Blank Wv 8453 PDF Template

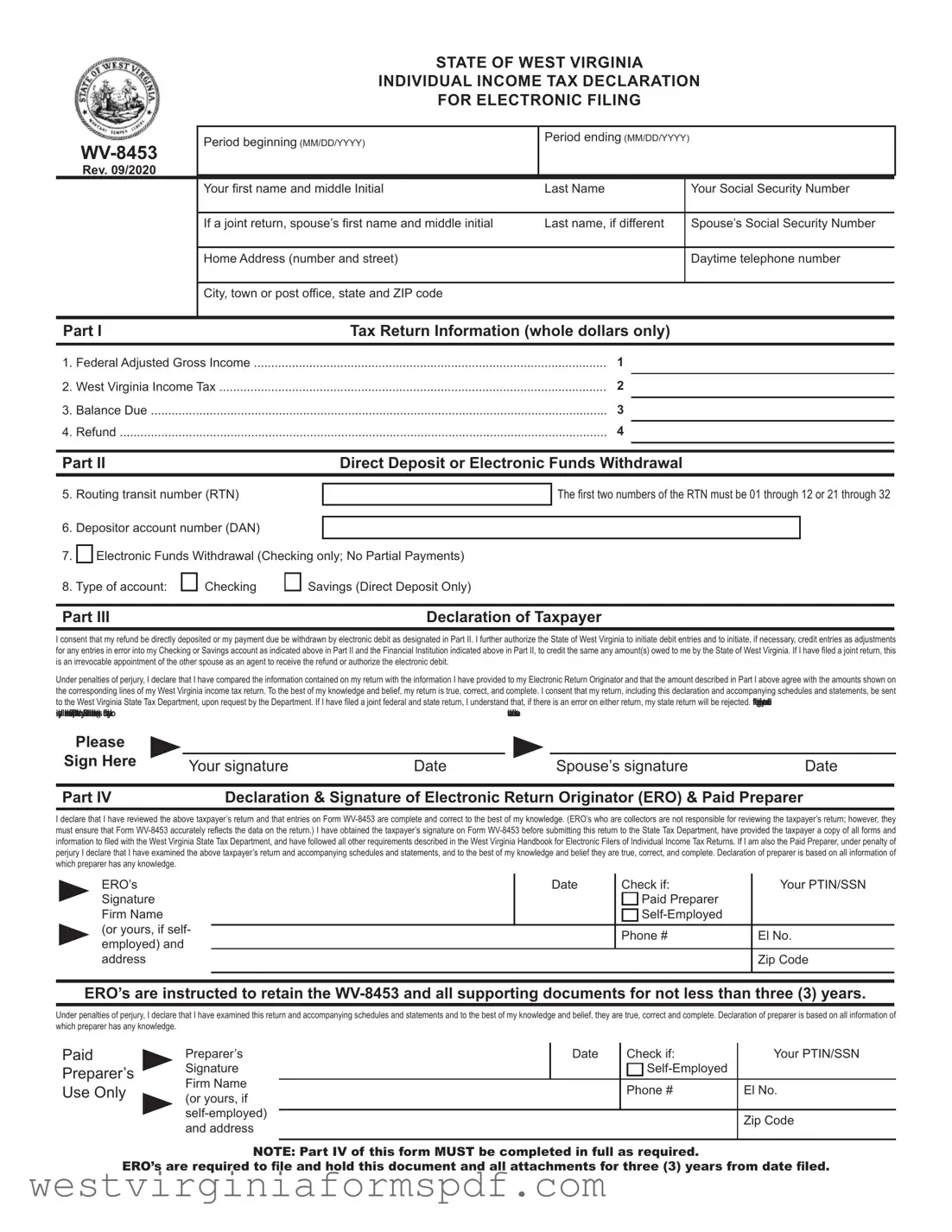

The WV 8453 form is an essential document for individuals filing their income tax electronically in West Virginia. It serves as a declaration of the taxpayer's intent to file their return electronically and provides crucial information about their income and tax obligations. This form includes sections where taxpayers can report their federal adjusted gross income, the amount of West Virginia income tax owed, and any balance due or refund expected. Additionally, it allows for direct deposit of refunds or electronic withdrawal of payments, streamlining the process for both the taxpayer and the state. The form requires signatures from both the taxpayer and their spouse, if applicable, affirming that the information provided is accurate and complete. Taxpayers must also ensure that their electronic return originator (ERO) completes the necessary declarations, confirming that all entries are correct. Overall, the WV 8453 is a critical step in the electronic filing process, helping to facilitate efficient tax administration in the state.

Browse More Forms

West Virginia Withholding Form - Keeping communication open with your employer about your withholding preferences is important.

