Blank Wv 8379 PDF Template

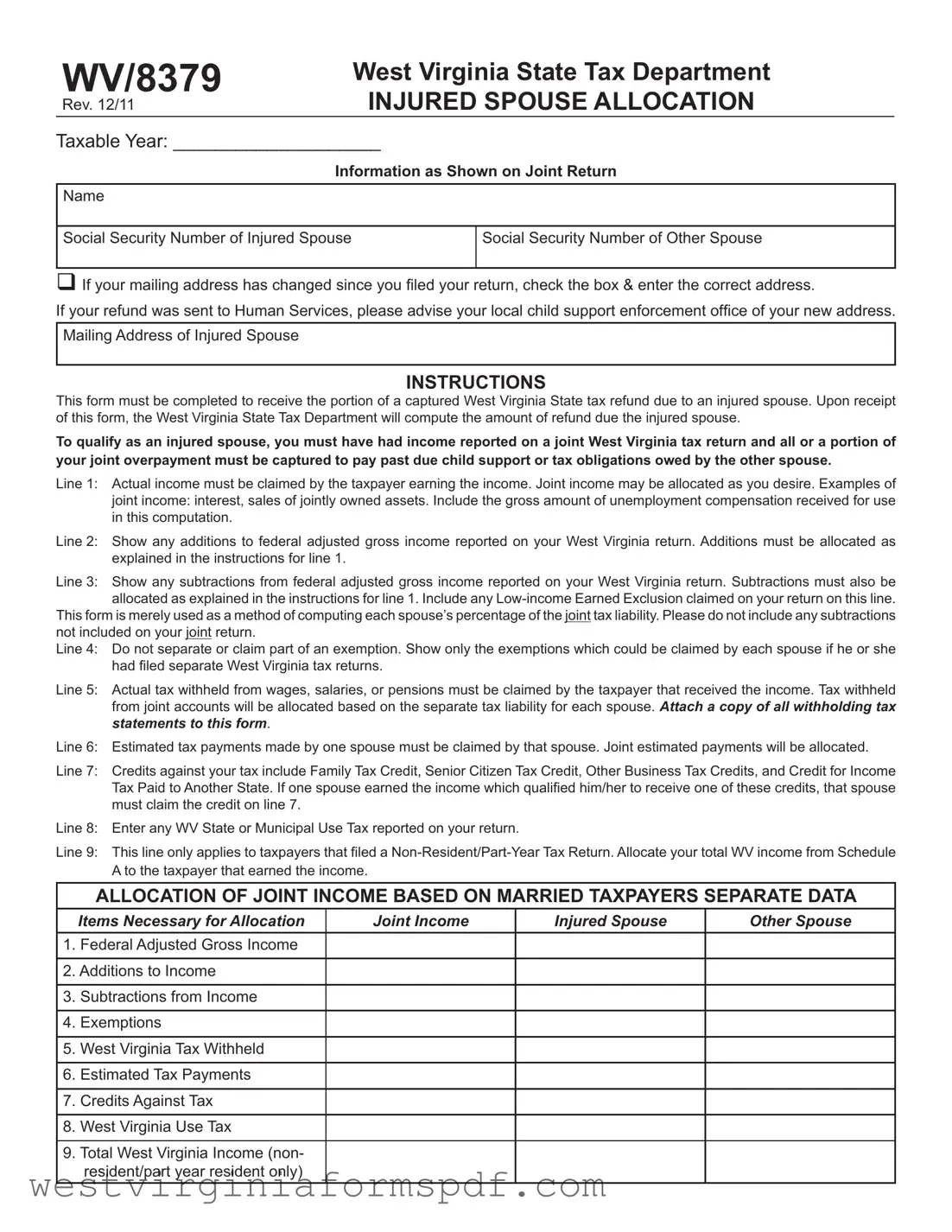

The WV 8379 form, officially known as the Injured Spouse Allocation form, plays a crucial role for married couples filing taxes in West Virginia, particularly when one spouse has outstanding debts that may affect the joint tax refund. This form is designed to help the "injured spouse" reclaim their portion of a tax refund that may have been intercepted to satisfy the other spouse's past due child support or tax obligations. To qualify as an injured spouse, it is essential that the couple filed a joint tax return and that the injured spouse had reported income. The form requires detailed information, including the names and Social Security numbers of both spouses, along with their respective incomes, tax withheld, and any applicable credits. It guides users through the process of allocating joint income and expenses, ensuring that each spouse's contributions are fairly represented. By completing the WV 8379, couples can navigate the complexities of tax liability and ensure that they receive the refund amounts they are rightfully entitled to, despite any financial difficulties faced by one spouse.

Browse More Forms

Wv Probate Laws - Entities such as trusts may complicate the asset identification process.

For anyone navigating legal processes, understanding the key features of the Affidavit of Service document can be vital. This form not only legitimizes the distribution of legal documents but also reinforces the necessity of accountability in procedural communications.

West Virginia Police Report - The clear outline of what is required helps guide users through the submission process smoothly.

Form Attributes

| Fact Name | Description |

|---|---|

| Purpose | The WV 8379 form is used by an injured spouse to claim their share of a tax refund that has been captured to pay the other spouse's past due obligations. |

| Eligibility | To qualify as an injured spouse, the individual must have reported income on a joint tax return and have a portion of the refund withheld for the other spouse's debts. |

| Allocation of Income | Joint income can be allocated between spouses as desired, with specific guidelines provided for reporting income, deductions, and credits. |

| Filing Instructions | It is essential to complete the form accurately and attach all necessary withholding tax statements to ensure proper processing by the West Virginia State Tax Department. |

| Governing Law | This form is governed by West Virginia state tax laws, particularly those related to tax refunds and obligations of married taxpayers. |

Similar forms

