Blank Wv Nrw 4 PDF Template

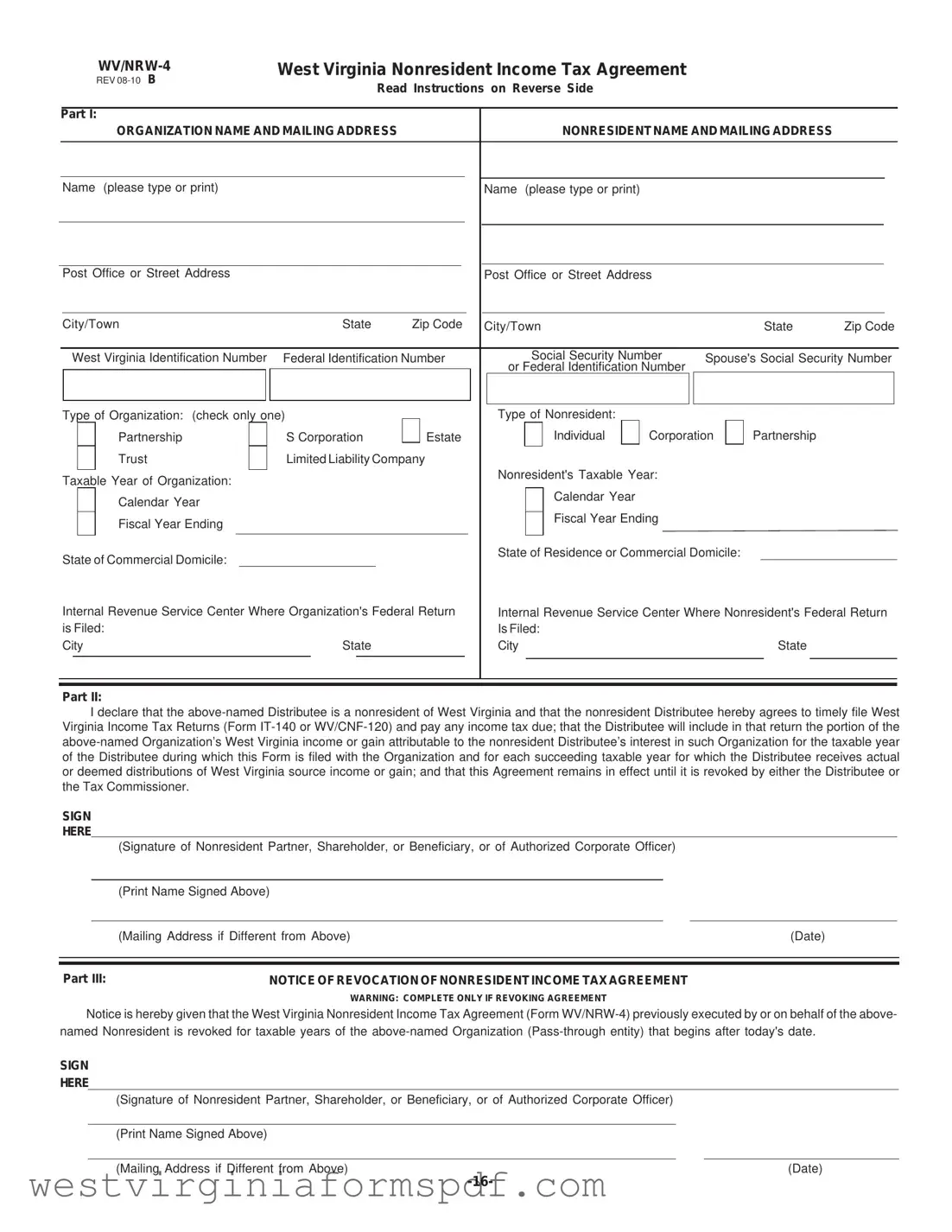

The WV/NRW-4 form serves as a crucial document for nonresidents earning income from West Virginia sources. It facilitates the agreement between nonresident individuals or corporations and organizations such as partnerships, S corporations, estates, trusts, and limited liability companies. By completing this form, nonresidents can avoid automatic withholding of West Virginia income tax on distributions they receive. The form requires essential information, including the names and addresses of both the nonresident and the organization, along with identification numbers. Nonresidents must also declare their agreement to file the appropriate West Virginia income tax returns and pay any taxes due on their share of income or gains from the organization. This agreement remains effective until revoked, providing a streamlined process for managing tax obligations. Additionally, the form outlines the procedure for revocation, ensuring that both parties are aware of their responsibilities and rights. Understanding the details of the WV/NRW-4 form is essential for nonresidents seeking to navigate their tax obligations in West Virginia efficiently.

