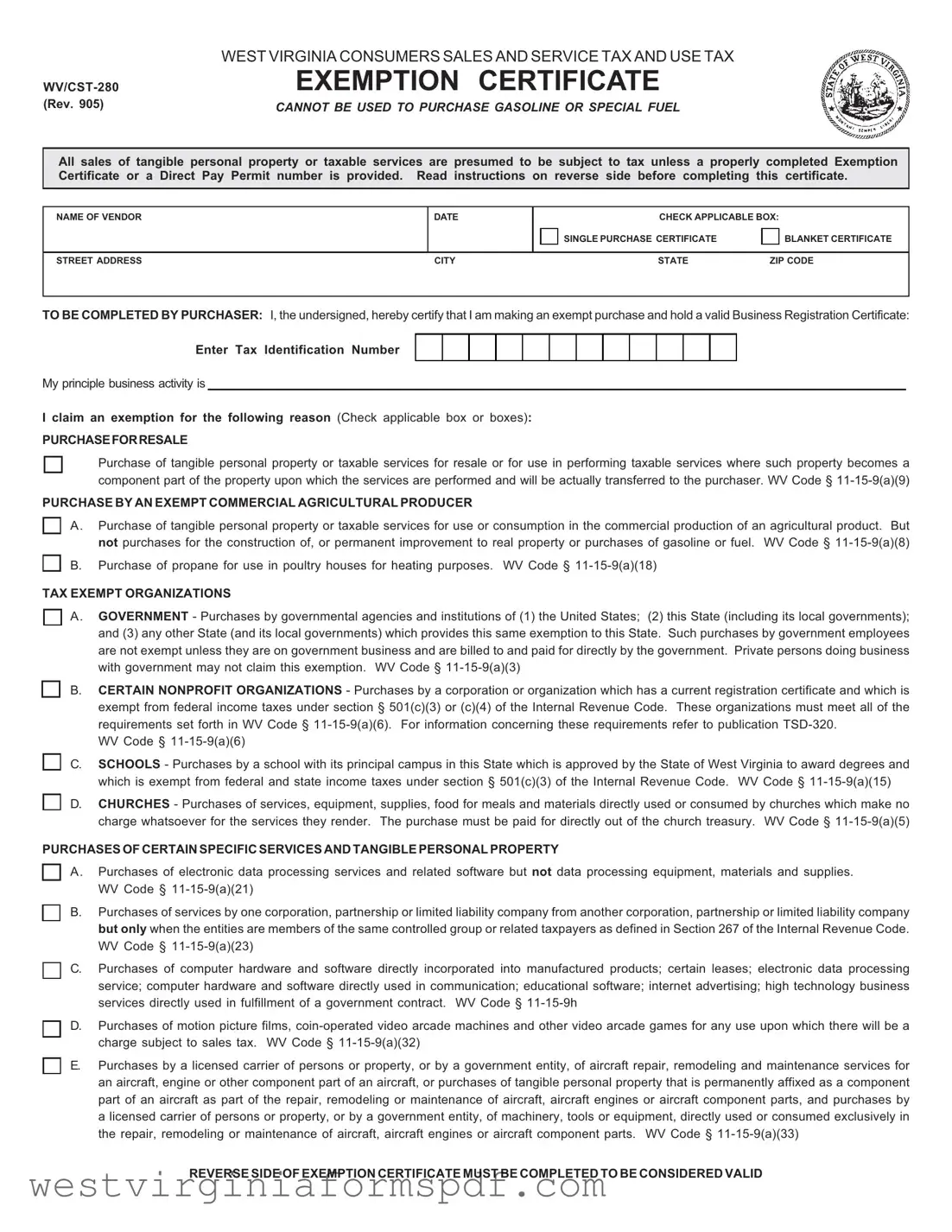

Understanding the West Virginia Consumers Sales and Service Tax and Use Tax Exemption Certificate (WV/CST-280) is essential for both buyers and sellers engaged in taxable transactions. This form allows eligible purchasers to make tax-exempt purchases of tangible personal property or services, provided they meet specific criteria outlined in the state's tax code. The exemption certificate cannot be used for purchasing gasoline or special fuel, and it requires the purchaser to hold a valid Business Registration Certificate. Buyers can choose between a single purchase certificate or a blanket certificate, which covers multiple transactions of the same type. The form includes sections for the vendor's information, the purchaser's details, and the specific reason for the exemption, such as purchases for resale or for use by exempt organizations like schools and churches. Importantly, the reverse side of the certificate must also be completed to ensure its validity. Misuse of this certificate can lead to significant penalties, making it crucial for both parties to understand their responsibilities when using or accepting this form.

Browse More Forms

West Virginia Residency - Tax preparers who file more than 25 returns must typically file electronically.

The use of the California ATV Bill of Sale form is essential for anyone engaging in the sale or purchase of an All-Terrain Vehicle within California, as it provides clarity and legality to the transaction. For those seeking a reliable template for this document, you can refer to toptemplates.info/bill-of-sale/atv-bill-of-sale/california-atv-bill-of-sale/, which outlines the necessary details to ensure that both parties understand and agree to the terms of sale.