The IRS Form 8379, known as the Injured Spouse Allocation form, serves a specific purpose in the realm of tax filings. Similar to the WV 8379, the IRS Form 8857, the Request for Innocent Spouse Relief, helps individuals who believe they should not be held responsible for tax liabilities incurred by their spouse. Both forms address the issue of financial responsibility in a joint tax return context. While the WV 8379 focuses on allocating tax refunds to the injured spouse, the IRS Form 8857 allows a spouse to request relief from joint tax liability due to the other spouse’s actions, such as underreporting income or claiming improper deductions. Thus, both forms aim to protect individuals from the financial repercussions of their partner's tax-related decisions.

Another document that shares similarities with the WV 8379 is the IRS Form 1040X, the Amended U.S. Individual Income Tax Return. This form allows taxpayers to correct errors on their previously filed tax returns. Like the WV 8379, which requires accurate reporting of income and allocations, the 1040X demands detailed information about changes made to the original return. Both documents necessitate careful consideration of income, deductions, and credits, emphasizing the importance of accuracy in tax reporting. In essence, while the 1040X addresses corrections, the WV 8379 focuses on the allocation of tax refunds, highlighting the interconnectedness of tax documents in the filing process.

The IRS Form 8862, the Information to Claim Earned Income Credit After Disallowance, also bears resemblance to the WV 8379. This form is used by taxpayers who have previously been denied the Earned Income Credit and are now seeking to claim it again. Both forms require detailed information about income and tax credits, underscoring the need for accurate reporting. The primary distinction lies in their purpose; while the WV 8379 seeks to allocate refunds due to an injured spouse, the 8862 is about reinstating eligibility for a tax credit. Nevertheless, both forms play a critical role in ensuring that taxpayers receive their rightful financial benefits.

The IRS Form 8332, the Release/Revocation of Release of Claim to Exemption for Child of Divorced or Separated Parents, is another document that shares a conceptual foundation with the WV 8379. This form allows one parent to release their claim to a child's tax exemption, thereby enabling the other parent to claim it. Both forms address issues of financial allocation within family structures, particularly in situations involving separation or divorce. While the WV 8379 focuses on tax refunds, the 8332 centers on exemptions, yet both are essential in ensuring fair treatment in tax matters following marital dissolution.