When engaging in activities that may pose certain risks, it is crucial to utilize protective measures, such as the California Release of Liability form, which can be found at https://smarttemplates.net/fillable-california-release-of-liability/. This form not only clarifies the responsibilities of each party involved but also plays a significant role in preventing misunderstandings and potential legal issues arising from accidents or injuries during those activities.

Wv Withholding Form - Review the instructions thoroughly to avoid common mistakes on the Wv 103 form.

Form Attributes

| Fact Name | Fact Description |

|---|---|

| Purpose | The WV-8453 form is used for declaring individual income tax for electronic filing in West Virginia. |

| Governing Law | This form is governed by West Virginia Code §11-10-1 et seq., which outlines the state's tax regulations. |

| Filing Year | The form is specifically for the tax year January 1 - December 31, 2005. |

| Signature Requirement | Taxpayers must sign the form to authorize the electronic submission of their income tax return. |

| Electronic Funds | The form allows for direct deposit of refunds or electronic withdrawal of payments, as indicated in Part II. |

| Joint Returns | If filing jointly, both spouses must consent to the declaration and authorize the electronic transactions. |

| Retention Period | Electronic Return Originators (EROs) are required to retain the WV-8453 form and all supporting documents for a minimum of three years. |

| Accuracy Declaration | Taxpayers declare that the information provided on the form matches their tax return and is true and complete. |

| Penalties | Filing false information on the WV-8453 can result in penalties under perjury laws. |

Similar forms

The IRS Form 1040 serves as the standard individual income tax return for U.S. taxpayers. Like the WV 8453, it collects essential information about a taxpayer’s income, deductions, and tax liabilities. Both forms require the taxpayer's signature, affirming the accuracy of the information provided. While the 1040 is used for federal tax purposes, the WV 8453 specifically pertains to state income tax filings in West Virginia. This distinction is crucial for taxpayers who must navigate both federal and state tax regulations.

The IRS Form 8879 is known as the e-file Signature Authorization. Similar to the WV 8453, this form allows taxpayers to authorize an Electronic Return Originator (ERO) to file their tax return electronically. It requires the taxpayer’s signature, which confirms that they have reviewed the return and agree with its contents. Both forms facilitate electronic filing, streamlining the process and ensuring that the taxpayer’s consent is documented.

The IRS Form 4868 is the Application for Automatic Extension of Time to File U.S. Individual Income Tax Return. This document shares similarities with the WV 8453 in that both require taxpayer information and signatures. While the WV 8453 is used to confirm an electronic filing, Form 4868 provides an extension for filing the return itself. Taxpayers must be aware of deadlines associated with both forms to avoid penalties.

In addition to the various tax forms, businesses and independent contractors can also benefit from tools such as the Free And Invoice Pdf form provided by TopTemplates.info, which helps streamline the invoicing process and ensures that billing is efficient and clear, thereby enhancing record-keeping and payment processing.

The IRS Form 8888 allows taxpayers to allocate their tax refund to multiple accounts. This form is similar to the WV 8453 in that it addresses financial transactions related to tax returns. Both documents require banking information for direct deposit or electronic funds withdrawal. Understanding the similarities can help taxpayers manage their refunds more effectively, ensuring they receive their money in the desired manner.

The IRS Form 1040-X is the Amended U.S. Individual Income Tax Return. This form is used to correct errors on a previously filed 1040. Like the WV 8453, it requires a signature from the taxpayer, affirming the accuracy of the amended information. Both forms are essential for ensuring that tax records are correct and up to date, helping taxpayers avoid potential issues with the IRS or state tax authorities.

The IRS Form 8862 is the Information to Claim Certain Refundable Credits After Disallowance. This form is similar to the WV 8453 in that it requires detailed taxpayer information and is used to claim credits after a previous claim has been denied. Both forms serve to clarify the taxpayer's eligibility for specific benefits, ensuring that the information provided is accurate and complete.

The IRS Form 4506-T allows taxpayers to request a transcript of their tax return. Similar to the WV 8453, this form requires personal identification information and a signature. Both documents help taxpayers manage their tax records, whether for personal review or for providing information to financial institutions or other entities.

The IRS Form 14157 is used to report suspected tax preparer misconduct. While it serves a different purpose than the WV 8453, it still requires detailed taxpayer information and signatures. Both forms emphasize the importance of accurate and honest tax reporting, holding preparers accountable for their actions.

The IRS Form 8948 is the Preparer e-file Hardship Waiver Request. This form is similar to the WV 8453 in that it addresses electronic filing procedures. It allows taxpayers to request a waiver from the requirement to e-file under certain circumstances. Both forms highlight the importance of compliance with tax filing regulations while providing pathways for exceptions when necessary.

