Blank Wv Cst 250 PDF Template

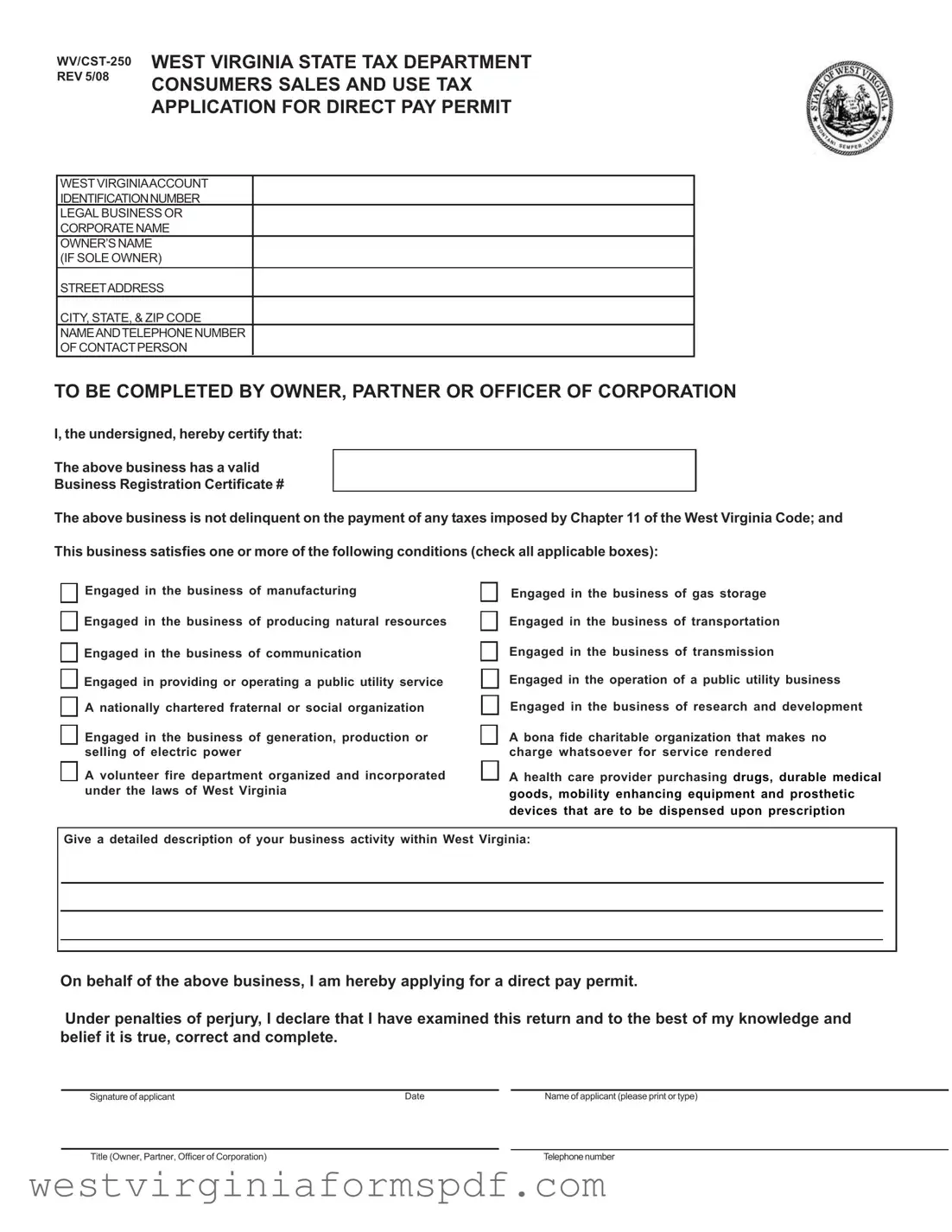

The WV CST 250 form is a crucial document for businesses operating in West Virginia that wish to apply for a Direct Pay Permit. This permit allows eligible businesses to pay sales and use taxes directly to the state, rather than having these taxes collected by vendors at the point of sale. To qualify for this permit, businesses must meet specific criteria, which include being engaged in activities such as manufacturing, providing public utility services, or operating as a bona fide charitable organization. The form requires detailed information about the business, including its legal name, address, and contact details, along with a certification that the business is compliant with tax obligations. Additionally, applicants must check relevant boxes indicating their business activities and provide a description of their operations within the state. Upon approval, the permit imposes certain responsibilities, such as notifying vendors of the permit number and filing tax returns by specified deadlines. It is important for businesses to maintain accurate records and understand that the permit does not apply to certain purchases like food or fuel. Understanding the requirements and implications of the WV CST 250 form is essential for any business looking to streamline its tax processes in West Virginia.