Similarly, the IRS Form 8863, the Education Credits (American Opportunity and Lifetime Learning Credits) form, aligns with the WV 8379 in that it allows taxpayers to claim educational tax credits. Both forms require meticulous documentation of income and credits, emphasizing the importance of accurate financial reporting. The 8863 form specifically targets educational expenses, while the WV 8379 focuses on tax refunds due to an injured spouse. However, both serve to maximize the financial benefits available to taxpayers, reflecting the broader aim of tax forms to facilitate fair financial outcomes.

Understanding the nuances of tax forms, such as the toptemplates.info/bill-of-sale/atv-bill-of-sale/california-atv-bill-of-sale/, is crucial for maximizing potential refunds and ensuring fair financial responsibility between spouses, particularly in cases where one partner may have outstanding debts impacting joint returns.

Another comparable document is the IRS Form 4506-T, the Request for Transcript of Tax Return. This form allows taxpayers to request a transcript of their tax return for various purposes, including verifying income for loans or other financial transactions. Like the WV 8379, which requires detailed income reporting, the 4506-T necessitates accurate information about past tax filings. Both forms highlight the importance of maintaining accurate records and provide mechanisms for individuals to access necessary financial information. While the 4506-T does not directly address tax refunds, it plays a crucial role in the overall tax process by ensuring that taxpayers have the information they need to navigate financial obligations.

The IRS Form 1040, the U.S. Individual Income Tax Return, is perhaps the most fundamental document in the tax system and shares similarities with the WV 8379 in that it is the primary form used by individuals to report income and calculate tax liability. Both forms require comprehensive information about income, deductions, and credits. While the 1040 serves as the foundational document for filing taxes, the WV 8379 operates as a supplementary form that addresses specific circumstances involving joint returns and the allocation of refunds. Together, they illustrate the complexity of tax reporting and the need for individuals to navigate various forms to achieve accurate financial outcomes.

Lastly, the IRS Form 1040-SR, designed for seniors, mirrors the WV 8379 in its focus on tax reporting but is tailored to meet the needs of older taxpayers. This form simplifies the filing process for seniors while still requiring detailed income reporting and deductions. Both forms emphasize the importance of accurately reporting income to ensure that individuals receive the benefits to which they are entitled. While the 1040-SR specifically addresses the unique circumstances of senior taxpayers, the WV 8379 focuses on the allocation of refunds in joint returns, showcasing the diverse landscape of tax documentation.

FAQ

What is the WV 8379 form?

The WV 8379 form, also known as the Injured Spouse Allocation form, is used by individuals in West Virginia who have filed a joint tax return. This form allows an injured spouse to claim their share of a tax refund that may have been withheld to cover debts owed by the other spouse, such as past due child support or taxes. By completing this form, the injured spouse can ensure they receive the portion of the refund they are entitled to.

Who qualifies as an injured spouse?

To qualify as an injured spouse, you must have reported income on a joint West Virginia tax return. Additionally, part or all of your tax refund must have been captured to pay for the other spouse’s debts. If you meet these criteria, you can complete the WV 8379 form to reclaim your share of the refund.

How do I fill out the WV 8379 form?

Filling out the WV 8379 form involves several steps:

- Provide your name and Social Security number, as well as the information for your spouse.

- Indicate any changes to your mailing address if applicable.

- Allocate your joint income, including any additions and subtractions to your federal adjusted gross income.

- Claim any exemptions, tax withheld, estimated payments, and credits against your tax.

- Attach copies of all relevant withholding tax statements.

Make sure to review the instructions carefully to ensure accurate completion.

What information do I need to provide on the form?

You will need to provide several key pieces of information, including:

- Your actual income and the income of your spouse.

