Blank Wv Cst 280 PDF Template

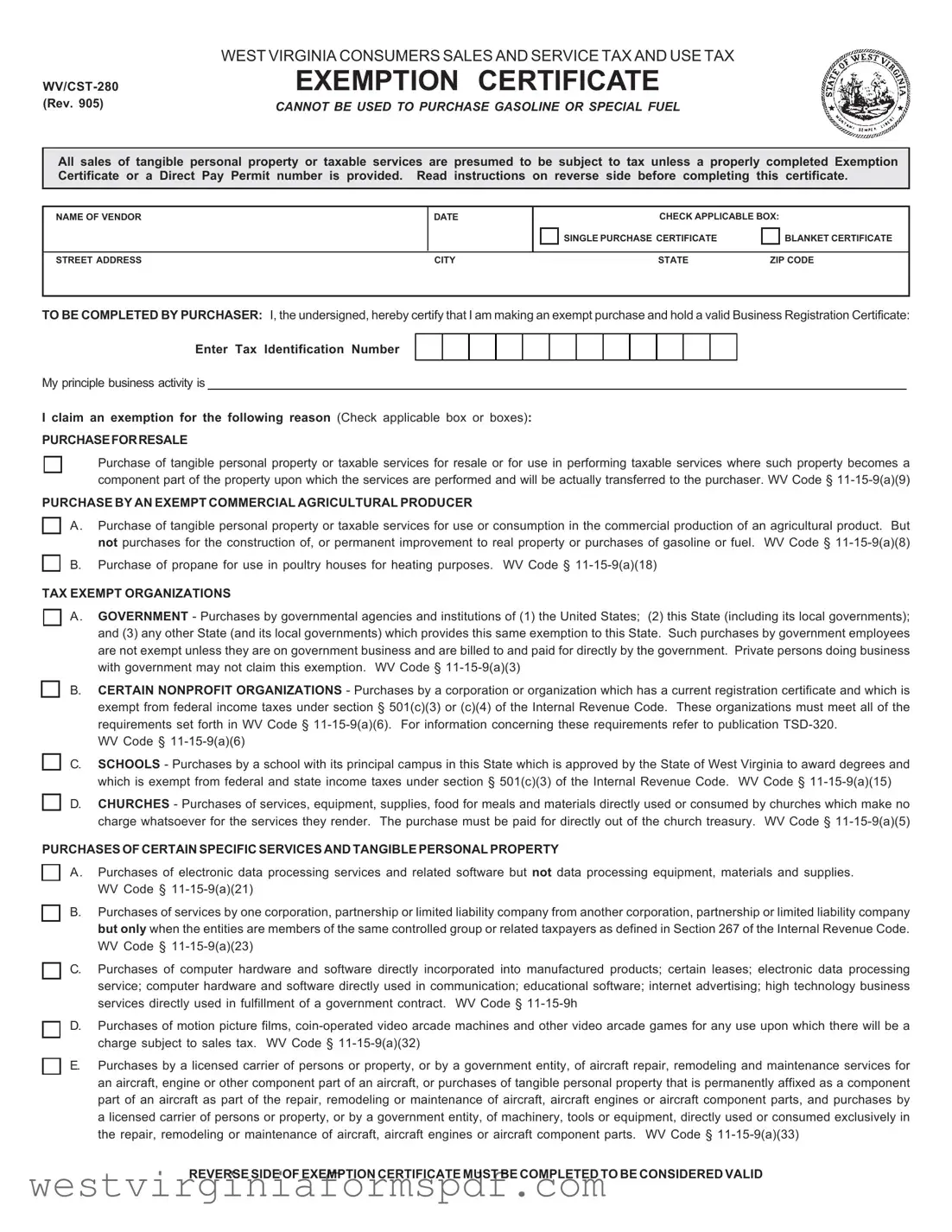

The WV/CST-280 Exemption Certificate is a crucial document for businesses and organizations in West Virginia seeking to make tax-exempt purchases. This form allows purchasers to certify that they are buying tangible personal property or taxable services for exempt purposes, thereby avoiding the Consumers Sales and Service Tax and Use Tax. Notably, the certificate cannot be used for gasoline or special fuel purchases. It requires the vendor's name, the date of the transaction, and the purchaser's details, including their Business Registration Certificate number. The form offers options for single purchase or blanket certificates, catering to different purchasing needs. Various exemptions are outlined, including those for resale, agricultural production, and certain nonprofit organizations. Government entities and educational institutions also benefit from specific tax exemptions. Importantly, the form emphasizes the need for accurate completion and warns against misuse, which could lead to penalties. Understanding the implications of this certificate is essential for compliance and financial management in business operations.

