Blank Wv Cst Af2 PDF Template

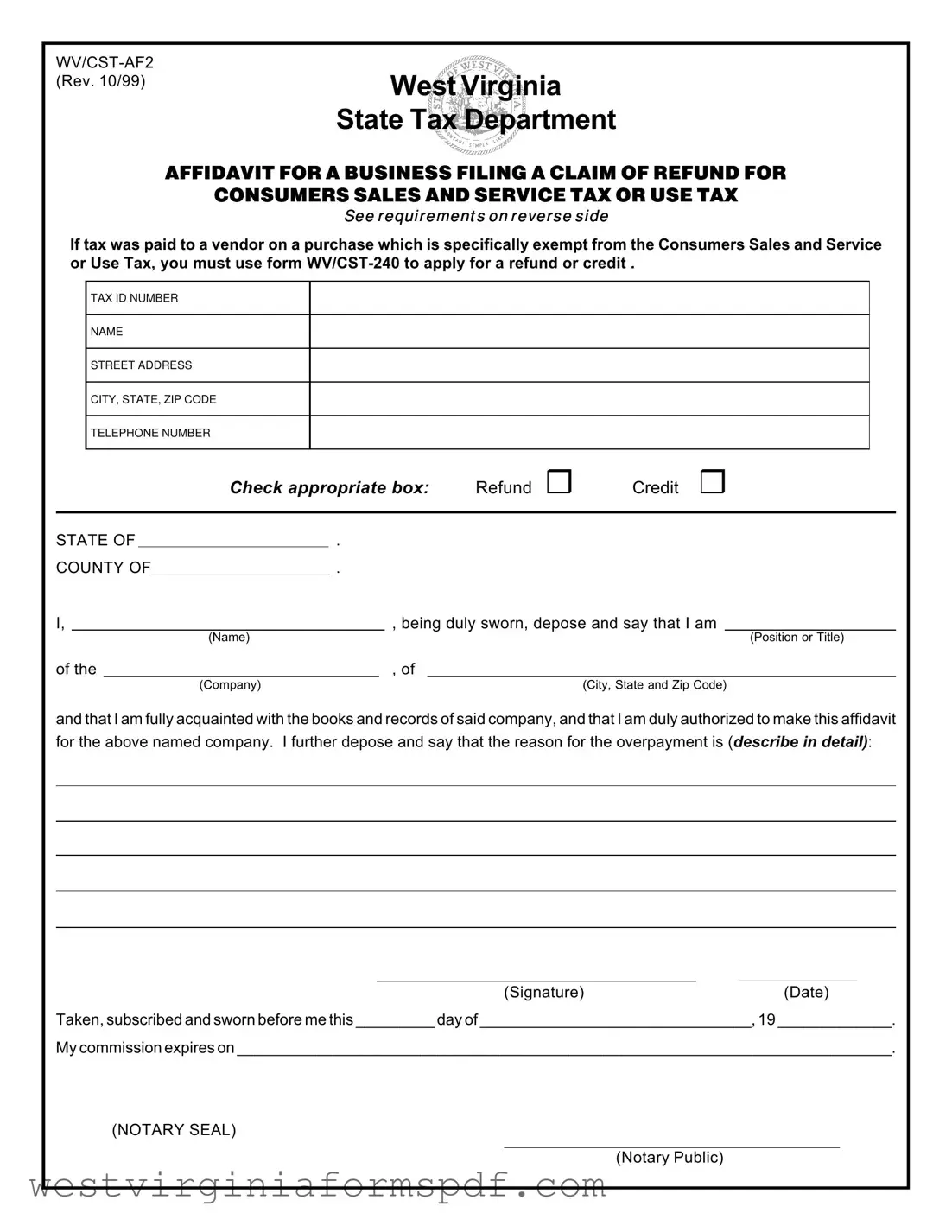

The WV/CST-AF2 form serves an essential purpose for businesses in West Virginia seeking to reclaim overpaid Consumers Sales and Service Tax or Use Tax. When a company has inadvertently paid tax on a purchase that qualifies for an exemption, this affidavit must be completed to initiate the refund or credit process. To ensure a smooth application, businesses must provide specific information, including their tax identification number, business name, and contact details. Additionally, the form requires a detailed explanation of the overpayment reason, which may involve errors in reporting or payments made on behalf of customers who later presented valid exemption certificates. It is crucial that the affidavit is completed and signed by an authorized individual, such as a business owner or corporate officer, and notarized to validate the claim. Furthermore, businesses must also submit an amended tax return for the period in question and include proof of any refunds issued to customers. By adhering to these guidelines, companies can effectively navigate the refund process and ensure compliance with state tax regulations.

Browse More Forms

Wv Court Forms - If the order is not final, an explanation is required for why the court can consider the appeal.

