Blank Wv Frm 01 PDF Template

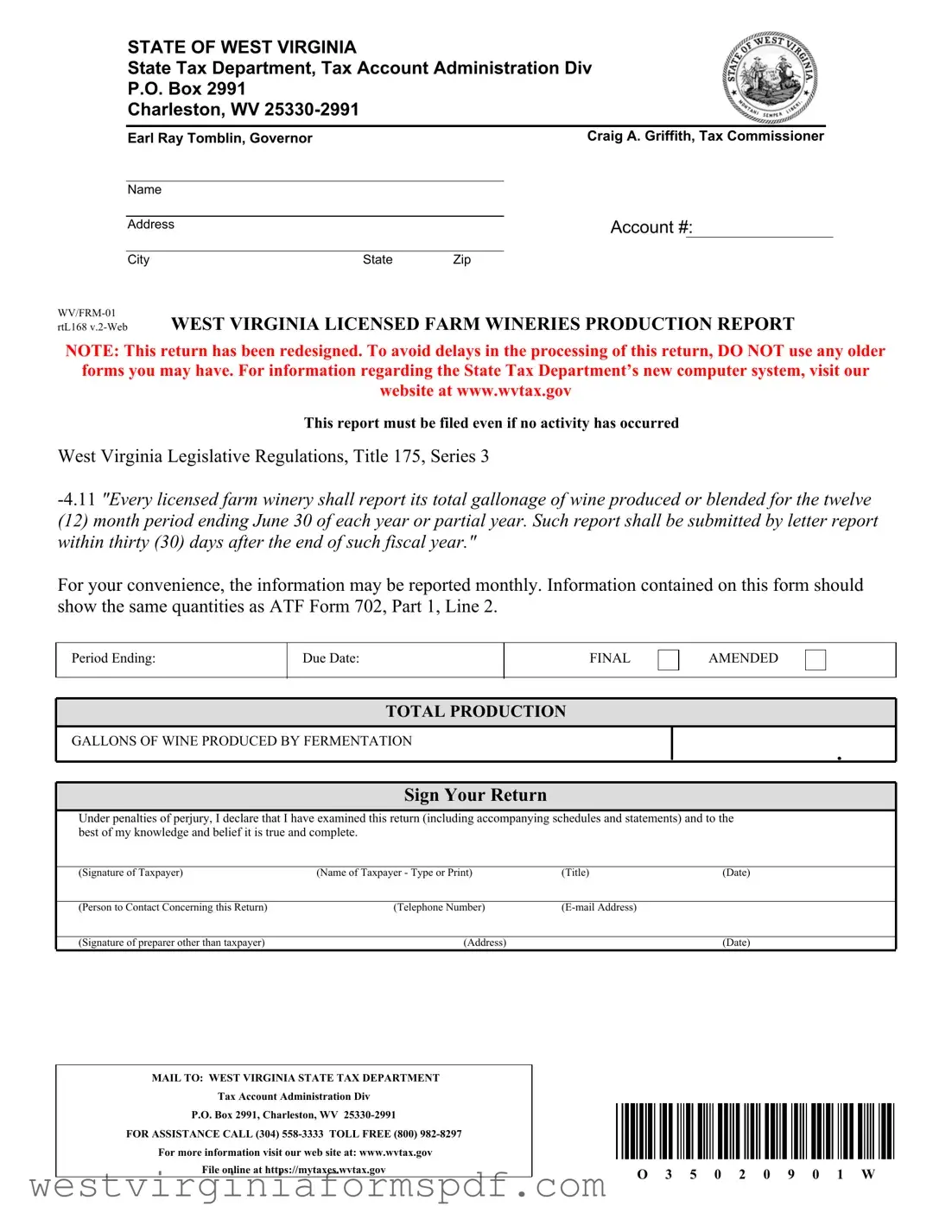

The WV Frm 01 form is an essential document for licensed farm wineries in West Virginia, serving as a production report that must be filed annually. This form is crucial for wineries to report their total wine production or blending for the twelve-month period ending June 30. It is important to note that even if no activity has occurred during the reporting period, submission of this form is still required. The West Virginia State Tax Department has redesigned the form, and it is advised not to use older versions to prevent processing delays. Wineries have the option to report their information monthly, which can help streamline the filing process. The details reported on the WV Frm 01 should align with the quantities provided on the ATF Form 702, ensuring consistency in reporting. Additionally, the form requires the signature of the taxpayer, affirming the accuracy of the information under penalties of perjury. Wineries must mail the completed form to the Tax Account Administration Division of the West Virginia State Tax Department, and assistance is readily available through provided contact numbers. For those looking for more information or to file online, resources are accessible on the State Tax Department’s website.

