Blank Wv 2848 PDF Template

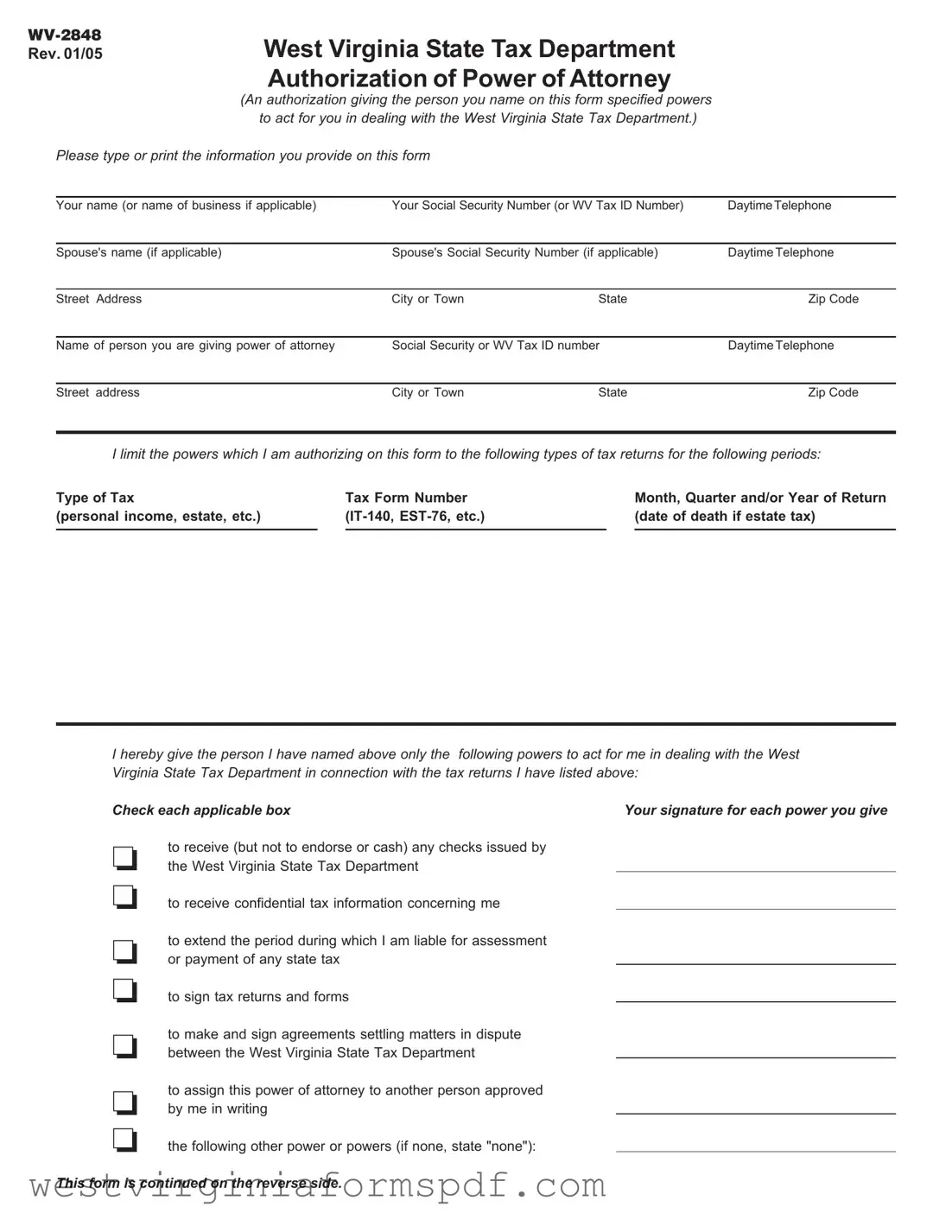

The WV 2848 form is a crucial document for individuals and businesses navigating their tax obligations in West Virginia. This form serves as an authorization of power of attorney, allowing a designated representative to act on behalf of the taxpayer in dealings with the West Virginia State Tax Department. By completing the WV 2848, taxpayers can provide specific powers to their chosen representative, including the ability to receive confidential tax information, sign tax returns, and negotiate settlements regarding tax disputes. The form requires essential details such as the taxpayer's name, Social Security number or tax ID, and the contact information of the appointed representative. Additionally, taxpayers must specify the types of tax returns and the relevant periods for which the power is granted, ensuring clarity in the scope of authority. The WV 2848 also emphasizes the taxpayer's right to revoke the authorization at any time, offering a layer of control over their tax matters. Understanding the intricacies of this form is vital for anyone looking to simplify their tax processes while ensuring compliance with state regulations.

