Blank Wv It 104 PDF Template

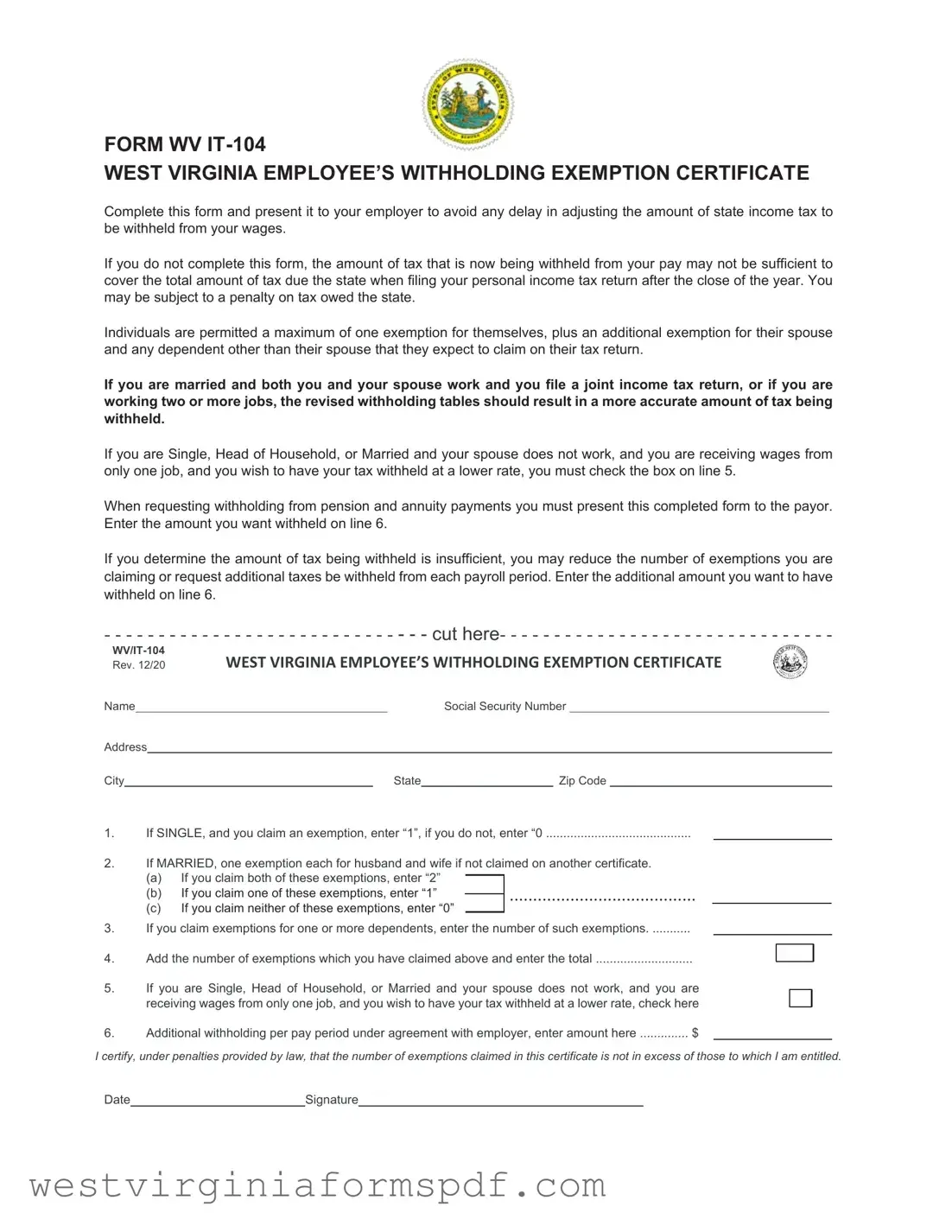

The WV IT-104 form, also known as the West Virginia Employee’s Withholding Exemption Certificate, plays a crucial role in managing state income tax withholding for employees. By completing this form and presenting it to your employer, you can ensure that the correct amount of state income tax is withheld from your wages, preventing any potential shortfall when you file your personal income tax return. Failing to submit the form may lead to insufficient withholding, resulting in penalties on any tax owed to the state. The form allows individuals to claim exemptions based on their personal circumstances, including one exemption for themselves, plus additional exemptions for a spouse and dependents. For married couples who both work, or individuals juggling multiple jobs, the revised withholding tables can help achieve a more accurate tax withholding amount. If you are single, head of household, or married with a non-working spouse, you have the option to request a lower withholding rate. Additionally, the form accommodates those who want to adjust their withholding from pension and annuity payments. If you find that the withholding amount is inadequate, you can modify your claimed exemptions or request additional withholding per pay period. Understanding and utilizing the WV IT-104 form can significantly impact your financial planning and tax obligations.