Browse More Forms

Wv Employee Withholding Form - Your payment should be made directly to the West Virginia State Tax Department as outlined.

For those navigating legal proceedings, a reliable resource is the "step-by-step guide to completing the Affidavit of Service," which can be found at this link. This guide assists individuals in understanding the proper procedures for delivering legal documents, thus ensuring compliance with necessary protocols.

West Virginia Tax Forms - A clear summary of total allowable credits and payments is crucial to accurately determine any balance due or refund.

West Virginia Cpa - Each applicant is afforded an opportunity to clarify their current professional standing.

Form Attributes

| Fact Name | Details |

|---|---|

| Form Title | West Virginia Licensed Farm Wineries Production Report |

| Governing Law | West Virginia Legislative Regulations, Title 175, Series 3 - 4.11 |

| Filing Requirement | This report must be filed even if no activity has occurred. |

| Submission Deadline | Reports are due within thirty (30) days after the end of the fiscal year. |

| Reporting Period | Reports cover the twelve (12) month period ending June 30 of each year or partial year. |

| Monthly Reporting Option | For convenience, information may be reported monthly. |

| Signature Requirement | The taxpayer must sign the return under penalties of perjury. |

| Contact Information | Taxpayer must provide contact details including name, telephone number, and email address. |

| Mailing Address | Forms should be mailed to West Virginia State Tax Department, Tax Account Administration Div, P.O. Box 2991, Charleston, WV 25330-2991. |

Similar forms

The West Virginia Sales Tax Return is a document that businesses in the state must file to report sales tax collected from customers. Similar to the WV Frm 01, this return requires detailed reporting of financial activity over a specified period. Businesses must report total sales and the amount of sales tax collected. Both forms emphasize accuracy and require a signature to certify the information provided is correct. Timely submission is crucial to avoid penalties, reflecting the importance of compliance in state tax regulations.

The Federal Alcohol Administration Act (FAA) Form 702 is another document that shares similarities with the WV Frm 01. This form is used by wineries to report production quantities to the Alcohol and Tobacco Tax and Trade Bureau (TTB). Like the WV Frm 01, the FAA Form 702 requires accurate reporting of wine production, ensuring that federal and state data align. Both forms necessitate a declaration of truthfulness, underscoring the seriousness of the information provided and the legal obligations of the winery operators.

The West Virginia Business Registration Certificate is also comparable to the WV Frm 01 in that it is a necessary document for businesses operating within the state. This certificate confirms that a business is registered to collect and remit taxes. Similar to the production report, it reflects the business's compliance with state regulations. Both documents require accurate information about the business's operations and are essential for maintaining good standing with state authorities.

The West Virginia Employer Withholding Tax Return is another document that parallels the WV Frm 01. Employers must file this return to report income tax withheld from employees' wages. Both forms require detailed reporting and must be submitted regularly, ensuring compliance with tax laws. They also emphasize the importance of accurate record-keeping and timely filing to avoid penalties, demonstrating the shared responsibility of businesses in maintaining tax compliance.

When navigating the complexities of vehicle transactions in California, it's important to utilize the appropriate documentation, such as the California ATV Bill of Sale form. This official document not only facilitates the sale and purchase of an All-Terrain Vehicle but also prevents any misunderstandings between the involved parties. For more detailed insights on this essential form, you can visit toptemplates.info/bill-of-sale/atv-bill-of-sale/california-atv-bill-of-sale/.

Lastly, the West Virginia Corporate Net Income Tax Return is similar to the WV Frm 01 in that it requires businesses to report their income and expenses to determine tax liability. Both forms serve as a means of accountability to the state tax authorities. They require thorough documentation and accuracy in reporting financial data. Additionally, both forms underscore the importance of filing within specified deadlines to avoid potential fines or legal repercussions.

FAQ

What is the purpose of the WV Frm 01 form?

The WV Frm 01 form is a production report specifically for licensed farm wineries in West Virginia. It requires wineries to report their total gallonage of wine produced or blended for the fiscal year ending June 30. This report is essential for compliance with state regulations and must be submitted even if no wine was produced during the reporting period.