- Additions and subtractions to your federal adjusted gross income.

- Exemptions that could have been claimed if you filed separately.

- Any taxes withheld from your wages or pensions.

- Estimated tax payments made by either spouse.

- Credits against your tax.

- Any applicable West Virginia State or Municipal Use Tax.

Each piece of information is crucial for determining the correct allocation of the tax refund.

What happens after I submit the WV 8379 form?

Once you submit the WV 8379 form, the West Virginia State Tax Department will review it. They will compute the amount of refund due to you as the injured spouse. If everything is in order, you should receive your portion of the refund. Keep in mind that processing times may vary, so it’s a good idea to check the status of your submission if you do not receive a response in a timely manner.

Can I file the WV 8379 form electronically?

As of now, the WV 8379 form must be submitted in paper format. Ensure that you print the completed form and send it to the appropriate address provided by the West Virginia State Tax Department. Always check for the latest updates on filing options, as procedures may change over time.

What if I have more questions about the WV 8379 form?

If you have additional questions or need assistance with the WV 8379 form, consider reaching out to the West Virginia State Tax Department directly. They can provide guidance specific to your situation. Additionally, consulting with a tax professional may also be beneficial, especially if your tax situation is complex.

Documents used along the form

The WV 8379 form is a crucial document for individuals seeking to reclaim a portion of their West Virginia state tax refund that may have been captured due to their spouse's debts. This form serves as a means to allocate the joint tax refund, ensuring that the injured spouse receives their rightful share. Alongside this form, several other documents are often necessary to facilitate the process. Understanding these related forms can streamline the experience for those navigating this system.

- WV State Tax Return (Form IT-140): This is the primary tax return form for residents of West Virginia. It provides a comprehensive overview of the taxpayer's income, deductions, and credits for the year. The information on this form is essential for completing the WV 8379, as it outlines the total joint income and tax liability.

- W-2 Forms: These forms report the annual wages and the taxes withheld from employees' paychecks. Each spouse should provide their respective W-2 forms to accurately determine the amount of tax withheld, which is necessary for the allocation process on the WV 8379.

- FedEx Release Form: Before submitting your claim, consider if you need to authorize someone else to receive packages on your behalf. For this, you can use the smarttemplates.net to access the necessary form.

- Form 1099: This document reports various types of income other than wages, such as interest, dividends, or freelance earnings. It is important for both spouses to include relevant 1099 forms to ensure all sources of income are accounted for in the tax allocation.

- Child Support Payment Records: If one spouse's tax refund is being captured to pay child support, documentation of these payments may be required. This helps clarify the reason for the tax offset and supports the injured spouse's claim for their portion of the refund.

- Proof of Estimated Tax Payments: If either spouse made estimated tax payments during the year, records of these payments should be included. This documentation is necessary to accurately allocate any credits or payments made towards the joint tax liability.

In summary, while the WV 8379 form is essential for claiming a portion of a tax refund, it is often accompanied by other documents that provide a fuller picture of the couple's financial situation. Collecting and submitting these forms can significantly enhance the chances of a successful allocation process, ensuring that both spouses receive their fair share of any tax refund due.

Dos and Don'ts

When filling out the WV 8379 form, it’s essential to ensure accuracy and completeness. Here are some important dos and don’ts to keep in mind:

- Do double-check all names and Social Security numbers for accuracy.

- Do ensure that you include your correct mailing address, especially if it has changed.

- Do report actual income earned by each spouse accurately.

- Do attach copies of all withholding tax statements to your form.

- Don’t separate or claim part of an exemption; report only what each spouse would claim if filing separately.

- Don’t include any subtractions that are not listed on your joint return.

- Don’t forget to allocate joint income and expenses according to the guidelines provided.

- Don’t leave any lines blank; complete all required fields to avoid delays.

Following these guidelines can help ensure that your form is processed smoothly and that you receive the refund you are entitled to as an injured spouse.