Browse More Forms

West Virginia State Tax Department - The process is intended to facilitate smoother tax transactions for qualifying organizations.

Injured Spouse Claim - Joint assets' income can be allocated as reported on the tax return.

When engaging in the purchase or sale of a dog in California, it is crucial to utilize the California Dog Bill of Sale form, which provides a clear legal framework for the transaction. This document not only serves as a receipt but also ensures that the transfer of ownership is properly recorded. For those looking for additional resources related to such transactions, please refer to All California Forms to access various templates and forms.

Power of Attorney West Virginia - Taxpayers should ensure that the WV-2848 is filled out accurately to avoid delays in representation.

Form Attributes

| Fact Name | Description |

|---|---|

| Purpose of Form | The WV IT-104 form is used by employees in West Virginia to declare their withholding exemptions to ensure the correct amount of state income tax is deducted from their wages. |

| Exemption Limits | Individuals can claim one exemption for themselves, plus additional exemptions for a spouse and dependents, not exceeding the number they are entitled to under state law. |

| Impact of Non-Completion | If the form is not completed, employees may face insufficient tax withholding, which could lead to penalties when filing their annual tax returns. |

| Governing Law | The use of the WV IT-104 form is governed by West Virginia state tax laws, specifically those related to personal income tax withholding. |

Similar forms

The IRS Form W-4 is similar to the WV IT-104 form in that both are used by employees to inform their employers about their withholding tax exemptions. Completing the W-4 allows employees to adjust the amount of federal income tax withheld from their paychecks. Like the WV IT-104, the W-4 requires individuals to provide personal information, including their filing status and number of dependents. Both forms aim to ensure that the correct amount of tax is withheld, thereby reducing the risk of underpayment at tax time.

The state-specific Form IT-2104 in New York serves a similar purpose as the WV IT-104. This form allows New York employees to claim exemptions from state income tax withholding. Both forms require individuals to disclose their filing status and the number of exemptions they are claiming. By completing the IT-2104, employees can ensure that the right amount of state tax is withheld from their wages, similar to the function of the WV IT-104 in West Virginia.

When it comes to buying or selling an ATV in California, having the right documentation is key, and the California ATV Bill of Sale form is essential for this process. This official document ensures that the transaction is clearly recorded and helps protect the rights of both buyer and seller. For more information on how to create or obtain this form, you can visit toptemplates.info/bill-of-sale/atv-bill-of-sale/california-atv-bill-of-sale, which provides resources and templates to facilitate a smooth sale.

The California Employee's Withholding Allowance Certificate, known as Form DE 4, is another document comparable to the WV IT-104. This form enables California employees to indicate their withholding allowances for state income tax. Just like the WV IT-104, it requires personal information and allows for adjustments based on marital status and dependents. Both forms aim to help employees manage their tax withholding effectively throughout the year.

The Massachusetts Employee's Withholding Exemption Certificate, or Form M-4, parallels the WV IT-104 in its function. Employees in Massachusetts use this form to claim exemptions from state tax withholding. The M-4 also asks for information regarding marital status and dependents, similar to the WV IT-104. This helps ensure that the appropriate amount of tax is withheld from an employee’s wages, aligning with the goals of the WV IT-104.

The Illinois Employee's Withholding Allowance Certificate, Form IL-W-4, is another document that shares similarities with the WV IT-104. This form allows employees in Illinois to claim allowances for state income tax withholding. It requires the same type of information regarding marital status and dependents, ensuring that the correct amount of tax is withheld from paychecks. Both forms are designed to help employees manage their tax liabilities effectively.

The Florida Employee Withholding Allowance Certificate, often referred to as Form W-4 Florida, is similar to the WV IT-104 in that it is used to determine the amount of tax withheld from an employee's wages. While Florida does not have a state income tax, the form allows employees to claim federal withholding allowances. Both forms require personal information and aim to prevent under-withholding, ensuring compliance with tax obligations.

The New Jersey Employee’s Certificate of Allowances, known as Form NJ-W4, is another comparable document. This form allows New Jersey employees to claim allowances for state income tax withholding. Similar to the WV IT-104, it requires information about marital status and dependents, helping to ensure that the correct amount of state tax is withheld from wages. Both forms serve to assist employees in managing their tax withholding accurately.

The Virginia Employee’s Withholding Exemption Certificate, Form VA-4, is also similar to the WV IT-104. This form allows Virginia employees to claim exemptions from state income tax withholding. It requires similar information regarding marital status and dependents, and both forms aim to ensure that the correct amount of tax is withheld from an employee’s pay. This helps mitigate the risk of underpayment when filing tax returns.

Finally, the Pennsylvania Employee’s Withholding Tax Exemption Certificate, known as Form REV-419, is another document that functions similarly to the WV IT-104. This form enables Pennsylvania employees to claim exemptions for state income tax withholding. Like the WV IT-104, it requires details about marital status and dependents, ensuring that the appropriate amount of tax is withheld from wages. Both forms are designed to help employees accurately manage their tax obligations throughout the year.