Browse More Forms

Courtswv - Applicants should keep a copy of the completed form for their records.

Injured Spouse Claim - This form serves as a proof of income division between spouses.

For those requiring legal documentation, the California Affidavit of Service form process is an invaluable resource that ensures all parties are notified and held accountable during legal proceedings.

Wv Sales Tax Exemptions - Purchasers must provide their Business Tax Identification Number within the form.

Form Attributes

| Fact Name | Description |

|---|---|

| Form Purpose | The WV/CST-250 form is used to apply for a Direct Pay Permit, allowing certain businesses to pay sales and use tax directly to the West Virginia State Tax Department. |

| Governing Law | This form is governed by West Virginia Code § 11-15-9d, which outlines the conditions and requirements for obtaining a Direct Pay Permit. |

| Eligibility Criteria | Applicants must meet specific conditions, such as engaging in manufacturing, providing utility services, or being a charitable organization, among others. |

| Notification Requirement | Holders of the Direct Pay Permit must notify vendors of their permit number and that tax will be paid directly to the Tax Department. |

| Filing Deadline | Direct Pay Consumers Sales or Use Tax Returns must be filed by the 20th day of the month following the transactions to avoid penalties. |

| Record Keeping | Permit holders are required to maintain detailed records, including invoices and vendor lists, for inspection by the West Virginia State Tax Department. |

| Prohibited Purchases | The Direct Pay Permit cannot be used for purchasing food, gasoline, or special fuel. |

| Validity and Cancellation | The Direct Pay Permit remains valid until surrendered or canceled, with the holder required to notify vendors of any changes. |

Similar forms

The West Virginia Business Registration Certificate serves as a foundational document for businesses operating within the state. It verifies that a business is legally registered and authorized to conduct operations. Similar to the WV/CST-250 form, it requires essential information about the business, such as its name, address, and ownership details. Both documents ensure compliance with state regulations and help maintain accurate records for tax purposes.

Understanding the significance of various tax forms is crucial for both individuals and businesses navigating the complexities of tax regulations. For instance, the WV CST-250 form aids in securing a Direct Pay Permit, similar to forms utilized in other states, such as the Pennsylvania REV-1706 and the New York ST-120. Additionally, for individuals planning for the future, resources like TopTemplates.info offer essential information on creating a Last Will and Testament, ensuring that financial matters are managed with clarity and foresight.

The West Virginia Sales Tax Exemption Certificate allows certain businesses to purchase goods without paying sales tax. This document is similar to the WV/CST-250 form in that it requires the applicant to demonstrate eligibility based on their business activities. Both forms serve to facilitate tax compliance while providing necessary exemptions for qualifying entities, thus supporting economic growth in the state.

The West Virginia Direct Pay Permit Application is directly related to the WV/CST-250 form, as it is specifically designed for businesses seeking to pay sales tax directly to the state. Both documents require detailed business information and a declaration of the applicant's tax status. The Direct Pay Permit allows for streamlined tax payments, benefiting businesses engaged in significant transactions that would otherwise involve complex vendor relationships.

The Federal Employer Identification Number (EIN) application is essential for businesses operating in the United States. Like the WV/CST-250 form, it requires basic business information and is necessary for tax identification purposes. Both documents help ensure that businesses are properly registered with the appropriate tax authorities, thereby facilitating compliance with federal and state tax laws.

The West Virginia Annual Report is a document that businesses must file to maintain their legal status in the state. Similar to the WV/CST-250 form, it requires current information about the business, including its structure and ownership. Both documents serve as a means of accountability, ensuring that businesses are transparent and compliant with state regulations.

The West Virginia Use Tax Return is another related document that businesses may need to file. It is similar to the WV/CST-250 form in that it addresses tax obligations for goods purchased out-of-state but used within West Virginia. Both forms are critical for ensuring that businesses meet their tax responsibilities and avoid penalties associated with non-compliance.

The West Virginia Contractor's Exemption Certificate is applicable for contractors who are purchasing materials for projects. This document is similar to the WV/CST-250 form as it allows for tax exemptions based on specific business activities. Both forms require applicants to provide proof of their business operations, ensuring that only eligible entities benefit from tax exemptions.

The West Virginia Nonprofit Organization Exemption Application allows qualifying nonprofits to apply for sales tax exemptions. This document shares similarities with the WV/CST-250 form by requiring detailed information about the organization’s activities and mission. Both forms are designed to support entities that contribute to the public good by alleviating their tax burdens.

The West Virginia Resale Certificate is utilized by businesses purchasing goods for resale. It is similar to the WV/CST-250 form in that it confirms the buyer's intent to resell the purchased items, thus exempting them from sales tax. Both documents help facilitate commerce by allowing businesses to operate efficiently within the state’s tax framework.