For anyone needing a reliable method to document the delivery of legal documents, the standard California Affidavit of Service form is indispensable. This form provides crucial evidence that all parties have been duly notified, which is vital for maintaining the integrity of legal procedures.

Injured Spouse Claim - The injured spouse must file this form promptly to secure their refund share.

Form Attributes

| Fact Name | Details |

|---|---|

| Form Title | WV/CST-AF2 Affidavit for a Business Filing a Claim of Refund for Consumers Sales and Service Tax or Use Tax |

| Governing Law | West Virginia Code § 11-15-1 et seq. governs the Consumers Sales and Service Tax. |

| Purpose of the Form | This form is used to claim a refund or credit for Consumers Sales and Service Tax or Use Tax paid in error. |

| Eligibility Criteria | Businesses must have overpaid tax and must provide proof of the overpayment and any refunds issued to customers. |

| Required Information | Tax ID number, business name, address, contact number, and a detailed explanation of the overpayment are required. |

| Signature Requirement | The affidavit must be signed by the business owner, corporate officer, bookkeeper, or accountant responsible for tax filings. |

| Notarization | This affidavit must be notarized to be considered valid. |

| Filing an Amended Return | An amended Consumers Sales and Service or Use Tax return must be filed for the period in which the tax was originally paid. |

| Refund Process | To receive a refund, attach copies of refund checks or credit memos issued to customers. |

| Contact Information | For assistance, contact the West Virginia State Tax Department at (304) 558-3333 or toll-free at 1-800-WVA-TAXS. |

Similar forms

The WV/CST-240 form is used for claiming a refund or credit for Consumers Sales and Service Tax or Use Tax paid on purchases that are specifically exempt. Similar to the WV/CST-AF2, it requires detailed information about the business and the reason for the refund request. Both forms necessitate a clear explanation of the overpayment, and they must be signed by an authorized representative of the business. The key difference lies in the specific exemptions that the WV/CST-240 addresses, making it a more targeted form for certain tax scenarios.

The IRS Form 843 is another document that serves a similar purpose. It is used to claim a refund or request an abatement of certain taxes, including employment taxes. Like the WV/CST-AF2, Form 843 requires the taxpayer to provide their identification information and explain the reason for the refund. Both forms aim to rectify overpayments, but Form 843 is broader in scope, covering various types of taxes beyond just sales and service taxes.

The California ATV Bill of Sale form serves as an official document that records the sale and purchase of an All-Terrain Vehicle (ATV) within the state of California. It provides a written account of the transaction's details, ensuring that both buyer and seller agree on the terms and the transfer of ownership. This document is fundamental for legal and administrative purposes, safeguarding the rights of all parties involved. For more details, you can visit toptemplates.info/bill-of-sale/atv-bill-of-sale/california-atv-bill-of-sale/.

The IRS Form 941-X is utilized for adjusting errors on previously filed employment tax returns. Much like the WV/CST-AF2, this form allows businesses to correct mistakes and claim refunds for overpaid taxes. Both forms require detailed explanations of the errors and the amounts involved. The primary distinction is that Form 941-X focuses specifically on employment taxes, whereas the WV/CST-AF2 deals with sales and service taxes.

The West Virginia Consumer Sales and Service Tax Return (WV/CST-1) is another related document. This return is filed periodically to report sales and service tax collected. While the WV/CST-AF2 is used for claiming refunds, the WV/CST-1 is about reporting and remitting taxes owed. Both forms require accurate record-keeping and accountability, but they serve different purposes in the tax process.

The IRS Form 1065 is a partnership return that reports income, deductions, gains, and losses from the operation of a partnership. While it may not seem directly related to the WV/CST-AF2, both documents require accuracy in financial reporting and may involve the need for refunds if overpayments occur. The distinction lies in the type of entity being reported; Form 1065 is specific to partnerships, whereas the WV/CST-AF2 is for sales and service tax refunds.

The WV/IT-140 is the West Virginia Personal Income Tax Return, which individuals use to report their income and calculate taxes owed. Like the WV/CST-AF2, it can result in refunds if too much tax has been paid. Both forms require personal and financial information, but they cater to different types of tax obligations—sales tax versus income tax.

The IRS Form 1120 is the U.S. Corporation Income Tax Return, which corporations use to report their income and expenses. Similar to the WV/CST-AF2, it can also involve refunds if overpayments occur. Both forms require detailed financial information and are essential for ensuring compliance with tax obligations, but they apply to different tax categories—corporate income tax versus sales and service tax.

The IRS Form 990 is filed by tax-exempt organizations to provide the IRS with information about their activities, governance, and finances. While it serves a different purpose than the WV/CST-AF2, both forms require transparency and accuracy in reporting. If an exempt organization overpays taxes, it may also seek refunds, creating a parallel in the need for accountability in tax filings.