Browse More Forms

Wv Probate Laws - Contact local authorities if you have specific questions about the form completion.

The completion of the New York Boat Bill of Sale form can be streamlined by utilizing resources available at smarttemplates.net/, which offers templates that ensure all necessary information is captured thoroughly, thereby minimizing potential disputes between buyers and sellers.

Wv Letter of Good Standing - Tax compliance can impact business operations, making the GSR-01 vital.

Form Attributes

| Fact Name | Details |

|---|---|

| Form Title | West Virginia Consumers Sales and Service Tax and Use Tax WV/CST-280 Exemption Certificate |

| Revision Date | Rev. 905 |

| Usage Restrictions | This form cannot be used to purchase gasoline or special fuel. |

| Tax Presumption | All sales of tangible personal property or taxable services are presumed to be subject to tax unless a properly completed certificate is provided. |

| Vendor Information | The vendor must complete their name, address, and date on the form. |

| Purchaser Requirement | The purchaser must hold a valid Business Registration Certificate and provide their Tax Identification Number. |

| Exemption Types | Exemptions include purchases for resale, commercial agricultural production, and purchases by tax-exempt organizations. |

| Governing Laws | West Virginia Code § 11-15-9 outlines the exemptions applicable to this certificate. |

| Validity Conditions | The reverse side of the certificate must be completed to be considered valid. |

| Penalties for Misuse | Misuse of this certificate can lead to penalties, including a fine of up to 50% of the tax due. |

Similar forms

The West Virginia Consumers Sales and Service Tax and Use Tax Exemption Certificate (WV/CST-280) is similar to the IRS Form 4506-T, which is used to request a transcript of tax returns. Both documents serve as official means to validate an exemption or request specific information regarding tax matters. Just as the WV/CST-280 certifies that a purchaser is making an exempt purchase, the IRS Form 4506-T allows individuals to obtain proof of their tax filings, which can be necessary for various financial transactions. Both forms require the submission of identifying information, such as names and addresses, to ensure that the correct records are accessed or verified.

Another document that bears resemblance to the WV/CST-280 is the Sales Tax Exemption Certificate used in many states. This certificate allows buyers to make tax-exempt purchases for specific categories of items or services, similar to how the WV/CST-280 allows for exemptions based on particular criteria. Both documents require the purchaser to provide details about their business, such as a registration number or tax identification number, and must be presented to the seller at the time of purchase. This process ensures that tax is not charged on qualifying transactions.

The Certificate of Exemption from the Federal Excise Tax is another similar document. This certificate is used by organizations to claim exemption from federal excise taxes on certain goods and services. Like the WV/CST-280, it requires the entity to provide its tax identification number and a description of the exempt purpose. Both documents aim to facilitate tax-exempt purchases, ensuring that eligible organizations can operate without incurring unnecessary tax burdens.

For those seeking a structured approach, the essential guide to the California Affidavit of Service document is invaluable. This form not only facilitates the confirmation of document delivery but also underscores the importance of keeping all parties informed, thereby ensuring legal transparency within various processes.

Additionally, the Nonprofit Organization Exemption Certificate is comparable to the WV/CST-280. Nonprofits can use this certificate to make tax-exempt purchases related to their charitable activities. Much like the WV/CST-280, this document requires the organization to prove its tax-exempt status and provides a framework for making purchases without sales tax. Both documents are essential for maintaining compliance with tax regulations while allowing qualifying entities to fulfill their missions without additional financial strain.

Lastly, the Direct Pay Permit is similar to the WV/CST-280 in that it allows certain purchasers to pay sales tax directly to the state rather than at the point of sale. This permit is typically issued to large businesses that make frequent purchases. Both the Direct Pay Permit and the WV/CST-280 require detailed information about the purchaser and the intended use of the items or services. This ensures that tax exemptions are granted appropriately and that the state can track tax obligations accurately.

FAQ

What is the purpose of the WV/CST-280 Exemption Certificate?

The WV/CST-280 Exemption Certificate is used to claim an exemption from the Consumers Sales and Service Tax and Use Tax in West Virginia. It allows eligible purchasers to buy tangible personal property or taxable services without paying sales tax, provided the items will be used for exempt purposes. Common exemptions include purchases for resale, agricultural production, and purchases made by certain nonprofit organizations.

Who is eligible to use the WV/CST-280 Exemption Certificate?