Wv State Income Tax - The format of the IT-140 ensures clarity and organization, allowing taxpayers to follow along easily and understand what is required of them.

West Virginia Cpa - Space is provided for an email address on the form.

Form Attributes

| Fact Name | Details |

|---|---|

| Form Title | West Virginia Consumers Sales and Service Tax and Use Tax WV/CST-280 Exemption Certificate (Rev. 905) |

| Usage Restrictions | This certificate cannot be used to purchase gasoline or special fuel. |

| Tax Presumption | All sales of tangible personal property or taxable services are presumed to be subject to tax unless a properly completed Exemption Certificate or a Direct Pay Permit number is provided. |

| Governing Law | The use of this exemption certificate is governed by West Virginia Code § 11-15-9. |

| Purchaser Requirements | The purchaser must hold a valid Business Registration Certificate to claim an exemption. |

| Types of Exempt Purchases | Exemptions include purchases for resale, agricultural production, and certain nonprofit organizations. |

| Validity Condition | The reverse side of the exemption certificate must be completed for it to be considered valid. |

| Penalties for Misuse | Issuing a false certificate can result in penalties, including a 50% tax penalty and potential misdemeanor charges. |

| Record Keeping | Vendors must keep the exemption certificate for at least three years after the due date of the last return related to the sale. |

Similar forms

The IRS Form 990 is a document that tax-exempt organizations in the United States must file annually. It provides a comprehensive overview of the organization's financial activities, governance, and compliance with federal tax laws. Similar to the West Virginia Tax Exempt form, it is designed to ensure transparency and accountability among non-profit entities. Both forms require detailed information about the organization’s activities and financial status, which helps maintain public trust and adherence to legal standards.

In navigating the complexities of tax exemption, it can be beneficial to access resources and templates that streamline the process, such as those available at smarttemplates.net, which may provide additional insights or tools related to various forms including the FedEx Release Form.

The IRS Form 1023 is the application for tax-exempt status under section 501(c)(3) of the Internal Revenue Code. Organizations seeking this status must provide extensive information about their purpose, governance, and planned activities. Like the West Virginia Tax Exempt form, it emphasizes the need for proper documentation and compliance to qualify for tax exemptions. Both forms aim to establish the legitimacy of the organization’s claims for exemption, ensuring that only eligible entities benefit from such status.

The Sales Tax Exemption Certificate used in many states serves a similar purpose to the West Virginia form. This certificate allows businesses to make purchases without paying sales tax if the items are intended for resale or are otherwise exempt. Both documents require the purchaser to certify that the purchase meets specific criteria for exemption. They also protect vendors by requiring proper documentation to avoid liability for unpaid taxes.

The Direct Pay Permit is another document that allows certain businesses to purchase goods or services without paying sales tax at the time of purchase. Instead, the businesses report and pay the tax directly to the state. This system is akin to the West Virginia Tax Exempt form, as both serve to streamline tax compliance for eligible entities while ensuring that tax obligations are ultimately met.

The Nonprofit Organization Exemption Certificate is utilized by qualifying nonprofits to purchase goods and services without incurring sales tax. Similar to the West Virginia Tax Exempt form, this certificate requires the organization to demonstrate its tax-exempt status and the intended use of the purchased items. Both forms aim to facilitate the operations of nonprofit organizations while ensuring compliance with tax regulations.

The State Tax Exemption Application is a form that entities must complete to request sales tax exemption at the state level. This document, like the West Virginia form, requires detailed information about the entity's operations and purpose. Both applications are designed to evaluate whether the requesting organization qualifies for tax-exempt status based on specific criteria outlined by state law.

The Certificate of Exemption for Educational Institutions is another relevant document. This certificate allows schools and educational organizations to purchase goods and services without sales tax. It parallels the West Virginia Tax Exempt form by requiring proof of the institution's status and the intended use of the items purchased. Both forms aim to support educational initiatives by reducing financial burdens through tax exemptions.

The Government Purchase Exemption Certificate is used by government entities to make tax-exempt purchases. This document is similar to the West Virginia Tax Exempt form in that it requires the purchaser to certify that the transaction is for an exempt purpose. Both forms are essential for ensuring that public funds are used efficiently and in compliance with tax laws.

The Agricultural Exemption Certificate allows farmers and agricultural producers to purchase supplies and equipment without paying sales tax. This certificate is similar to the West Virginia Tax Exempt form, as both require the purchaser to demonstrate that the items will be used for exempt purposes. Both documents are vital for supporting the agricultural sector by minimizing tax burdens on essential purchases.

Finally, the Charitable Organization Exemption Certificate is used by organizations that provide charitable services. This certificate allows them to make tax-exempt purchases, similar to the West Virginia Tax Exempt form. Both forms require the organization to provide proof of their charitable status and the intended use of the purchased items, ensuring that tax exemptions are granted only to legitimate entities engaged in charitable work.