FAQ

What is the purpose of the WV IT-104 form?

The WV IT-104 form, known as the West Virginia Employee’s Withholding Exemption Certificate, is designed to help employees manage the amount of state income tax withheld from their wages. By completing this form and presenting it to your employer, you can ensure that the correct amount of tax is withheld. This is important because insufficient withholding may lead to a tax bill when you file your personal income tax return, possibly resulting in penalties.

Who should fill out the WV IT-104 form?

Any employee who wishes to adjust their state income tax withholding should complete the WV IT-104 form. This includes individuals who are single, married, or head of household. It is particularly important for those with multiple jobs or those whose spouses work to accurately report their exemptions. If you do not fill out this form, your employer may withhold a standard amount that may not reflect your actual tax liability.

How do I determine the number of exemptions to claim?

To determine the number of exemptions you can claim on the WV IT-104 form, consider the following:

- For yourself, you can claim one exemption if you are single.

- If you are married, you can claim one exemption for yourself and one for your spouse.

- You may also claim additional exemptions for any dependents you expect to claim on your tax return.

Simply add these together to calculate your total exemptions to report on the form.

What should I do if I believe my withholding is insufficient?

If you feel that the amount of tax being withheld from your paychecks is not enough, you have options. You can either reduce the number of exemptions you are claiming or request that additional taxes be withheld from each paycheck. To specify an additional amount, simply enter it on line 6 of the form. This proactive approach can help prevent any surprises when tax season arrives.

What happens if I don’t submit the WV IT-104 form?

If you choose not to submit the WV IT-104 form, your employer will likely withhold a default amount of state income tax based on standard tables. This amount may not align with your actual tax liability, leading to the risk of under-withholding. If you owe taxes when you file your return, you could face penalties for the unpaid amount. Therefore, it is advisable to complete and submit the form to avoid such issues.

Can I use the WV IT-104 form for pension and annuity payments?

Yes, the WV IT-104 form can also be used for pension and annuity payments. If you are receiving such payments and wish to adjust the withholding, you must present the completed form to the payor. Additionally, you can specify the amount you want withheld on line 6 of the form. This ensures that your pension or annuity payments reflect the appropriate tax withholding based on your personal situation.

Documents used along the form

The WV IT-104 form is essential for West Virginia employees to manage their state income tax withholding effectively. However, several other forms and documents are often used in conjunction with it to ensure compliance and accuracy in tax matters. Below is a list of these related documents.

- WV IT-140: This is the West Virginia Personal Income Tax Return form. It is used to report income, calculate taxes owed, and claim any refunds for the tax year.

- WV IT-140N: This is the Nonresident Personal Income Tax Return. Nonresidents use it to report income earned in West Virginia and determine their tax liability.

- W-2 Form: Employers provide this form to employees, detailing annual wages and the amount of taxes withheld. It is crucial for completing the WV IT-140.

- W-4 Form: This federal form allows employees to indicate their tax situation to their employer. It helps determine the amount of federal income tax to withhold from paychecks.

- WV IT-104A: This is the West Virginia Employee’s Withholding Exemption Certificate for Additional Withholding. It is used to request extra withholding from wages if the standard amount is insufficient.

- Form 1099: This form reports various types of income other than wages, salaries, and tips. It is important for individuals who may have freelance income or interest earnings.

- Form IT-210: This form is used for claiming a credit for taxes paid to another state. It helps prevent double taxation for individuals earning income in multiple states.

- FedEx Release Form: Essential for those expecting deliveries without being home, this form authorizes FedEx to leave packages securely at designated locations. More details can be found at smarttemplates.net.

- Form WV/IT-140S: This is the West Virginia Personal Income Tax Return for Small Business. It is specifically for reporting income from pass-through entities.

- Form WV/IT-141: This form is the West Virginia Income Tax Credit for Low-Income Individuals. It allows eligible taxpayers to claim a credit based on their income level.

- Form 4868: This is the Application for Automatic Extension of Time to File U.S. Individual Income Tax Return. It provides an extension for filing federal taxes, which may also impact state tax obligations.

Understanding these forms and documents is crucial for maintaining compliance with tax regulations in West Virginia. Proper use of these resources can significantly ease the tax filing process and help avoid potential penalties.

Dos and Don'ts

When filling out the WV IT-104 form, there are several important practices to keep in mind. Below is a list of things you should and shouldn't do to ensure the process goes smoothly.

- Do read the instructions carefully before starting to fill out the form.

- Do provide accurate personal information, including your name and Social Security number.

- Do check the appropriate boxes for your filing status and exemptions.

- Do present the completed form to your employer to avoid delays in tax withholding.

- Don't claim more exemptions than you are entitled to, as this could lead to penalties.

- Don't forget to sign and date the form before submitting it.