Blank Wv Mip 31 PDF Template

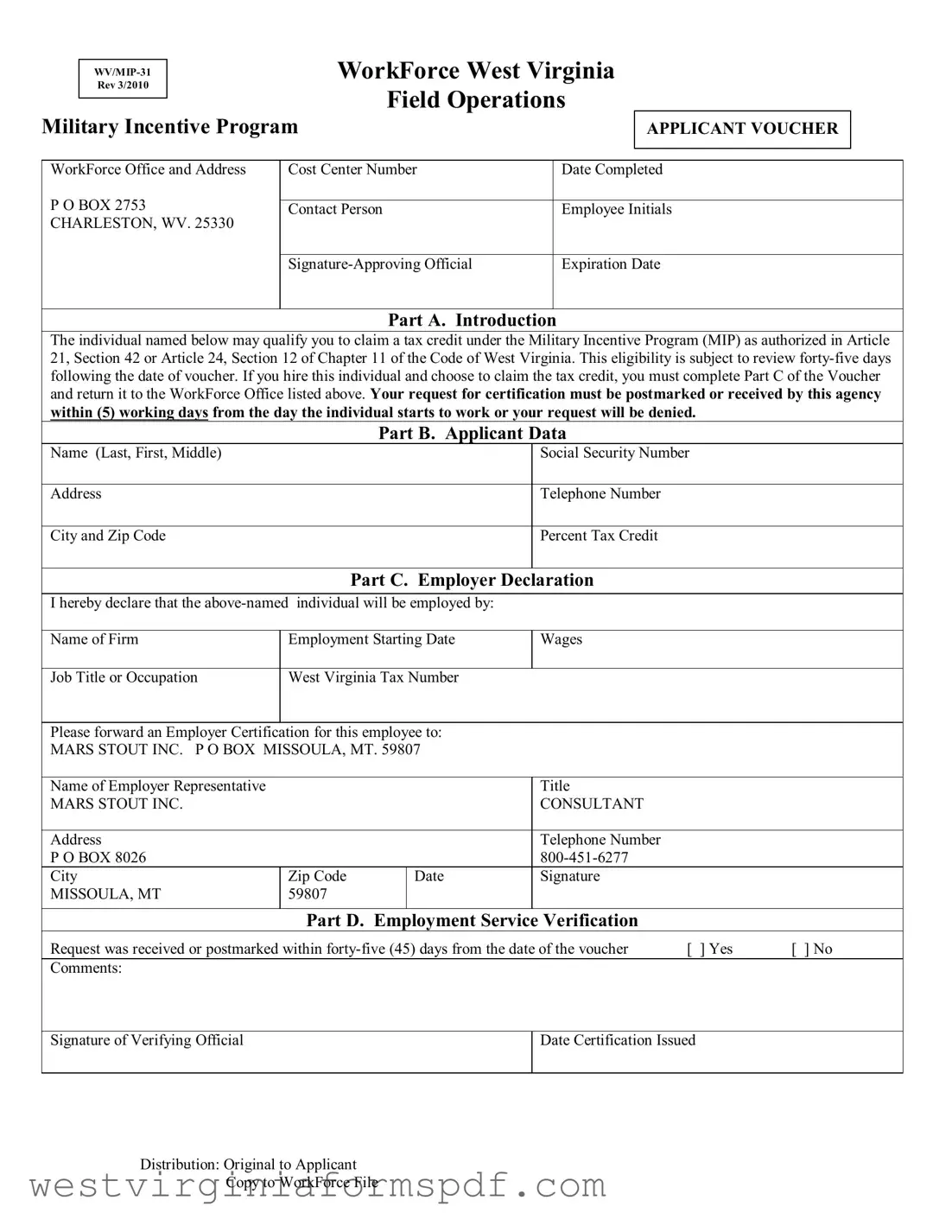

The WV MIP 31 form is an essential document for employers looking to take advantage of tax credits under the Military Incentive Program (MIP) in West Virginia. Designed to streamline the process, this form allows employers to verify the eligibility of individuals they hire, who may qualify for these tax benefits. Upon completion, the form must be submitted to the designated WorkForce Office, where it will undergo a review within a strict forty-five-day window. Employers are required to act quickly; they must submit the form within five working days of the new hire's start date to ensure their request is not denied. The form includes sections for applicant data, employer declarations, and verification requests, ensuring all necessary information is captured efficiently. By utilizing the WV MIP 31, employers can not only support veterans in their transition to civilian employment but also benefit from significant tax savings that can enhance their bottom line.