The West Virginia Franchise Tax Report is required for certain business entities and is similar to the WV/CST-250 form in that it assesses the tax obligations of businesses based on their structure and revenue. Both documents are vital for maintaining compliance with state tax laws and ensuring that businesses contribute appropriately to state revenues.

FAQ

What is the WV CST 250 form?

The WV CST 250 form is an application for a Direct Pay Permit issued by the West Virginia State Tax Department. This permit allows certain businesses to pay consumers sales and use tax directly to the state, rather than having the vendor collect it. This can simplify the tax payment process for eligible businesses.

Who is eligible to apply for a Direct Pay Permit?

Eligibility for a Direct Pay Permit typically includes businesses engaged in specific activities such as manufacturing, transportation, or providing public utility services. Additionally, organizations like fraternal groups, volunteer fire departments, and bona fide charitable organizations may qualify. It's important to check the specific criteria listed on the form to determine if your business meets the requirements.

What are the responsibilities of a Direct Pay Permit holder?

As a holder of a Direct Pay Permit, you have several important responsibilities:

- Notify each vendor from whom you purchase tangible personal property or services about your Direct Pay Permit number.

- File a Direct Pay Consumers Sales or Use Tax Return by the 20th of each month for the previous month's transactions.

- Maintain accurate records and invoices for inspection by the West Virginia State Tax Department.

Failure to meet these obligations can result in penalties or cancellation of the permit.

How do I apply for a Direct Pay Permit?

To apply for a Direct Pay Permit, complete the WV CST 250 form in its entirety. Ensure that you provide accurate information about your business and check all applicable boxes regarding your business activities. After submission, the West Virginia State Tax Department will review your application. If approved, you will receive a numbered Direct Pay Permit by mail.

What should I do if my application is rejected?

If your application for a Direct Pay Permit is rejected, you will receive written notification from the West Virginia State Tax Department. It’s advisable to carefully review the reasons for rejection and address any issues before reapplying. If you have questions about the rejection, you can contact the department for clarification.

Can the Direct Pay Permit be used for purchasing food or gasoline?

No, the Direct Pay Permit cannot be used to purchase food, gasoline, or special fuel. This limitation is important to keep in mind when planning your purchases. Ensure that you are using the permit only for eligible transactions to avoid any issues with compliance.

Documents used along the form

When applying for the Direct Pay Permit using the WV/CST-250 form, several other forms and documents may be necessary to ensure compliance with West Virginia tax regulations. Each of these documents serves a specific purpose and can facilitate a smoother application process. Below is a list of these commonly used forms and documents.

- Business Registration Certificate: This certificate proves that your business is registered with the state. It is essential for verifying your business's legitimacy and compliance with local laws.

- Direct Pay Consumers Sales and Use Tax Return: This return must be filed monthly or quarterly to report and remit the sales and use tax owed directly to the state.

- Vendor Notification Letter: This letter informs vendors of your Direct Pay Permit number. It ensures that they understand tax payments will be made directly to the state, not collected by them.

- Tax Exemption Certificate: If applicable, this certificate may be used to claim exemption from sales tax on certain purchases related to your business activities.

- California Articles of Incorporation: This document is crucial for businesses looking to establish themselves as a corporation in California, detailing essential information such as the corporation's name and purpose. For more details, you can visit onlinelawdocs.com/california-articles-of-incorporation/.

- Financial Statements: These documents provide a snapshot of your business's financial health. They may be required for certain tax exemptions or permits.

- Proof of Tax Compliance: This may include documentation showing that your business is current on all state and federal tax obligations, which is necessary for the approval of your Direct Pay Permit.

- Operating Agreements or Bylaws: If your business is a partnership or corporation, these documents outline the structure and governance of your business, which may be required for the application process.

- Identification Documents: Personal identification, such as a driver's license or Social Security number, may be necessary to verify the identity of the business owner or authorized signatory.

- Detailed Business Description: A comprehensive description of your business activities in West Virginia is crucial for the application. It helps the state assess your eligibility for the Direct Pay Permit.

Gathering these documents before submitting your application can streamline the process and help avoid delays. Ensure that all forms are filled out accurately and completely to facilitate a smooth review by the West Virginia State Tax Department.

Dos and Don'ts

When filling out the WV CST 250 form, it’s important to follow certain guidelines to ensure a smooth application process. Here are some dos and don’ts:

- Do ensure all entries are completed accurately.

- Do provide a valid Business Registration Certificate number.

- Do check all applicable boxes that describe your business activities.

- Do sign and date the application before submission.

- Don’t leave any required fields blank.

- Don’t forget to notify vendors of your Direct Pay Permit number.

Following these guidelines will help avoid delays and ensure compliance with the West Virginia State Tax Department's requirements.