Blank Wv It 140 PDF Template

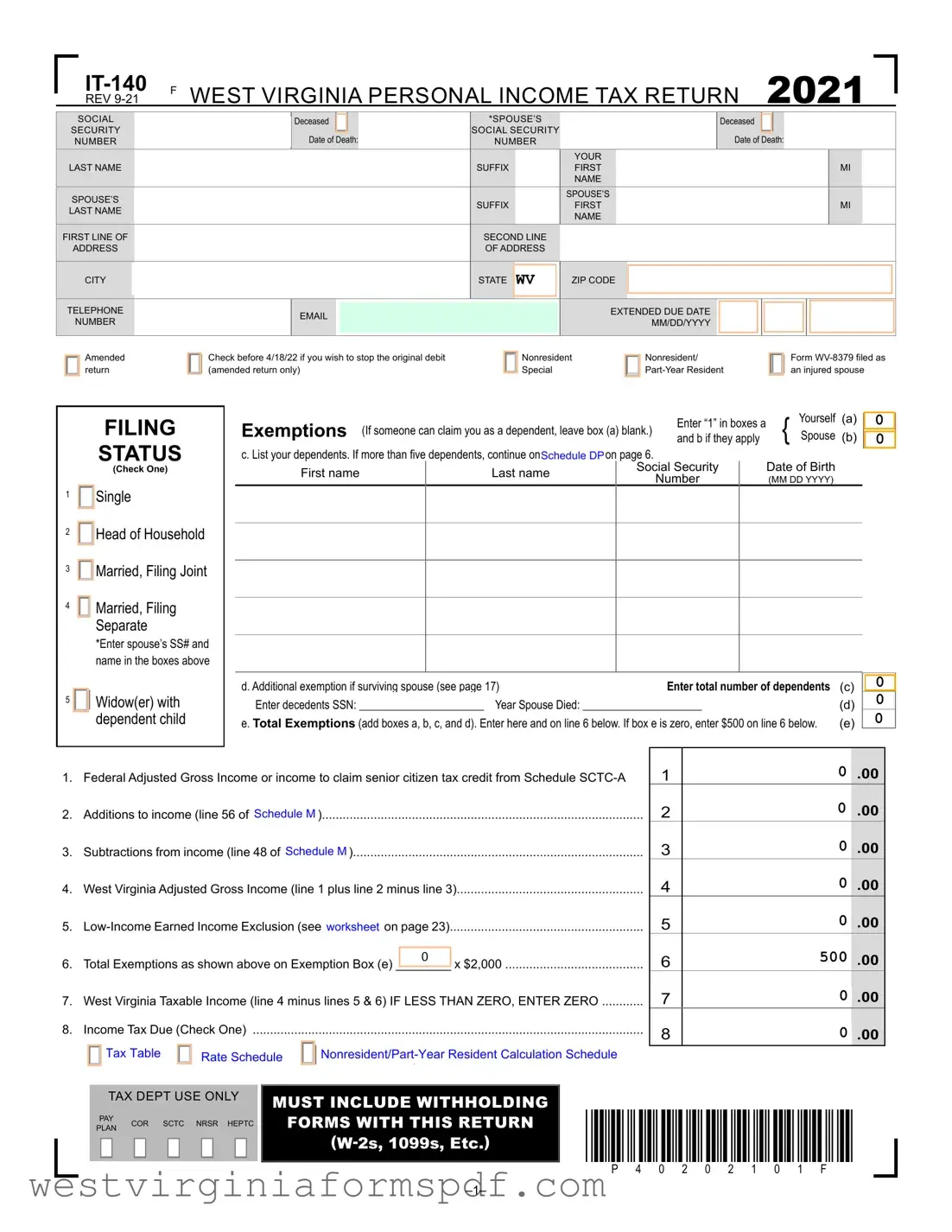

The WV IT-140 form is a crucial document for individuals filing their personal income tax returns in West Virginia. This form is designed for residents, nonresidents, and part-year residents to report their income, claim exemptions, and determine their tax liability for the year. It requires personal information such as names, Social Security numbers, and addresses, ensuring that the state can accurately process each return. The form includes sections for filing status, exemptions, and income calculations, as well as various credits that may apply. Taxpayers must also provide details about dependents and any modifications to their federal adjusted gross income. Additionally, the IT-140 allows for the reporting of tax credits and payments made, ensuring that individuals can account for any overpayments or amounts due. For those who need to amend their returns, there is a specific checkbox to indicate this change. Overall, the IT-140 serves as a comprehensive tool for West Virginia residents to fulfill their tax obligations effectively.

Browse More Forms

West Virginia State Tax Department - Nonprofit organizations recognized under 501(c)(3) or 501(c)(4) may claim exemption.

Ensuring the accuracy of official records is vital, and for those needing to rectify errors, the Error Correction Affidavit provides a simple route to achieve this. By properly completing this form, individuals can promptly address inaccuracies that may otherwise lead to complications in various legal matters.

West Virginia Cpa - The information provided aids in maintaining updated records for licensed professionals.

Form Attributes

| Fact Name | Details |

|---|---|

| Purpose | The IT-140 form is used by individuals in West Virginia to file their personal income tax returns. |

| Filing Status Options | Taxpayers can select from various filing statuses, including Single, Married Filing Jointly, and Head of Household. |

| Exemptions | Taxpayers can claim exemptions for themselves and their dependents, which can reduce taxable income. |

| Governing Law | The IT-140 form is governed by West Virginia Code §11-21, which outlines personal income tax regulations. |

| Amended Returns | Taxpayers can file an amended return by checking a specific box if they wish to correct their original submission. |

Similar forms

