Blank Wv Spf 100 PDF Template

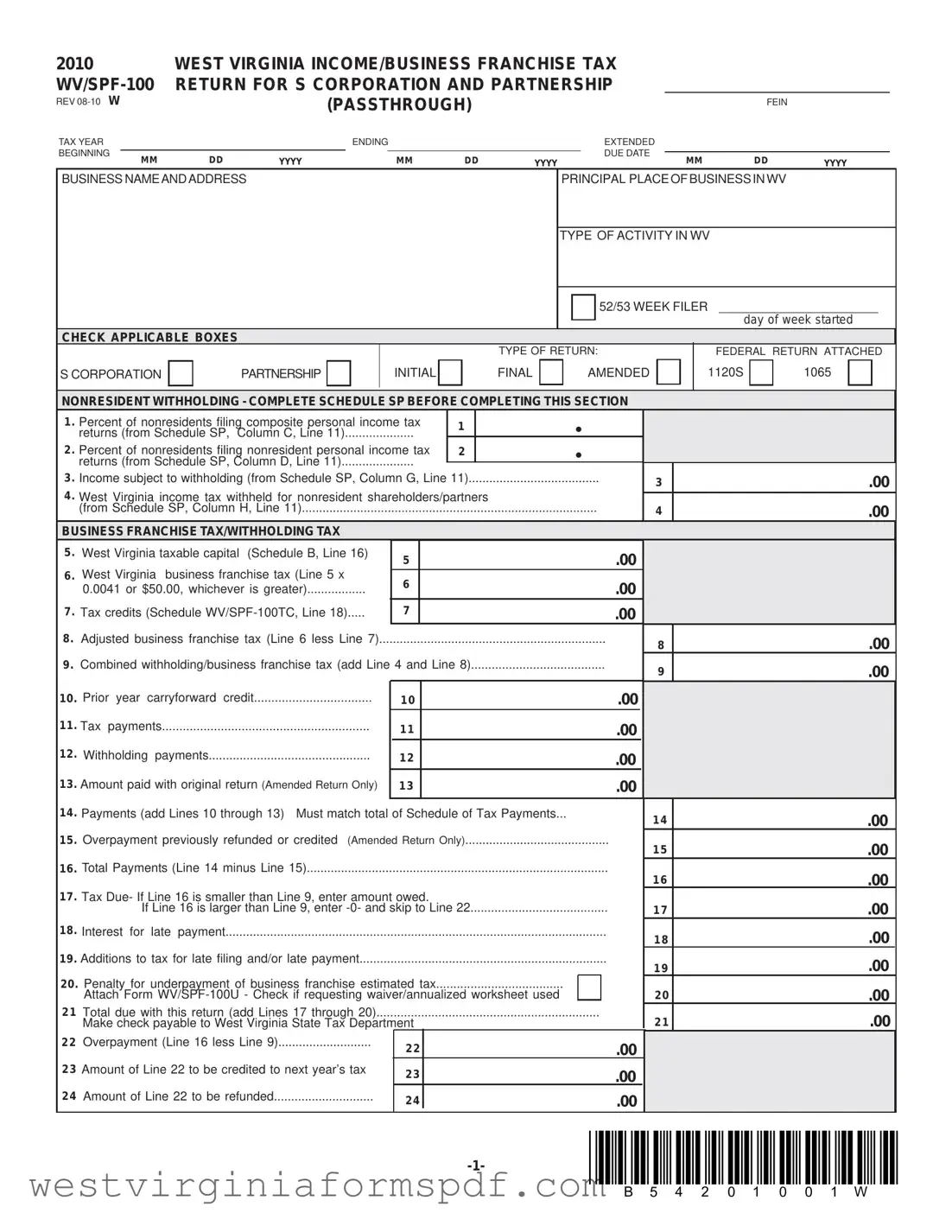

The WV SPF-100 form is a crucial document for S corporations and partnerships operating in West Virginia, serving as the official return for income and business franchise tax. This form is essential for reporting various financial details, including income, deductions, and tax liabilities for the specified tax year. Notably, it requires information such as the business name, address, and type of activity conducted within the state. Taxpayers must also indicate whether the return is initial, final, or amended, and attach the appropriate federal returns, such as Form 1120S or 1065, as needed. Additionally, the form collects data on nonresident withholding, allowing businesses to report income subject to withholding tax and any tax credits applicable. The calculation of West Virginia taxable capital is another critical aspect, as it determines the business franchise tax owed. Completing the WV SPF-100 accurately and timely is vital to avoid penalties and ensure compliance with state tax regulations. As the due date approaches, it's important for businesses to gather all necessary information and prepare this form diligently to fulfill their tax obligations effectively.

