Blank Wv Nrsr PDF Template

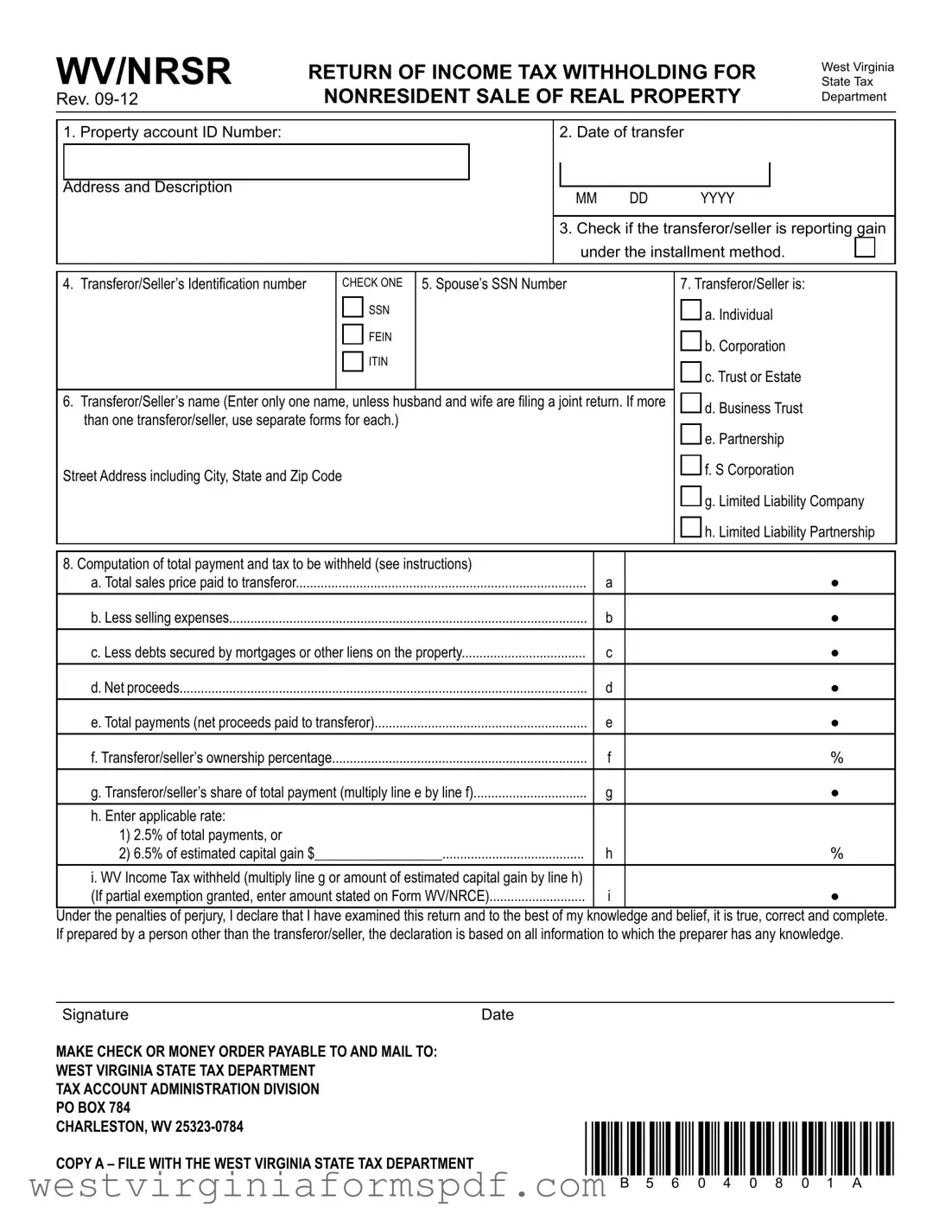

The West Virginia Nonresident Sale of Real Property Withholding Tax Return, commonly referred to as the WV/NRSR form, plays a crucial role in the taxation process for nonresident sellers of real estate in West Virginia. This form is designed to facilitate the timely collection of state income tax from individuals or entities that do not reside in West Virginia but are selling property located within the state. The WV/NRSR form requires detailed information, including the property account ID number, the date of the transfer, and the identification numbers of the transferor or seller. It also allows for the reporting of gains under the installment method, which can affect the tax calculation. The form includes sections for calculating the total sales price, selling expenses, and debts secured by mortgages or liens, ultimately determining the net proceeds and the applicable tax rate for withholding. Additionally, it mandates that separate forms be completed for each nonresident transferor or seller, unless they are filing jointly as a married couple. This ensures accurate reporting and compliance with state tax laws. The completed form must be submitted to the West Virginia State Tax Department along with payment of the calculated withholding tax, ensuring that the tax obligations are met promptly and accurately.