When is the WV Frm 01 form due?

The form must be submitted within thirty days after the end of the fiscal year, which is June 30. Therefore, the due date for the report is July 30 each year. If you are reporting monthly, ensure that each report is submitted on time to avoid any penalties.

What should I do if I have no production to report?

Even if there was no wine production during the reporting period, you are still required to file the WV Frm 01 form. Indicate zero production on the form and submit it by the due date. This ensures compliance with state regulations and helps maintain your winery's good standing.

Can I file the WV Frm 01 form online?

Yes, you can file the WV Frm 01 form online. Visit the West Virginia State Tax Department's website at mytaxes.wvtax.gov to access the online filing system. This option can simplify the submission process and help you keep track of your filings.

What information is required on the form?

The WV Frm 01 form requires specific information, including:

- Your winery's name and address

- Your account number

- The total gallons of wine produced by fermentation

- Contact information for any inquiries related to the report

- Signatures of the taxpayer and any preparers

Make sure the quantities reported match those on ATF Form 702, Part 1, Line 2.

Where should I send the completed form?

Once you have completed the WV Frm 01 form, mail it to the following address:

West Virginia State Tax Department

Tax Account Administration Division

P.O. Box 2991

Charleston, WV 25330-2991

If you have questions or need assistance, you can call the State Tax Department at (304) 558-3333 or toll-free at (800) 982-8297.

Documents used along the form

When dealing with the West Virginia Licensed Farm Wineries Production Report (WV Frm 01), several other forms and documents may also be necessary to ensure compliance with state regulations. Each of these documents serves a specific purpose in the tax reporting and regulatory process. Below is a list of commonly used forms that complement the WV Frm 01.

- ATF Form 702: This form is used to report the production of wine to the Alcohol and Tobacco Tax and Trade Bureau. It provides detailed information about the gallons produced and is essential for federal compliance.

- WV Form 100: This is the West Virginia Business Registration Certificate application. It is necessary for any business operating in West Virginia, including farm wineries, to ensure they are registered to collect state taxes.

- WV Form 150: This form is used for the annual business franchise tax report. It is required for all businesses, including wineries, to report their income and pay any applicable franchise taxes.

- WV Form 11: This is the Sales and Use Tax Return. Wineries must file this form if they sell wine directly to consumers, reporting the sales tax collected on those transactions.

- WV Form 140: This is the Individual Income Tax Return for residents. If a winery owner receives income from the business, they must report it using this form.

- WV Form 200: This form is used for the application for a liquor license in West Virginia. It is crucial for any winery that intends to sell alcoholic beverages directly to consumers.

- FedEx Release Form: This form is essential for anyone expecting a delivery but won't be home. It allows recipients to authorize FedEx to leave packages at a designated location. For more details, visit smarttemplates.net.

- WV Form 270: This is the Monthly Sales Tax Return. Wineries that sell products directly to consumers may need to file this form monthly to report sales tax collected.

- WV Form 301: This is the Employer's Quarterly Tax Return. If a winery has employees, it must report payroll taxes using this form.

- WV Form 500: This is the Corporate Net Income Tax Return. Corporations operating as wineries must file this form to report their income and pay taxes accordingly.

- WV Form 600: This is the Application for a Certificate of Good Standing. It may be required when dealing with banks or other entities to prove that the winery is compliant with state regulations.

Filing the correct forms is essential to maintaining compliance with state and federal regulations. Each document plays a role in ensuring that your winery operates smoothly and legally. Be proactive and stay informed about the requirements to avoid any potential issues down the line.

Dos and Don'ts

When filling out the Wv Frm 01 form, it is important to ensure accuracy and compliance with state regulations. Below is a list of things you should and shouldn't do to help you navigate the process smoothly.

- Do use the most current version of the form to avoid processing delays.

- Do report all gallonage of wine produced or blended for the fiscal year.

- Do sign your return to confirm that the information is true and complete.

- Do include your contact information for any follow-up questions.

- Do file your report within thirty days after the end of the fiscal year.

- Don't use older versions of the form; they may not be accepted.

- Don't leave any sections blank; incomplete forms can lead to delays.

- Don't forget to double-check the quantities reported against ATF Form 702.

- Don't hesitate to seek assistance if you have questions about the form.

By following these guidelines, you can help ensure that your submission is processed efficiently and accurately. Remember, thoroughness and attention to detail are key when dealing with tax forms.