The West Virginia Business Registration Certificate is another document that relates to business operations. While it does not directly deal with refunds, it is essential for businesses to have this certificate to operate legally. The WV/CST-AF2 requires businesses to be registered to claim refunds, highlighting the interconnectedness of various business documents and compliance requirements.

Finally, the IRS Form 1099 is used to report various types of income other than wages, salaries, and tips. Like the WV/CST-AF2, it can lead to tax adjustments if errors are found. Both forms emphasize the importance of accurate financial reporting, though they pertain to different aspects of tax obligations—sales and service tax refunds versus income reporting.

FAQ

What is the WV/CST-AF2 form used for?

The WV/CST-AF2 form is an affidavit used by businesses in West Virginia to claim a refund or credit for overpaid Consumers Sales and Service Tax or Use Tax. This form is necessary when a tax was mistakenly paid to a vendor on a purchase that is exempt from these taxes. It serves as a formal declaration that the tax was paid in error and outlines the details of the overpayment.

Who is eligible to complete the WV/CST-AF2 form?

The form must be completed by an authorized individual within the business. This could be the owner, a corporate officer, a bookkeeper, or an accountant responsible for filing and paying the Consumers Sales and Service or Use Tax. It is crucial that the person completing the form has full knowledge of the company’s financial records and is authorized to make such declarations.

What information is required on the form?

To complete the WV/CST-AF2 form, the following information is necessary:

- Your tax identification number.

- The name of your business.

- Your complete mailing address, including city, state, and ZIP code.

- A contact telephone number.

- Indicate whether you are requesting a refund or credit.

- A detailed explanation of the reason for the overpayment.

Additionally, the affidavit must be signed and notarized to be valid.

What steps must be taken after submitting the WV/CST-AF2 form?

After submitting the WV/CST-AF2 form, you must also file an amended Consumers Sales and Service or Use Tax return for the period in which the tax was originally paid. If tax was collected from customers, you need to provide proof that the tax was refunded or credited to them. This could include attaching copies of refund checks or credit memos issued to customers. Failure to follow these steps may delay the processing of your refund or credit.

Documents used along the form

When filing a claim for a refund or credit of Consumers Sales and Service Tax or Use Tax in West Virginia, several other forms and documents may be required. These documents help ensure that the process is thorough and compliant with state regulations. Below is a list of commonly used forms along with brief descriptions of each.

- WV/CST-240: This form is specifically used to apply for a refund or credit for taxes paid on purchases that are exempt from Consumers Sales and Service or Use Tax.

- Amended Consumers Sales and Service Tax Return: This document must be filed to correct any errors in the original tax return for the period in which the tax was initially paid.

- FedEx Release Form: This document allows recipients to authorize FedEx to leave packages at a specified location, ensuring delivery even when they are not home. For more details, visit smarttemplates.net.

- Exemption Certificate: This certificate serves as proof that a customer is exempt from paying sales tax. It must be properly executed and provided when claiming a refund.

- Refund Check or Credit Memo: A copy of the refund check or credit memo issued to customers must be attached to the affidavit to validate the claim for a refund.

- Notarized Affidavit: The WV/CST-AF2 form itself must be notarized to confirm the authenticity of the information provided.

- Tax Identification Number: This number identifies the business for tax purposes and must be included on the affidavit and other related documents.

- Contact Information: A document detailing the name, address, and telephone number of the contact person responsible for the tax filings is often necessary.

- Detailed Explanation of Overpayment: A written statement explaining the reasons for the tax overpayment must accompany the affidavit.

- Corporate Resolution: If applicable, this document authorizes a specific individual to act on behalf of the business in tax matters.

- Proof of Tax Collection: Evidence that tax was collected from customers, such as sales invoices, may be required to support the refund claim.

Each of these documents plays a vital role in the refund process. Ensuring that all necessary forms are completed accurately and submitted in a timely manner will facilitate a smoother experience. For any further assistance, it is advisable to reach out to the West Virginia State Tax Department.

Dos and Don'ts

When filling out the WV/CST-AF2 form, it’s essential to follow specific guidelines to ensure your submission is accurate and complete. Here are nine important dos and don’ts to consider:

- Do provide your correct tax identification number as shown on your tax returns.

- Do clearly state the name of your business in the designated area.

- Do include a complete mailing address, along with a telephone number for a contact person.

- Do indicate whether you are requesting a refund or a credit by checking the appropriate box.

- Do ensure the affidavit is completed by an authorized individual, such as the business owner or a corporate officer.

- Don’t forget to provide a detailed explanation of the reason for the overpayment.

- Don’t submit the affidavit without a signature from the responsible party and notarization.

- Don’t neglect to file an amended Consumers Sales and Service or Use Tax return for the period in question.

- Don’t forget to attach copies of any refund checks or credit memos issued to your customers if applicable.

Following these guidelines will help streamline the process and increase the likelihood of a successful claim for refund or credit. If you have any questions, consider reaching out to the West Virginia State Tax Department for assistance.