Browse More Forms

Personal Property Tax Exemption Affidavit Wv - Sellers must indicate if they are reporting gains through the installment method on the form.

The important Power of Attorney for a Child form serves as a crucial tool for parents or guardians, enabling them to authorize another adult to act on their behalf regarding their child's welfare during their absence.

West Virginia Cd 3 - The offer must be filed within a reasonable time frame after its submission.

How Long Does It Take to Get a Liquor License in Wv - Submit license fees via certified or cashier’s checks only.

Form Attributes

| Fact Name | Details |

|---|---|

| Form Purpose | The WV/MIP-31 form is used to claim a tax credit under the Military Incentive Program for hiring eligible military veterans in West Virginia. |

| Governing Laws | The program is authorized under Article 21, Section 42 and Article 24, Section 12 of Chapter 11 of the Code of West Virginia. |

| Submission Deadline | Requests for certification must be submitted within five working days from the employee's start date to avoid denial. |

| Eligibility Review | Eligibility for the tax credit is subject to review within forty-five days from the date the voucher is completed. |

Similar forms

The IRS Form 5884, known as the Work Opportunity Credit form, shares similarities with the WV MIP 31 form in that both documents aim to incentivize the hiring of specific groups of individuals. The Work Opportunity Credit provides tax credits to employers who hire individuals from targeted groups, such as veterans or those receiving public assistance. Like the WV MIP 31, it requires employers to submit documentation to claim the credit, ensuring that the hiring aligns with the program's eligibility criteria. Both forms necessitate verification of employment and timely submission to secure the tax benefits.

The IRS Form 8862, entitled "Information to Claim Certain Credits After Disallowance," is another document that parallels the WV MIP 31 form. This form is used by taxpayers who have previously been denied certain tax credits and wish to claim them again. Similar to the MIP 31, it requires detailed information about the applicant and their eligibility for the credits. Both forms emphasize the importance of providing accurate information to avoid disqualification and ensure compliance with the respective programs.

The Federal Form 941, the Employer's Quarterly Federal Tax Return, also bears resemblance to the WV MIP 31 form. While Form 941 is primarily focused on reporting income taxes withheld and Social Security taxes, it can also reflect the impact of tax credits like those offered under the Military Incentive Program. Employers must accurately report wages and credits claimed, making both forms essential for maintaining compliance with tax obligations. The connection lies in the reporting requirements tied to employment and tax benefits.

The State of West Virginia's Form WV/IT-140, the Individual Income Tax Return, is similar in that it allows taxpayers to report income and claim various deductions and credits, including those associated with military service. Like the WV MIP 31, it requires accurate reporting of personal information and employment details to determine eligibility for tax benefits. Both forms serve as tools for taxpayers to maximize their tax advantages while adhering to state regulations.

The Department of Labor's Form ETA-9061, the Individual Self-Attestation Form, is another document that aligns with the WV MIP 31 form. This form is used to determine eligibility for employment programs and benefits, similar to how the MIP 31 assesses eligibility for tax credits. Both forms require the applicant to provide personal information and attest to their qualifications, reinforcing the importance of self-reporting in the claims process.

The State of West Virginia's Form WV/IT-140ES, the Estimated Tax Payment Voucher, is akin to the WV MIP 31 form in that it allows taxpayers to make estimated tax payments based on anticipated credits and deductions. While the MIP 31 focuses on employment-related tax credits, both forms require a proactive approach to tax management. Timely submission is crucial for both documents to ensure that taxpayers can benefit from their respective programs without penalties.

The California ATV Bill of Sale form is an essential document for individuals involved in the purchase or sale of an All-Terrain Vehicle in California, ensuring clarity and mutual agreement on the transaction's particulars; it guarantees both buyer and seller have a record of the sale, much like how various employment-related forms secure compliance and protect rights. For further details on how to properly utilize this form, you can visit https://toptemplates.info/bill-of-sale/atv-bill-of-sale/california-atv-bill-of-sale.

Lastly, the IRS Form 7202, which is used to claim the Employee Retention Credit, shares a similar purpose with the WV MIP 31 form. Both forms are designed to provide financial relief to employers by offering tax credits based on employment practices. The similarities lie in the requirement for documentation and verification of employment status, ensuring that employers can accurately claim the benefits available to them under federal and state programs.

FAQ

What is the WV MIP 31 form?