Browse More Forms

Courtswv - The application process is designed to be efficient and supportive for both parties.

The important Power of Attorney for a Child form allows parents to assign temporary care responsibilities to trusted adults, ensuring that children's needs are appropriately met during times when the primary guardians are unavailable.

Personal Property Tax Exemption Affidavit Wv - The information on this form contributes to the state’s revenue management and compliance efforts.

Wv Court Forms - If any part of the case is confidential, that must be identified with authority for such confidentiality.

Form Attributes

| Fact Name | Fact Description |

|---|---|

| Form Title | The form is titled "WV/NRW-4 West Virginia Nonresident Income Tax Agreement." |

| Governing Law | This form is governed by W.Va. Code § 11-21-71a. |

| Filing Requirement | Nonresident individuals or C corporations must file this form to avoid income tax withholding. |

| Deadline for Filing | The form must be filed with the Organization by the last day of the Organization’s taxable year. |

| Withholding Tax Rate | The withholding tax rate is 6.5% on distributions of West Virginia source income. |

| Duration of Agreement | The agreement remains in effect until revoked by the Nonresident Distributee or the Tax Commissioner. |

| Revocation Process | Revocation can be executed by completing and filing the form with the Organization. |

| Multiple Organizations | A separate form must be filed with each Organization if receiving income from multiple sources. |

| Tax Credit | The amount withheld by the Organization can be credited against the Distributee’s West Virginia income tax liability. |

| Filing Copies | Three copies of the form must be distributed: one for the Organization's tax return, one for retention, and one for the nonresident. |

Similar forms

The IRS Form W-8BEN is similar to the WV/NRW-4 form in that it serves to establish the foreign status of a nonresident and to claim benefits under an applicable tax treaty. Like the WV/NRW-4, the W-8BEN is used to avoid withholding taxes on certain types of income. Both forms require the nonresident to provide identifying information, such as name and address, and to certify that they are not subject to U.S. tax withholding on the income they receive. This ensures that both documents facilitate tax compliance while protecting the interests of nonresidents in their respective jurisdictions.

The California Release of Liability form, akin to various tax-related documents, serves a critical purpose by allowing individuals and entities to waive their right to sue for potential claims of harm or damage during risky activities. Just as tax forms help clarify financial obligations, this release is essential for confirming that participants recognize and accept the risks involved. For more information on how to create a legally binding release, you can visit https://smarttemplates.net/fillable-california-release-of-liability/.

The IRS Form 8832, which allows an entity to elect its classification for federal tax purposes, shares similarities with the WV/NRW-4 in that both require detailed information about the organization and its members. Each form is designed to streamline the tax process for nonresidents and their organizations. While the WV/NRW-4 focuses on state income tax obligations, Form 8832 addresses federal classifications. Both forms ultimately help ensure that the correct tax treatment is applied based on the organization’s structure and the nonresident’s status.

The IRS Form 1040-NR is another document that parallels the WV/NRW-4. This form is specifically for nonresident aliens filing their U.S. income tax return. Like the WV/NRW-4, it requires individuals to report income earned in the U.S. Both forms aim to clarify tax responsibilities and ensure compliance with tax laws. While the WV/NRW-4 is more focused on withholding issues related to West Virginia source income, the 1040-NR is a comprehensive return for all U.S. income, thus serving a broader purpose.

The West Virginia Personal Income Tax Return (Form IT-140) is also akin to the WV/NRW-4. Both documents are used by individuals to report income and fulfill tax obligations in West Virginia. While the WV/NRW-4 is specifically for nonresidents to avoid withholding, the IT-140 is for residents and nonresidents alike to report their income tax. Each form plays a vital role in ensuring that taxpayers meet their respective obligations while allowing for appropriate deductions and credits based on their residency status.

Lastly, the IRS Form 1065, which is used by partnerships to report income, deductions, and other important tax information, resembles the WV/NRW-4 in that both forms involve pass-through entities. Each document requires detailed information about the organization and its members, and both are designed to ensure that income is reported correctly for tax purposes. While the WV/NRW-4 focuses on the nonresident’s tax agreement with West Virginia, Form 1065 ensures that the partnership itself complies with federal tax reporting requirements, thus maintaining a clear line of accountability for tax obligations.