Browse More Forms

Wv Pte-100 Instructions 2022 - Organization types include estates, trusts, and limited liability companies, among others.

Wv Refund - Filing an amended tax return is necessary alongside the WV/CST-AF2 form.

To further clarify the importance of a California Bill of Sale form, it not only serves as a legal record of the transaction but also can help in resolving potential disputes between the seller and buyer. For those interested in obtaining a ready-to-use document, more information can be found at https://onlinelawdocs.com/, where you can access various templates and guidelines for creating your own Bill of Sale.

West Virginia Police Report - Each request is formally tracked with a report number for easy reference.

Form Attributes

| Fact Name | Description |

|---|---|

| Form Purpose | The WV-2848 form allows individuals to authorize another person to act on their behalf when dealing with the West Virginia State Tax Department. |

| Required Information | Users must provide personal details, including their name, Social Security Number or WV Tax ID, and contact information, along with details of the person being authorized. |

| Types of Powers | The form allows the taxpayer to specify which powers are granted, such as signing tax returns, receiving confidential information, or extending liability periods. |

| Revocation Rights | Taxpayers can revoke the power of attorney at any time by notifying both the authorized person and the West Virginia State Tax Department in writing. |

| Governing Law | This form is governed by West Virginia Code § 11-10-5, which outlines the powers and limitations of a power of attorney in tax matters. |

| Witnessing Requirements | If the power of attorney is granted to someone other than an attorney or CPA, the taxpayer's signature must be witnessed or notarized to be valid. |

Similar forms

The IRS Form 2848, also known as the Power of Attorney and Declaration of Representative, serves a similar function to the WV 2848 form. Both documents allow a taxpayer to designate someone to represent them before a tax authority. The IRS Form 2848 specifically permits the appointed representative to receive confidential tax information and act on behalf of the taxpayer for federal tax matters. Like the WV 2848, it requires the taxpayer's signature and can be revoked at any time by the taxpayer.

The Durable Power of Attorney is another document that resembles the WV 2848 form. This document grants an individual the authority to make decisions on behalf of another person, even if that person becomes incapacitated. While the WV 2848 is specific to tax matters in West Virginia, a Durable Power of Attorney can cover a wide range of financial and legal decisions. Both forms require clear identification of the parties involved and can be revoked by the principal at any time.

In addition to the essential tax-related forms mentioned, it is also important to understand the documentation involved in vehicle transactions, such as the California ATV Bill of Sale form. This form serves as an official record of the sale and purchase of an All-Terrain Vehicle (ATV) within California, ensuring that both buyer and seller acknowledge the terms of the transaction. For those looking for more information, you can visit toptemplates.info/bill-of-sale/atv-bill-of-sale/california-atv-bill-of-sale/ to obtain the necessary templates and details pertaining to this important document.

The General Power of Attorney also shares similarities with the WV 2848 form. This document allows one person to act on behalf of another in a variety of matters, including financial transactions and legal decisions. While the WV 2848 is limited to tax-related matters, the General Power of Attorney can be broader in scope. Both documents require a signature from the principal and can be terminated by the principal’s written notice.

The Limited Power of Attorney is another comparable document. It restricts the powers granted to specific tasks or periods, similar to how the WV 2848 specifies the types of tax returns and periods covered. This document is often used for particular transactions, such as selling property or handling a specific financial matter. Both forms emphasize the importance of clarity in the powers granted and can be revoked at any time by the principal.

The Medical Power of Attorney allows an individual to make healthcare decisions on behalf of another person. While this document is focused on medical matters, it shares the fundamental principle of granting authority to another individual. Like the WV 2848, it requires the principal's signature and can be revoked. Both documents highlight the need for the principal to trust the appointed individual to act in their best interest.

The Financial Power of Attorney is similar to the WV 2848 in that it allows one person to manage another's financial affairs. This document can cover a wide range of financial decisions, whereas the WV 2848 is strictly for tax matters. Both require clear identification of the parties involved and can be revoked by the principal at any time. The trust placed in the appointed individual is paramount in both cases.

The Authorization for Release of Information form is another document that aligns with the WV 2848. This form permits the release of specific information to a designated individual, often used in various contexts, including financial and healthcare matters. While it does not grant the same level of authority as a power of attorney, it shares the objective of allowing another person to access important information. Both forms require the principal's consent and can be revoked at any time.

Lastly, the Tax Information Authorization (TIA) form serves a similar purpose as the WV 2848. This document allows taxpayers to authorize someone to receive their tax information from the IRS or state tax authorities. Like the WV 2848, it is limited to information access and does not grant broader powers. Both forms require the taxpayer's signature and can be revoked at any time, emphasizing the importance of control over personal tax information.

FAQ

What is the WV 2848 form?