Browse More Forms

How to Become a Resident of West Virginia - If filing jointly, both spouses' information must be included on the form.

West Virginia Residency - This form should be completed if your tax preparer did not request electronic filing.

The importance of having a Power of Attorney for a Child cannot be understated, as it provides critical legal authority for decision-making in the absence of a parent or guardian. This document plays a significant role in ensuring that a child's needs are adequately addressed during emergencies or temporary situations where the primary caregiver is not available.

Injured Spouse Claim - Required to show that you earned income reported on a joint tax return.

Form Attributes

| Fact Name | Description |

|---|---|

| Form Title | The form is titled "West Virginia Income/Business Franchise Tax WV/SPF-100 Return for S Corporation and Partnership." It is used for tax reporting by S Corporations and Partnerships in West Virginia. |

| Tax Year | This form is applicable for the tax year ending in 2010, as indicated in the title. |

| Governing Laws | The form is governed by West Virginia Code §11-24-6 and §11-23-3(b)(2), which outline the requirements for business franchise tax and income tax. |

| Filing Requirements | Taxpayers must complete all sections of the form. Incomplete submissions will not be accepted as timely filed. |

| Types of Returns | The form allows for initial, final, and amended returns. It also requires the selection of the appropriate return type at the beginning of the form. |

| Tax Credits | Taxpayers may claim tax credits by completing Schedule WV/SPF-100TC. These credits can reduce the overall tax liability. |

| Payment Instructions | Payments should be made payable to the West Virginia State Tax Department. Specific instructions for payment are included on the form. |

| Signature Requirement | The form must be signed by an officer, partner, or member of the business, confirming the accuracy of the information provided. |

Similar forms

The IRS Form 1120S is a crucial document for S Corporations, similar to the WV SPF 100 form. Both forms are used to report income, deductions, and credits for S Corporations. The 1120S specifically focuses on federal tax obligations, while the WV SPF 100 addresses state-level taxes in West Virginia. Each form requires detailed financial information, including income and expenses, and both must be filed annually. Understanding the similarities between these forms can help S Corporations navigate their tax responsibilities more effectively.

Form 1065, the U.S. Return of Partnership Income, shares similarities with the WV SPF 100 form in that it is designed for partnerships to report their income and expenses. Like the SPF 100, the 1065 allows partnerships to pass through income to partners, who then report it on their individual tax returns. Both forms require detailed financial reporting and include sections for deductions and credits. By comparing these forms, partnerships can better manage their tax filings at both the federal and state levels.

The Schedule K-1, which accompanies both the 1120S and the 1065, is another document that aligns with the WV SPF 100 form. Schedule K-1 provides detailed information about each partner's or shareholder's share of income, deductions, and credits. This document is essential for individual tax reporting and complements the information found on the WV SPF 100. Understanding the interplay between these forms can ensure accurate tax reporting for all parties involved.

Understanding the tax obligations of businesses can be complex, especially in relation to the specific forms required by different jurisdictions. For instance, the use of forms like the WV/SPF-100 and its counterparts ensures that businesses remain compliant with local tax laws while accurately reporting their financial standings. Resources like smarttemplates.net can provide guidance on handling similar documentation required for various formalities, underlining the importance of proper paperwork in business operations.

The West Virginia Business Franchise Tax Return is closely related to the WV SPF 100 form as it specifically addresses the business franchise tax obligations for entities operating in West Virginia. Both forms require similar financial information and calculations to determine tax liabilities. The WV Business Franchise Tax Return focuses on the capital and income of the business, paralleling the SPF 100's aim to capture the financial health of S Corporations and partnerships in the state.

The Nonresident Withholding Tax Return is another document that bears similarities to the WV SPF 100 form. This return is used to report and pay taxes withheld from nonresident partners or shareholders in a business. Like the SPF 100, it requires precise calculations and reporting of income subject to withholding. Both forms aim to ensure compliance with state tax laws while addressing the unique considerations of nonresident taxation.

Lastly, the West Virginia Schedule SP is akin to the WV SPF 100 form, as it is used to report composite personal income tax for nonresident individuals. This schedule complements the SPF 100 by providing additional details on income sourced from West Virginia. Both documents are essential for accurately reporting tax obligations and ensuring that nonresidents fulfill their tax responsibilities in the state.

FAQ

What is the WV SPF 100 form?