Browse More Forms

Wv Divorce Papers - Utilize the provided e-mail address field for better communication.

Wv Probate Laws - The forms require complete identification details of the decedent.

In order to properly manage your tax responsibilities, it is essential to have a clear understanding of the IRS W-9 form, which confirms a person's taxpayer identification number (TIN) for the IRS. This form is particularly important in various financial contexts where income reporting is necessary. For more insights on effectively handling this form, you can visit TopTemplates.info, which offers valuable guidance on tax reporting and compliance.

West Virginia State Tax Department - Healthcare providers making qualified purchases can utilize the Direct Pay Permit as well.

Form Attributes

| Fact Name | Description |

|---|---|

| Purpose of the Form | The WV/NRSR form is designed to ensure the timely collection of West Virginia income tax from nonresident sellers of real property. It calculates the amount of tax withholding required at the time of the sale or transfer. |

| Who Must File | Nonresident individuals or entities transferring an interest in real property located within West Virginia must file this form, unless exempt from the income tax withholding requirement. Each transferor/seller must complete a separate form. |

| Filing Deadline | The form must be filed at the closing of the sale. It is crucial to submit it within thirty days of the withholding to avoid penalties. |

| Payment Instructions | Payment of the withheld tax should be made via check or money order payable to the West Virginia State Tax Department. It must accompany Copy A of the form when submitted. |

| Governing Law | This form is governed by the West Virginia Code § 11-21-71, which outlines the tax withholding requirements for nonresident sellers of real property. |

Similar forms

The WV/NRSR form is similar to the IRS Form 1099-S, which is used for reporting the sale of real estate. Both forms are designed to ensure that the appropriate taxes are withheld during the sale of property. The 1099-S specifically reports the proceeds from the sale, while the WV/NRSR focuses on the income tax withholding for nonresidents. Both documents require details about the property, the seller, and the financial aspects of the transaction, ensuring compliance with tax regulations.

Another comparable document is the IRS Form 1040, which is the standard individual income tax return form. While the 1040 is used to report annual income and claim deductions, it also includes provisions for reporting capital gains from property sales. The WV/NRSR form, on the other hand, is specifically for nonresidents selling real property in West Virginia and addresses withholding requirements at the time of the sale, making it a more immediate concern for tax compliance.

For those navigating the intricacies of boat transactions, utilizing resources such as the https://smarttemplates.net can provide essential guidance and clarity, particularly regarding the necessary legal documentation and compliance requirements involved in a boat sale.

The WV/NRSR form is also similar to the IRS Form 8288, which is used for withholding tax on dispositions of U.S. real property interests by foreign persons. Both forms serve the purpose of ensuring that taxes are collected from sellers who may not be residents. However, the Form 8288 is specifically targeted at foreign sellers, while the WV/NRSR is aimed at nonresident sellers within the U.S., focusing on state-level tax obligations.

Additionally, the state of West Virginia has a form known as the WV/NRCE, which is used for claiming a partial exemption from withholding tax. This document is relevant when a seller qualifies for a reduction in the amount withheld. The WV/NRSR form works in conjunction with the WV/NRCE, as it calculates the withholding tax based on the sale while the NRCE provides the basis for any exemptions, ensuring that sellers are not overtaxed during the transaction.

The IRS Form W-9 is another document that shares similarities with the WV/NRSR form. The W-9 is used to provide taxpayer identification information to entities that will report income to the IRS. While the W-9 focuses on providing identification for tax purposes, the WV/NRSR form requires this information to ensure that the correct amount of tax is withheld from the sale of property. Both forms are essential for proper tax reporting and compliance.

Finally, the IRS Form 1041, which is the U.S. Income Tax Return for Estates and Trusts, is relevant in the context of property sales involving estates or trusts. Similar to the WV/NRSR, this form addresses tax obligations related to the sale of property held in an estate or trust. Both forms require detailed information about the seller and the transaction, ensuring that tax liabilities are met according to the law.

