Blank Wv Cpa Renewal PDF Template

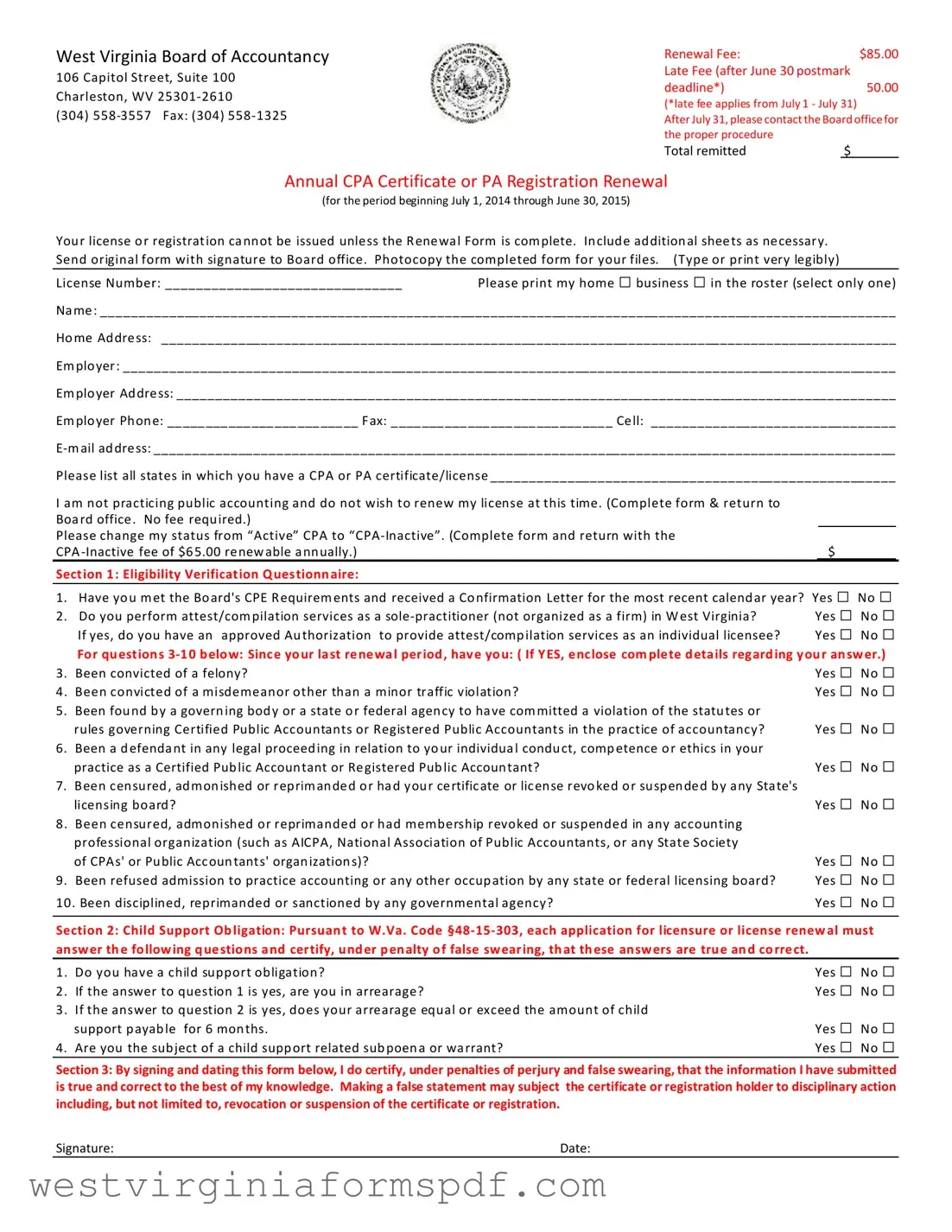

Renewing your CPA license in West Virginia involves a straightforward process, but attention to detail is crucial. The West Virginia CPA Renewal Form is essential for maintaining your certification and ensuring compliance with state regulations. This form requires you to provide personal information, including your license number, name, and contact details, as well as your employer’s information. An annual renewal fee of $85 is applicable, with a late fee of $50 if submitted after the June 30 deadline. If you choose not to renew, you must indicate your status on the form. Additionally, the form includes an eligibility verification questionnaire that addresses Continuing Professional Education (CPE) requirements and any legal or ethical issues that may have arisen since your last renewal. Furthermore, it contains a section regarding child support obligations, which you must answer truthfully under penalty of perjury. Completing this form accurately is vital, as an incomplete submission may delay your license renewal. Remember to keep a photocopy for your records before sending the original to the Board office.