The WV SPF 100 form is the West Virginia Income/Business Franchise Tax Return specifically designed for S Corporations and Partnerships. This document is essential for reporting income and calculating taxes owed to the state of West Virginia. It includes various sections that require detailed financial information, including income, deductions, and tax credits.

Who needs to file the WV SPF 100 form?

Any S Corporation or Partnership that conducts business in West Virginia is required to file the WV SPF 100 form. This applies to both resident and nonresident entities. If your business has generated income in West Virginia, you must complete and submit this form to ensure compliance with state tax regulations.

What information is required to complete the form?

To complete the WV SPF 100 form, you will need to provide various pieces of information, including:

- Business name and address.

- Federal Employer Identification Number (FEIN).

- Type of business activity conducted in West Virginia.

- Income and deductions as reported on federal tax returns (Form 1120S for S Corporations or Form 1065 for Partnerships).

- Details of any tax credits being claimed.

Gathering this information in advance can help streamline the filing process.

What are the deadlines for filing the WV SPF 100 form?

The deadline for filing the WV SPF 100 form typically aligns with the federal tax return deadlines. For most S Corporations and Partnerships, this means the form is due on the 15th day of the third month following the end of the tax year. If you are unable to meet this deadline, you may apply for an extension, but be aware that any taxes owed must still be paid by the original due date to avoid penalties.

What happens if I do not file the WV SPF 100 form?

Failing to file the WV SPF 100 form can result in significant consequences, including penalties and interest on any unpaid taxes. The West Virginia State Tax Department may also take further action, such as placing liens on business assets or initiating collection proceedings. It is crucial to file the form on time to avoid these issues.

Can I amend a previously filed WV SPF 100 form?

Yes, if you need to make corrections to a previously filed WV SPF 100 form, you can submit an amended return. This is done by checking the "Amended" box on the form and providing the corrected information. Ensure that you also include any necessary schedules or documentation to support your amendments.

What are the tax rates applied on the WV SPF 100 form?

The tax rates for the West Virginia business franchise tax are generally based on the taxable capital of the business. The minimum tax is set at $50, while the rate is calculated at 0.0041 of the taxable capital. It's important to accurately determine your taxable capital to ensure the correct tax amount is calculated.

Where should I send the completed WV SPF 100 form?

Once you have completed the WV SPF 100 form, it should be mailed to the West Virginia State Tax Department, specifically to the Tax Account Administration Division. The mailing address is:

West Virginia State Tax Department

Tax Account Administration Division

PO Box 11751

Charleston, WV 25339-1751

Ensure that you send it well before the deadline to allow for processing time.

Can I get help with completing the WV SPF 100 form?

If you find the process of completing the WV SPF 100 form challenging, assistance is available. You may consider consulting with a tax professional or a legal document preparer who specializes in business taxes. Additionally, the West Virginia State Tax Department offers resources and guidance on their website to help you understand the requirements and complete the form accurately.

Documents used along the form

The WV SPF 100 form is an essential document for S Corporations and Partnerships in West Virginia. Along with this form, several other documents may be required to ensure compliance with state tax regulations. Below is a list of commonly used forms that accompany the WV SPF 100.

- Federal Form 1120S: This form is used by S Corporations to report income, deductions, and credits to the IRS. It provides a detailed account of the corporation's financial activities for the tax year.

- IRS W-9 Form: This form is necessary for confirming taxpayer identification numbers (TINs) and is essential in situations where income is paid or financial transactions are reported to the IRS. For more information, visit TopTemplates.info.

- Federal Form 1065: Partnerships utilize this form to report their income, deductions, gains, and losses. It is essential for determining each partner's share of the income or loss.

- Schedule SP: This schedule is specifically for nonresident withholding. It outlines the amounts withheld from nonresident shareholders or partners and is necessary for accurate tax reporting.

- Schedule WV/SPF-100TC: This schedule is used to claim tax credits related to the business franchise tax. It helps in calculating any credits that may reduce the overall tax liability.

- Form WV/SPF-100APT: This form calculates the apportionment of income for businesses operating in multiple states. It is crucial for determining the taxable income allocated to West Virginia.

Each of these forms plays a vital role in the overall tax filing process for S Corporations and Partnerships in West Virginia. Ensuring that all necessary documents are completed accurately can help prevent delays and ensure compliance with state tax laws.

Dos and Don'ts

When filling out the WV SPF 100 form, it is essential to follow certain guidelines to ensure accuracy and compliance. Here are four important dos and don'ts:

- Do double-check all entries for accuracy before submission.

- Do ensure that all required sections of the form are completed.

- Don't leave any fields blank; an incomplete form may be rejected.

- Don't forget to attach any necessary schedules or supporting documents.