FAQ

What is the purpose of the WV/NRSR form?

The WV/NRSR form is used to ensure the timely collection of West Virginia income tax from nonresident sellers of real property. It determines the amount of income tax withholding due at the time of the sale or transfer of property located in West Virginia.

Who needs to file the WV/NRSR form?

Any nonresident individual or nonresident entity selling real property in West Virginia must file this form. If multiple sellers are involved, each seller must complete a separate form unless they are a married couple filing jointly. A nonresident entity is defined as one that is not formed under West Virginia laws and is not registered to do business in the state.

When should the WV/NRSR form be filed?

The form must be completed and submitted at the closing of the sale, unless the transaction is exempt from withholding requirements. Additionally, the appropriate West Virginia income tax return must be filed for the year in which the property transfer occurred.

What information is required to complete the WV/NRSR form?

Key information includes:

- Property account ID number

- Date of transfer

- Transferor/seller's identification number

- Transferor/seller's name and address

- Computation details for total payment and tax to be withheld

Ensure all relevant details are accurately filled in, as errors can lead to complications.

How is the tax amount calculated on the WV/NRSR form?

The tax amount is calculated based on the net proceeds from the sale, the ownership percentage of the transferor/seller, and the applicable tax rate. The form provides specific lines to calculate total payments and the amount of tax to be withheld, which can either be 2.5% of total payments or 6.5% of estimated capital gain.

What should be done with the WV/NRSR form after it is completed?

Once the form is completed, copy A must be submitted to the West Virginia State Tax Department along with payment for the tax due. Copy B should be provided to the transferor/seller at closing, while Copy C should be retained by the taxpayer for their records.

Documents used along the form

The WV/NRSR form is a critical document for nonresident sellers of real property in West Virginia. However, several other forms and documents often accompany it to ensure compliance with state tax regulations. Below is a list of these essential forms and their brief descriptions.

- WV/NRCE: This form is used to apply for a certificate of partial exemption from withholding tax. If granted, it allows the seller to reduce or eliminate the withholding amount based on specific criteria.

- WV/IT-140: Nonresident individuals must file this income tax return to report their income and claim any tax withheld as shown on the WV/NRSR form.

- WV/CNF120: C corporations use this combined corporation net income/business franchise tax return to report income and claim withholding tax paid on their behalf.

- WV/SPF-100: This form is for S corporations, partnerships, and limited liability companies to report income and claim any withholding tax that applies to their nonresident members.

- WV/IT-141: Trustees and personal representatives of estates file this fiduciary income tax return to report income and claim withholding tax paid on behalf of the trust or estate.

- Schedule K-1: This document reports each partner's share of income, deductions, and credits from partnerships and S corporations. It helps nonresident members claim their share of the withholding tax.

- Arizona Homeschool Letter of Intent: This form is essential for families looking to homeschool in Arizona. For detailed guidance, please visit arizonapdf.com/homeschool-letter-of-intent.

- Closing Disclosure: A document that outlines the final terms of the mortgage loan, including costs and fees associated with the property sale. It’s crucial for transparency in the transaction.

- Deed: This legal document transfers ownership of the property from the seller to the buyer. It must be properly executed and recorded to finalize the transaction.

- IRS Form 1099-S: This form is used to report the sale of real estate to the IRS. It provides necessary details about the transaction and is essential for tax reporting purposes.

Each of these documents plays a vital role in the process of selling real property in West Virginia. Understanding their purpose can help ensure a smooth transaction and compliance with state tax laws.

Dos and Don'ts

When filling out the WV/NRSR form, it's important to follow certain guidelines to ensure the process goes smoothly. Here’s a list of things you should and shouldn't do:

- Do enter the correct property account ID number as listed with the county assessor.

- Do complete a separate form for each transferor/seller if there are multiple parties involved.

- Do verify the date of transfer, ensuring it reflects the effective date of the deed.

- Do sign the form to confirm that the information provided is true and complete.

- Don't skip any required fields; missing information can delay processing.

- Don't use the same form for multiple transferors/sellers unless filing jointly as a married couple.

- Don't forget to include the applicable tax identification numbers for all parties involved.

- Don't neglect to keep a copy of the form for your records after submission.