The WV MIP 31 form is an applicant voucher used in West Virginia's Military Incentive Program. This program offers tax credits to employers who hire eligible military veterans. The form must be completed by the employer to claim these credits, and it serves as a formal request for certification of the tax credit by the state.

Who is eligible to use the WV MIP 31 form?

Eligibility for using the WV MIP 31 form primarily includes employers who hire individuals with military backgrounds. These individuals must meet specific criteria set forth in the West Virginia Code, particularly in Article 21, Section 42 or Article 24, Section 12 of Chapter 11. Employers should ensure that the hired individual qualifies under the Military Incentive Program guidelines.

What information is required on the WV MIP 31 form?

The form requires various pieces of information, including:

- Name of the applicant (last, first, middle)

- Social Security number

- Address and contact information

- Percent of tax credit being claimed

- Name of the firm employing the individual

- Employment start date

- Job title or occupation

- West Virginia tax number

Completing all sections accurately is crucial for the approval process.

How long does an employer have to submit the form after hiring an eligible individual?

Employers must submit the WV MIP 31 form within five working days from the date the eligible individual starts working. Failing to meet this deadline may result in denial of the tax credit request.

What happens after the form is submitted?

Once the form is submitted, the WorkForce Office will review the application. The eligibility of the individual will be confirmed within forty-five days. If approved, the employer will receive certification for the tax credit. If denied, the employer will be notified of the reasons for denial.

Can an employer claim the tax credit for multiple employees using the same form?

No, the WV MIP 31 form is specific to each individual employee. Employers must complete a separate form for each eligible individual they wish to claim a tax credit for. This ensures that each application is assessed on its own merits.

What should an employer do if they encounter issues with the form?

If any issues arise while completing or submitting the WV MIP 31 form, employers should reach out to the WorkForce Office listed on the form. They can provide guidance and assistance to ensure that the application is correctly processed.

Is there a cost associated with submitting the WV MIP 31 form?

No, there is no fee for submitting the WV MIP 31 form. The program is designed to support employers who hire veterans by offering tax incentives, and thus, the submission process is free of charge.

Where can employers find the WV MIP 31 form?

The WV MIP 31 form can typically be obtained from the WorkForce West Virginia website or directly from the WorkForce Office. It is advisable to ensure that you are using the most current version of the form to avoid any complications during the submission process.

Documents used along the form

The WV MIP 31 form is essential for individuals seeking to claim a tax credit under the Military Incentive Program in West Virginia. Alongside this form, several other documents may be necessary to ensure compliance and facilitate the process. Below is a list of related forms and documents often used in conjunction with the WV MIP 31.

- WV/MIP-32 Form: This form is used for the employer's certification of the employee's eligibility for the tax credit. It provides additional details about the employee's job and wages.

- Employer Tax Identification Number (EIN): This number is required for tax reporting purposes. It identifies the business entity to the IRS and is essential for processing tax credits.

- Employee's Social Security Card: A copy of the employee's Social Security card may be required to verify their identity and eligibility for the tax credit.

- FedEx Release Form: This essential document allows recipients to authorize FedEx to leave packages at a designated location when they're away, ensuring delivery. For more information, visit smarttemplates.net.

- Job Offer Letter: This letter outlines the terms of employment and confirms the start date. It serves as proof of the employment relationship.

- Payroll Records: Documentation of wages paid to the employee is necessary to substantiate the claim for the tax credit. These records should include pay stubs or payroll summaries.

- Verification of Employment Form: This form may be used to confirm the employee's start date and job title with the employer. It is often filled out by a human resources representative.

Each of these documents plays a crucial role in the application process for the Military Incentive Program. Collecting and submitting them accurately can help ensure that the tax credit is granted without delays.

Dos and Don'ts

When completing the WV MIP 31 form, it is essential to follow certain guidelines to ensure accuracy and compliance. Below is a list of things to do and avoid.

- Do provide accurate personal information, including your name, Social Security number, and contact details.

- Do ensure that the employment start date is clearly stated and accurate.

- Do submit the form within the specified timeframe of five working days after the individual begins employment.

- Do include the correct tax credit percentage applicable to the individual.

- Do have the employer representative sign the form to validate the information provided.

- Don't leave any sections of the form incomplete; all required fields must be filled out.

- Don't submit the form after the deadline, as it may lead to denial of your request.

- Don't provide false information or misrepresent any details, as this could have legal consequences.

- Don't forget to keep a copy of the completed form for your records.