Browse More Forms

West Virginia State Tax Department - Check the appropriate boxes to indicate the reason for exemption.

Wv Pte-100 Instructions 2022 - The form contains sections for providing mailing addresses for both the organization and the nonresident.

A Last Will and Testament form is a legal document that outlines how a person's assets and responsibilities should be handled after their death. It allows individuals to specify beneficiaries for their property and appoint guardians for minor children. Understanding this essential document can provide peace of mind and ensure that one's final wishes are respected. For more information on creating this vital document, visit TopTemplates.info.

Personal Property Tax Exemption Affidavit Wv - Only one name should be entered for the transferor unless filing jointly as a married couple.

Form Attributes

| Fact Name | Details |

|---|---|

| Governing Authority | The West Virginia Board of Accountancy oversees the CPA renewal process. |

| Renewal Fee | The renewal fee is $85.00. |

| Late Fee | A late fee of $50.00 applies for renewals postmarked after June 30. |

| Late Renewal Period | The late fee is applicable from July 1 to July 31. |

| Contact Information | The Board office can be reached at (304) 558-3557. |

| Required Completeness | The renewal form must be complete for the license or registration to be issued. |

| Additional Sheets | Applicants may include additional sheets if necessary. |

| Inactive Status | A fee of $65.00 is required to change status to “CPA-Inactive.” |

| Child Support Obligation | Applicants must answer questions regarding child support obligations as per W.Va. Code §48-15-303. |

Similar forms

The West Virginia CPA Renewal form shares similarities with the general Business License Renewal form. Both documents require individuals to verify their compliance with specific regulations and standards. Just like the CPA Renewal, the Business License Renewal form often asks for confirmation of continuing education or training, ensuring that the business owner remains updated on industry practices. Both forms also necessitate a fee payment, which can vary depending on the jurisdiction and the type of business. Failure to submit either form on time can lead to penalties or the inability to operate legally.

Another document that aligns with the CPA Renewal form is the Professional License Renewal application. This application is common across various professions, such as nursing or engineering. Much like the CPA Renewal, it requires proof of continuing education and may include questions about any legal or ethical violations that may have occurred since the last renewal. Both forms emphasize the importance of maintaining professional standards and provide a clear process for individuals to follow to ensure their licenses remain valid.

The Occupational Therapy License Renewal form is also quite similar to the CPA Renewal form. Both documents require the applicant to confirm that they have met continuing education requirements. They also ask for personal and professional information, including any changes in employment status or address. Additionally, both forms typically include a certification statement, where the applicant must affirm that all information provided is accurate and truthful, highlighting the ethical responsibility of the license holder.

In the realm of real estate, the Real Estate License Renewal form mirrors the CPA Renewal form in several ways. Both require the submission of proof of completed continuing education courses. They also ask for a fee and may inquire about any legal issues that could affect the applicant's ability to practice. This ensures that both CPAs and real estate agents maintain a high level of professionalism and compliance with state regulations.

The EDD DE 2501 form, essential for workers seeking temporary financial assistance, highlights the importance of proper documentation in the claims process. To understand better the requirements and guidelines surrounding this form, resources such as OnlineLawDocs.com can provide valuable insights and assistance, ensuring that eligible employees navigate the process smoothly during periods of disability.

The Nursing License Renewal application is another document that shares characteristics with the CPA Renewal form. Both forms require verification of continuing education and often include questions about any disciplinary actions taken against the applicant. They also require a fee payment and a signed declaration affirming the truthfulness of the information provided. This similarity underscores the importance of ongoing education and ethical conduct across various professions.

Similarly, the Teaching License Renewal application is akin to the CPA Renewal form. Both require educators to demonstrate that they have engaged in professional development activities. They also ask for personal details and may include questions about any legal or ethical issues. This ensures that teachers, like CPAs, uphold high standards in their respective fields, contributing to the integrity of their professions.

Lastly, the Pharmacy License Renewal form shares common ground with the CPA Renewal form. Both documents require proof of continuing education and include questions regarding any legal or ethical violations. Additionally, both forms necessitate a fee payment and a signed statement affirming the accuracy of the information provided. This highlights the shared commitment to maintaining professional standards in both accounting and pharmacy practices.