FAQ

What is the purpose of the WV/NRW-4 form?

The WV/NRW-4 form serves as a Nonresident Income Tax Agreement for individuals and corporations who receive income from West Virginia sources. By completing this form, nonresidents can avoid having West Virginia income tax withheld from their distributions. It is essential for those who derive income from partnerships, S corporations, estates, trusts, or limited liability companies based in West Virginia.

Who is eligible to file the WV/NRW-4 form?

Any nonresident individual or C corporation that has West Virginia source income from a pass-through entity is eligible to file this form. A corporation qualifies as a nonresident if its commercial domicile is located outside of West Virginia. To ensure compliance, individuals must file the form with each organization from which they receive income to avoid withholding taxes.

When should the WV/NRW-4 form be filed?

The form must be completed and submitted to the organization by the last day of the organization’s taxable year. If a nonresident receives income from multiple organizations, a separate WV/NRW-4 form is required for each. Timely filing is crucial to prevent withholding of taxes on distributions.

What happens if the WV/NRW-4 agreement is revoked?

If a nonresident chooses to revoke the agreement, they must complete the revocation section of the WV/NRW-4 form and file it with the organization. The revocation will take effect for taxable years beginning after the revocation is filed. Additionally, the Tax Commissioner has the authority to revoke the agreement if the nonresident fails to file their West Virginia income tax return within 60 days of its due date.

Documents used along the form

The WV/NRW-4 form is essential for nonresidents who receive income from West Virginia sources, allowing them to avoid withholding taxes on distributions. However, several other forms and documents are often utilized alongside this agreement to ensure compliance with state tax regulations. Below is a brief overview of these accompanying documents.

- Form IT-140: This is the West Virginia Personal Income Tax Return, which nonresidents must file to report their income and calculate their tax liability for the year. It includes information about all sources of income, deductions, and credits.

- Form WV/CNF-120: This form is used by nonresidents to report income from pass-through entities such as partnerships or S corporations. It helps ensure that the income derived from these entities is accurately taxed in West Virginia.

- Form WV/SPF-100: This is the West Virginia Corporate Net Income Tax Return. Nonresident corporations must file this form to report their income and pay taxes on income earned in the state.

- Form WV/NRW-4A: This form serves as an application for a nonresident to claim a refund of any overpaid West Virginia income tax. It is crucial for ensuring that nonresidents receive any credits they are entitled to.

- Emotional Support Animal Letter: This document, which can be obtained from a licensed mental health professional, confirms the need for an emotional support animal and is essential for individuals to comply with federal laws. More information can be found at toptemplates.info.

- Form WV/NRW-4B: This document is used to provide additional information about the nonresident's income sources and is sometimes required by the state to clarify tax obligations.

- Form W-2: Employers provide this form to report wages paid to employees and the taxes withheld. Nonresidents receiving income from West Virginia employers will need this for their tax filings.

- Form 1099: This form is issued to report various types of income other than wages, salaries, and tips. Nonresidents may receive 1099 forms for income from freelance work, investments, or other sources.

- Form 1040: While this is a federal tax return, nonresidents must file it to report their worldwide income, including income earned in West Virginia. It is essential for ensuring compliance with federal tax laws.

- Form 8862: This form is used to claim the Earned Income Credit after a prior disallowance. Nonresidents who qualify may need to file this to ensure they receive available credits.

Understanding these forms and their purposes is crucial for nonresidents engaged in business or investment activities in West Virginia. Properly completing and submitting these documents helps ensure compliance with state tax laws and avoids potential penalties or issues with tax authorities.

Dos and Don'ts

When filling out the WV/NRW-4 form, there are important guidelines to follow to ensure accuracy and compliance. Below is a list of things to do and things to avoid.

- Do read all instructions carefully before beginning to fill out the form.

- Do provide accurate information for all required fields, including names and addresses.

- Do check the box for the correct type of organization.

- Do ensure that the form is submitted before the last day of the organization’s taxable year.

- Do keep a copy of the completed form for your records.

- Don’t leave any fields blank; all sections must be completed as applicable.

- Don’t use an outdated version of the form; always use the most recent version available.

- Don’t forget to sign and date the form where indicated.

- Don’t submit the form without double-checking for any errors or omissions.

By following these guidelines, you can help ensure that your WV/NRW-4 form is filled out correctly and submitted in a timely manner, minimizing any potential issues with your nonresident income tax agreement.