FAQ

What is the WV Tax Exempt Form?

The WV Tax Exempt Form, officially known as the West Virginia Consumers Sales and Service Tax and Use Tax Exemption Certificate (WV/CST-280), allows certain purchasers to buy tangible personal property or taxable services without paying sales tax. It is essential for businesses and organizations that qualify for tax exemptions under specific categories outlined by West Virginia law.

Who can use the WV Tax Exempt Form?

Eligible users of the WV Tax Exempt Form include:

- Businesses making purchases for resale.

- Exempt commercial agricultural producers.

- Government agencies and institutions.

- Nonprofit organizations with a 501(c)(3) or 501(c)(4) status.

- Approved educational institutions.

- Churches making purchases for exempt services.

Each category has specific conditions that must be met to qualify for the exemption.

How do I complete the WV Tax Exempt Form?

To complete the form, follow these steps:

- Fill in your name and address as the purchaser.

- Provide your Business Registration Certificate number.

- Check the applicable exemption reason(s) on the form.

- Sign the form, including your title and date.

Ensure that all sections are filled out accurately to avoid issues during the purchase.

Can I use the form for any purchase?

No, the WV Tax Exempt Form cannot be used for all purchases. It is specifically designed for tangible personal property or services that will be used for exempt purposes. Notably, it cannot be used for purchasing gasoline or special fuel.

What happens if I misuse the WV Tax Exempt Form?

Misusing the form can lead to serious consequences. If you use the certificate for non-exempt purchases, you may be liable for the sales tax, along with penalties and interest. Additionally, willful issuance of a false certificate can result in misdemeanor charges.

How long should vendors keep the WV Tax Exempt Form on file?

Vendors are required to keep the completed WV Tax Exempt Form for at least three years from the due date of the last tax return related to the exempt sale. This ensures that there is a record in case of audits or inquiries from tax authorities.

What if I have more questions about the form?

If you have further questions, it’s best to consult the West Virginia Department of Tax and Revenue or a tax professional. They can provide guidance tailored to your specific situation and help ensure compliance with all tax regulations.

Documents used along the form

The West Virginia Tax Exempt form, officially known as the WV/CST-280 Exemption Certificate, is essential for individuals and organizations seeking to make tax-exempt purchases. However, several other forms and documents often accompany this certificate to ensure compliance with state tax regulations. Below is a list of these related documents, each serving a specific purpose in the tax exemption process.

- Business Registration Certificate: This document verifies that a business is registered to operate in West Virginia. It is required to claim tax exemptions and must be presented alongside the Exemption Certificate.

- Direct Pay Permit: This permit allows businesses to pay sales tax directly to the state rather than to vendors at the point of sale. It can be used in place of the Exemption Certificate for qualifying purchases.

- Tax Identification Number (TIN): This number is issued by the IRS and is necessary for businesses to report taxes. It must be included on the Exemption Certificate to validate the exempt status of the purchase.

- Affidavit of Service Form: To confirm the delivery of important documents, utilize the comprehensive affidavit of service document template that ensures all parties have received necessary paperwork.

- Nonprofit Organization Certification: Nonprofits seeking tax exemptions must provide proof of their tax-exempt status under sections § 501(c)(3) or § 501(c)(4) of the Internal Revenue Code. This certification confirms eligibility for tax exemption.

- Government Purchase Order: This document is used by governmental entities to authorize purchases. It serves as proof that the purchase is for government use, thereby qualifying for tax exemption.

- Sales Tax Exemption Letter: Some organizations may need a letter from the state tax authority confirming their tax-exempt status. This letter can be presented to vendors to facilitate tax-exempt purchases.

- Invoices or Receipts: These documents must reflect the purchaser's name and business registration number when claiming exemptions. They serve as proof of the transaction and must be retained for record-keeping purposes.

- Exempt Use Certificate: This certificate is sometimes required for specific types of purchases, such as machinery or equipment, to confirm that the items will be used for exempt purposes.

Understanding these documents and their purposes can help ensure a smooth tax-exempt purchasing process. Always keep these forms organized and readily accessible to avoid any potential issues with tax compliance.

Dos and Don'ts

When filling out the West Virginia Tax Exempt form, there are important guidelines to follow. Here’s a list of things you should and shouldn’t do to ensure the process goes smoothly.

- Do read the instructions carefully before starting. Understanding what is required will help you avoid mistakes.

- Do provide all necessary information, including your Business Registration Certificate number and the reason for your exemption. Incomplete forms may be rejected.

- Do ensure that the purchases you are claiming as tax exempt are indeed for exempt purposes, as specified on the form.

- Do keep a copy of the completed form for your records. This can be helpful if there are any questions later on.

- Don't use the exemption certificate for purchases that do not qualify for tax exemption. Misuse can lead to penalties.

- Don't submit a blank form. Every section must be filled out correctly to avoid delays or issues.

- Don't forget to sign the form. An unsigned certificate is not valid and may be considered incomplete.

- Don't assume that the exemption applies to all purchases. Review the specific exemptions listed to ensure compliance.