FAQ

-

What is the renewal fee for the West Virginia CPA Renewal form?

The renewal fee is $85. If you miss the June 30 postmark deadline, a late fee of $50 will apply from July 1 to July 31. After July 31, you will need to contact the Board office for further instructions.

-

How do I submit the renewal form?

You must complete the renewal form and send the original, signed copy to the West Virginia Board of Accountancy. Be sure to keep a photocopy for your records. If necessary, include additional sheets to provide complete information.

-

What happens if I do not wish to renew my license?

If you are not practicing public accounting and do not wish to renew your license, complete the form and return it to the Board office. No fee is required in this case.

-

Can I change my status from Active CPA to CPA-Inactive?

Yes, you can change your status to CPA-Inactive. Complete the form and return it with the CPA-Inactive fee of $65. This status is renewable annually.

-

What is the eligibility verification questionnaire?

The eligibility verification questionnaire consists of a series of questions that confirm your compliance with the Board's Continuing Professional Education (CPE) requirements and any legal or ethical issues since your last renewal. Answer each question truthfully.

-

What should I do if I answer 'yes' to any questions in the eligibility verification?

If you answer 'yes' to any of the questions, you must provide complete details regarding your answer. This information is crucial for the Board to assess your eligibility for renewal.

-

What child support obligations must I disclose?

You must answer questions related to your child support obligations. This includes whether you have an obligation, if you are in arrearage, and if your arrearage equals or exceeds the amount of child support payable for six months. You must also disclose if you are subject to a child support-related subpoena or warrant.

-

What are the consequences of providing false information?

Providing false information on the renewal form can lead to disciplinary action, including the revocation or suspension of your CPA certificate or registration. It is essential to ensure that all information is accurate and truthful.

-

Where can I find the contact information for the Board office?

The West Virginia Board of Accountancy is located at 106 Capitol Street, Suite 100, Charleston, WV 25301-2610. You can reach them by phone at (304) 558-3557 or by fax at (304) 558-1325.

-

What should I do if I have further questions about the renewal process?

If you have any additional questions or need clarification about the renewal process, you should contact the Board office directly. They can provide the most accurate and up-to-date information regarding your situation.

Documents used along the form

The West Virginia CPA Renewal Form is essential for maintaining your license as a Certified Public Accountant in the state. Alongside this form, several other documents may be required or beneficial during the renewal process. Below is a list of related forms and documents that you might encounter.

- CPE Documentation: This includes records of Continuing Professional Education (CPE) courses completed. CPAs must meet specific educational requirements to renew their licenses, and proof of these courses is often necessary.

- Authorization to Provide Attest/Compilation Services: If you plan to offer attest or compilation services as a sole practitioner, this authorization form must be completed and submitted. It ensures compliance with state regulations.

- Affidavit of Service Form: For your legal documentation needs, refer to the important Affidavit of Service form resources to ensure proper delivery confirmation.

- CPA-Inactive Status Form: For those who wish to change their status from active to inactive, this form is required. It includes a fee and allows you to maintain your license without practicing.

- Child Support Obligation Certification: This certification is part of the renewal process. It confirms whether you have any child support obligations and ensures compliance with state laws.

- Application for Reinstatement: If your license has lapsed, this application is necessary for reinstatement. It outlines the steps and requirements to regain your active status.

- Professional Ethics Declaration: This document is often required to affirm adherence to ethical standards in accounting practices. It may include disclosures about any disciplinary actions or legal issues.

Understanding these documents will help streamline your renewal process. Ensure that all forms are completed accurately and submitted on time to avoid any disruptions in your CPA status.

Dos and Don'ts

When filling out the West Virginia CPA Renewal form, it is important to follow specific guidelines to ensure a smooth process. Here are ten things you should and shouldn't do:

- Do read the entire form carefully before starting to fill it out.

- Don't leave any required fields blank; incomplete forms can delay your renewal.

- Do use legible handwriting or type your responses to avoid misinterpretation.

- Don't forget to include your license number; it is essential for processing your application.

- Do check the current renewal fee and include the correct amount with your submission.

- Don't submit the form without signing it; an unsigned form will not be accepted.

- Do photocopy the completed form for your records before sending it to the Board office.

- Don't ignore the late fee schedule; submit your renewal before the deadline to avoid extra charges.

- Do provide accurate information regarding your continuing education and any legal issues.

- Don't hesitate to contact the Board office if you have questions or need clarification on any part of the form.