Eligibility for using the WV/CST-280 Exemption Certificate includes various categories of purchasers. These include:

- Businesses purchasing items for resale.

- Exempt commercial agricultural producers buying items for agricultural production.

- Government agencies making purchases for government business.

- Nonprofit organizations that are tax-exempt under specific sections of the Internal Revenue Code.

- Schools and churches that meet certain criteria.

Each category has specific requirements, so it's important to check if you qualify under one of these exemptions.

What must be completed on the WV/CST-280 Exemption Certificate?

To ensure the WV/CST-280 Exemption Certificate is valid, several key pieces of information must be filled out. This includes:

- The name and address of the vendor.

- The date of the transaction.

- The purchaser's name, address, and Business Registration Certificate number.

- The reason for the exemption, with the appropriate boxes checked.

- The signature of the purchaser or authorized representative.

Completing all these sections accurately is crucial for the certificate to be accepted.

What happens if the certificate is misused?

Misusing the WV/CST-280 Exemption Certificate can lead to serious consequences. If a purchaser uses the certificate for items or services that do not qualify for an exemption, they may be liable for the sales tax due. Additionally, penalties can apply. These may include a penalty of fifty percent of the tax that would have been due, plus interest. Willfully issuing a false certificate can also result in misdemeanor charges. Therefore, it is essential to use the certificate correctly to avoid these issues.

Documents used along the form

The WV CST 280 form, also known as the Exemption Certificate, is essential for businesses in West Virginia to claim tax exemptions on certain purchases. Along with this form, there are several other documents that may be necessary to facilitate various transactions and ensure compliance with tax regulations. Below is a list of these forms and documents, along with brief descriptions of each.

- Business Registration Certificate: This document proves that a business is registered to operate in West Virginia. It is required to validate the use of the Exemption Certificate.

- Direct Pay Permit: This permit allows certain businesses to pay sales tax directly to the state rather than at the point of sale. It is an alternative to using the Exemption Certificate.

- Sales Tax Return: This form is filed periodically to report sales and pay any sales tax owed. It provides a record of taxable sales and exemptions claimed.

- Purchase Order: A document issued by a buyer to a seller, indicating the types, quantities, and agreed prices for products or services. It may be required to support tax-exempt purchases.

- California Bill of Sale form: This form is crucial for recording the transfer of ownership of an item in California. For detailed guidance on the process, access the document here.

- Resale Certificate: This certificate is used by businesses to buy goods intended for resale without paying sales tax. It confirms the buyer’s intention to resell the purchased items.

- Tax Exempt Organization Certificate: Nonprofit organizations may use this certificate to claim exemptions from sales tax on qualifying purchases, similar to the Exemption Certificate.

- Vendor's License: This license is necessary for businesses selling goods or services in West Virginia. It ensures that vendors comply with local tax laws.

- Affidavit of Exempt Use: This sworn statement may be required to confirm that a purchase was made for an exempt purpose, providing additional assurance to the vendor.

- Invoice: A detailed bill sent by the seller to the buyer, listing goods or services provided. It serves as proof of purchase and may be needed for tax records.

- Exemption Claim Form: This form is sometimes required for specific exemptions, allowing businesses to formally request tax-exempt status for certain transactions.

Understanding these documents can help ensure smooth transactions and compliance with tax regulations in West Virginia. It's important to keep all necessary paperwork organized and readily accessible for any audits or inquiries that may arise.

Dos and Don'ts

Things to Do When Filling Out the WV CST 280 Form:

- Ensure all entries are filled out completely and accurately.

- Check the appropriate box for either a single purchase or blanket certificate.

- Provide your valid Business Registration Certificate number.

- Specify the reason for the exemption by checking the relevant boxes.

- Sign the form where indicated, ensuring that the signature belongs to an authorized individual.

- Include the date of the transaction.

- Keep a copy of the completed form for your records.

- Review the reverse side of the form for additional instructions and requirements.

- Submit the form to the vendor at the time of purchase.

Things to Avoid When Filling Out the WV CST 280 Form:

- Do not leave any required fields blank.

- Avoid using the certificate for purchases that do not qualify for exemption.

- Do not forget to check the appropriate box for the type of exemption being claimed.

- Do not submit the form without the necessary signature from an authorized person.

- Do not use a false or misleading Business Registration Certificate.

- Avoid making any alterations to the form after it has been completed.

- Do not neglect to review the vendor’s requirements for accepting the exemption certificate.

- Do not assume that the exemption is valid without proper documentation.

- Do not ignore the penalties associated with misuse of the exemption certificate.