Finally, the IRS Form 8821 is the Tax Information Authorization form. This document allows taxpayers to authorize someone else to receive their tax information. Like the WV 8453, it requires signatures from the taxpayer and the authorized individual. Both forms facilitate communication between taxpayers and their representatives, ensuring that sensitive tax information is handled appropriately.

FAQ

What is the WV 8453 form?

The WV 8453 form is the Individual Income Tax Declaration for Electronic Filing used in West Virginia. This form is required for individuals who file their state income tax returns electronically. It serves as a declaration that the taxpayer's information is accurate and that they consent to the electronic filing of their tax return.

Who needs to file the WV 8453 form?

Anyone who is filing their West Virginia individual income tax return electronically must complete the WV 8453 form. This includes both single filers and those filing jointly with a spouse. The form ensures that the taxpayer agrees to the electronic submission of their tax return and authorizes any refunds or payments to be processed electronically.

What information is required on the WV 8453 form?

The WV 8453 form requires several pieces of information, including:

- Your name and Social Security Number.

- If applicable, your spouse's name and Social Security Number.

- Your home address and daytime telephone number.

- Federal Adjusted Gross Income and West Virginia Income Tax amounts from your tax return.

- Details for direct deposit or electronic funds withdrawal, including routing transit number and account number.

How does the direct deposit option work on the WV 8453 form?

The direct deposit option allows taxpayers to receive their refunds directly into their bank accounts. To use this option, you must provide your bank's routing transit number and your account number on the form. It is important to ensure that these numbers are accurate to avoid any issues with receiving your refund.

What happens if there is an error on my tax return?

If there is an error on either your federal or state tax return, your state return may be rejected. This means that it is crucial to double-check all information provided on both returns. If you find an error after submission, you will need to file an amended return to correct it.

How long should I keep the WV 8453 form and supporting documents?

It is recommended that you retain the WV 8453 form and all supporting documents for at least three years from the date you filed your tax return. Keeping these documents is important in case of any future inquiries or audits by the West Virginia State Tax Department.

What is the purpose of the Electronic Return Originator (ERO) section on the form?

The ERO section is for the tax professional or service that is electronically filing the return on behalf of the taxpayer. The ERO must complete this section to confirm that they have reviewed the taxpayer's return for accuracy and that they have obtained the necessary signatures. This ensures accountability and compliance with state filing requirements.

Documents used along the form

When filing your income tax return in West Virginia, the WV-8453 form is essential for electronic filing. However, several other forms and documents often accompany it to ensure a smooth and complete submission. Here’s a list of those documents, each playing a crucial role in the tax filing process.

- Form IT-140: This is the primary income tax return form for West Virginia residents. It reports your total income, deductions, and the final tax owed or refund due.

- Form IT-140N: This is the non-resident income tax return form. If you earned income in West Virginia but reside elsewhere, this form is necessary to report your earnings and calculate your tax liability.

- Form IT-140ES: This is the estimated tax payment form. If you expect to owe tax for the year, you may need to submit estimated payments using this form to avoid penalties.

- Power of Attorney for a Child Form: For parents granting caregiver authority, our comprehensive Power of Attorney for a Child form ensures legal rights are clearly defined and actionable in your absence.

- Form IT-140V: This is the payment voucher for those who owe taxes. It should be included with your payment when filing your return if you are not using electronic funds withdrawal.

- Form WV-PT: The West Virginia Personal Property Tax form may be required if you own personal property. It helps determine any additional taxes owed on property you possess.

- W-2 Forms: These forms report your annual wages and the taxes withheld by your employer. They are essential for accurately completing your income tax return.

- 1099 Forms: If you received income from sources other than an employer, such as freelance work or interest, these forms document that income and are necessary for your tax return.

- Form WV-8453-OL: This is the online version of the WV-8453 form, used for electronically filed returns. It serves a similar purpose but is tailored for online submissions.

- Supporting Schedules: These may include additional documentation that supports deductions or credits claimed on your return, such as Schedule A for itemized deductions.

Each of these forms and documents serves a specific purpose in the tax filing process. By understanding their roles, you can ensure that your tax return is complete and accurate, minimizing the risk of delays or issues with the West Virginia State Tax Department.

Dos and Don'ts

When filling out the WV 8453 form, keep these important tips in mind:

- Do double-check your personal information for accuracy.

- Don't leave any required fields blank.

- Do use whole dollars when reporting your income and tax amounts.

- Don't forget to sign and date the form.

- Do provide correct bank information for direct deposit.

- Don't use a routing number that doesn't match your bank.

- Do keep a copy of the completed form for your records.

Following these guidelines will help ensure a smoother filing process.