The West Virginia IT-140 form is similar to the IRS Form 1040, which is the standard individual income tax return used in the United States. Both forms serve the primary purpose of reporting income, calculating tax liability, and determining any refunds or payments due. The IT-140 is tailored specifically for West Virginia residents, incorporating state-specific deductions, credits, and tax rates. While the 1040 is a federal form applicable nationwide, the IT-140 reflects the unique tax regulations and exemptions applicable within West Virginia, such as the state’s specific tax credits and modifications to federal adjusted gross income.

The Trader Joe's application form is an essential tool for anyone looking to start a career with the popular grocery chain, capturing important details such as personal information and work history. As part of the application process, candidates are encouraged to fill out the Trader Joe's application form carefully to maximize their chances of securing a position, showcasing their qualifications and availability in a structured manner.

Another document that parallels the IT-140 is the IRS Form 1040X, which is used for amending a previously filed federal tax return. Just like the IT-140 allows for amendments to state tax returns, the 1040X enables taxpayers to correct errors or make changes to their federal returns. Both forms require the taxpayer to explain the reason for the amendment and provide any necessary supporting documentation. This ensures that any adjustments made to income or deductions are clearly communicated to the respective tax authorities, whether at the state or federal level.

The West Virginia Schedule M is another document similar to the IT-140. This schedule is used to report modifications to federal adjusted gross income for state tax purposes. Just as the IT-140 calculates taxable income based on various adjustments, the Schedule M provides a detailed breakdown of additions and subtractions that affect the final taxable income. Both documents work together to ensure that taxpayers accurately report their income and apply the correct modifications based on state regulations.

Lastly, the West Virginia IT-210 form, which is used to report any penalties due, shares similarities with the IT-140. The IT-210 allows taxpayers to calculate and report penalties for late payment or filing, similar to how the IT-140 includes sections for calculating total taxes due and any potential penalties. Both forms are essential for ensuring compliance with tax obligations, and they help taxpayers understand their financial responsibilities to the state, including any penalties that may arise from errors or late submissions.

FAQ

-

What is the WV IT-140 form?

-

The WV IT-140 form is the West Virginia Personal Income Tax Return. It is used by residents to report their income, calculate their tax liability, and determine any refunds or payments due to the state. This form must be completed and submitted to the West Virginia State Tax Department by the designated deadline each year.

-

Who needs to file the WV IT-140 form?

-

Individuals who are residents of West Virginia and have earned income during the tax year are required to file the WV IT-140 form. This includes those who are single, married, or head of household. Nonresidents and part-year residents may need to use a different form, such as the WV-8379.

-

What information is required to complete the WV IT-140 form?

-

To complete the WV IT-140 form, you will need to provide various personal details, including:

- Your Social Security number

- Your name and address

- Your filing status (e.g., single, married filing jointly, etc.)

- Your income details, including federal adjusted gross income

- Information about any dependents

- Details of any tax credits or deductions you wish to claim

-

When is the deadline for filing the WV IT-140 form?

-

The deadline for filing the WV IT-140 form is typically April 15th of the year following the tax year. However, if April 15th falls on a weekend or holiday, the deadline may be extended. It is important to check for any announcements from the West Virginia State Tax Department regarding deadline changes.

-

What should I do if I need to amend my WV IT-140 form?

-

If you need to amend your WV IT-140 form, you should check the box indicating that it is an amended return. You will then need to provide the corrected information and submit it to the West Virginia State Tax Department. Keep in mind that you may also need to include any additional documentation to support your amendments.

-

How can I pay any taxes owed on my WV IT-140 form?

-

There are several options available for paying taxes owed on your WV IT-140 form. You can:

- Send a check or money order with your return.

- Make an electronic payment through the West Virginia State Tax Department's website.

- Pay via credit card through the Treasurer's website.

Ensure that you follow the instructions provided on the form for each payment method to avoid any delays.

Documents used along the form

When completing the West Virginia Personal Income Tax Return (Form IT-140), several additional forms and documents may be necessary to ensure accurate filing. These documents help clarify income sources, tax credits, and any adjustments that may apply to your tax situation. Below is a list of commonly used forms that accompany the IT-140.

- Schedule M: This schedule is used to report modifications to your federal adjusted gross income. It includes both additions and subtractions that may affect your taxable income in West Virginia.

- Tax Credit Recap Schedule: This form summarizes all tax credits you are claiming against your personal income tax. It ensures that you provide the necessary details for each credit, which must be included with your return.

- Form WV-8379: This form is for individuals who are filing as an injured spouse. It allows one spouse to claim their portion of a joint refund when the other spouse has debts that could offset the refund.

- W-2 Forms: These forms report wages paid to you and the taxes withheld from your paycheck. You must include all relevant W-2s when filing your IT-140 to accurately report your income.

- 1099 Forms: If you received income from sources other than traditional employment, such as freelance work or interest payments, you will need to include the appropriate 1099 forms. These documents detail the income earned and any taxes withheld.

- FedEx Release Form: This document is essential for recipients who will not be present to receive their packages, allowing authorization for FedEx to leave deliveries without direct hand-off. Additional information about filling out the form can be found at smarttemplates.net.

- Schedule SCTC-1: This schedule is used to claim the Senior Citizen Tax Credit for property taxes paid. If applicable, it must be submitted along with your IT-140 to receive this credit.

Gathering these documents before starting your tax return can help streamline the process and ensure that you do not miss any important details. Each form plays a crucial role in accurately reporting your financial situation and maximizing any potential credits or deductions.

Dos and Don'ts

When filling out the WV IT-140 form, follow these guidelines to ensure accuracy and compliance.

- Do: Double-check your Social Security Number for accuracy.

- Do: Ensure that all names are spelled correctly, including your spouse's name.

- Do: Use black or blue ink if filling out the form by hand.

- Do: Review the instructions carefully to understand your filing status.

- Do: Include all necessary documentation, such as W-2s and 1099s.

- Don't: Leave any fields blank; if not applicable, write "N/A."

- Don't: Forget to sign and date the form before submission.