The WV 2848 form, officially known as the Authorization of Power of Attorney, allows individuals or businesses to designate someone else to act on their behalf in matters related to the West Virginia State Tax Department. This form grants specified powers, enabling the appointed person to handle various tax-related tasks, such as filing returns and receiving confidential tax information.

Who should use the WV 2848 form?

This form is beneficial for anyone who needs assistance with their state tax matters. Individuals, business owners, or even spouses can utilize the WV 2848 to authorize someone else—be it a family member, friend, or professional tax advisor—to manage their tax affairs. It is particularly useful for those who may not have the time or expertise to navigate the complexities of state tax regulations.

What powers can be granted through the WV 2848 form?

The WV 2848 form allows you to limit the powers granted to the appointed person. You can authorize them to:

- Receive confidential tax information.

- Sign tax returns and forms.

- Make agreements to settle disputes with the tax department.

- Extend the period of liability for assessment or payment of state taxes.

- Receive checks issued by the tax department (though they cannot endorse or cash them).

Additionally, you can assign this power of attorney to another person with your written approval.

How do I complete the WV 2848 form?

To complete the WV 2848 form, you should follow these steps:

- Type or print your name, Social Security Number (or WV Tax ID Number), and contact details.

- Provide the name and contact information of the person you are granting power of attorney.

- Specify the types of tax returns and the periods for which this authorization applies.

- Check the applicable boxes to indicate the powers you are granting.

- Sign the form, and if applicable, have it witnessed or notarized.

Once completed, mail the form to the West Virginia State Tax Department at the specified address.

Can I revoke the power of attorney granted by the WV 2848 form?

Yes, you have the right to revoke the power of attorney at any time. To do this, you must notify both the person you appointed and the West Virginia State Tax Department in writing. It is important to remember that revoking this power will only affect the powers granted in the WV 2848 form, and any previous authorizations for the same types of taxes will be revoked to that extent.

What if the power of attorney is granted to someone other than an attorney or CPA?

If you choose to grant power of attorney to someone who is not a licensed attorney or certified public accountant, the signature of the taxpayer must be witnessed or notarized. This requirement ensures that the authorization is valid and that the person granting the power fully understands their decision. The form provides sections for either two disinterested witnesses or a notary public to complete this process.

Documents used along the form

The WV-2848 form is an important document for individuals seeking to authorize someone to represent them before the West Virginia State Tax Department. Along with this form, there are several other documents that may be useful in various tax-related situations. Below is a list of forms and documents commonly used in conjunction with the WV-2848.

- Form IT-140: This is the West Virginia Personal Income Tax Return. Taxpayers use it to report income and calculate their tax liability.

- Form EST-76: This form is used for the West Virginia Estate Tax Return. It is required when the estate exceeds a certain value threshold, allowing for the proper reporting of estate taxes.

- Form WV-40: The West Virginia Personal Income Tax Return for residents. This form is specifically for residents to report their income and claim any deductions or credits.

- Form WV-PT-1: This is the West Virginia Partnership Tax Return. Partnerships use it to report income, deductions, and credits to the state.

- Form WV-CORP: The West Virginia Corporation Income Tax Return. Corporations must file this form to report their income and pay applicable taxes.

- Form WV-IT-140N: This is the Nonresident Personal Income Tax Return for those who earn income in West Virginia but reside elsewhere.

- Form WV-IT-103: This form allows taxpayers to claim a credit for taxes paid to another state, reducing their West Virginia tax liability.

- Form WV-PT-2: This is the West Virginia Partnership Return of Income for nonresident partners, used to report income earned by partners who do not reside in West Virginia.

- FedEx Release Form: Essential for recipients who won't be home for delivery, this form allows FedEx to leave packages at designated locations. It requires a signature and each package needs its individual form for processing—more details can be found at smarttemplates.net.

- Form WV-IT-140X: This is the Amended Personal Income Tax Return form. Taxpayers use it to correct errors on previously filed returns.

- Form WV-14: This is the West Virginia Employer's Quarterly Tax Return. Employers use it to report and pay withholding taxes for their employees.

Understanding these forms can help taxpayers navigate their obligations and rights when dealing with state tax matters. Each form serves a specific purpose and may be necessary depending on individual circumstances. It is advisable to review each document carefully to ensure compliance with West Virginia tax laws.

Dos and Don'ts

When filling out the WV 2848 form, it’s important to follow certain guidelines to ensure your application is processed smoothly. Here’s a list of things you should and shouldn’t do:

- Do type or print your information clearly.

- Do provide your Social Security Number or WV Tax ID Number accurately.

- Do include your daytime telephone number for easy contact.

- Do specify the types of tax returns and periods you are authorizing.

- Do ensure that the person you are giving power of attorney to is trustworthy.

- Don't leave any required fields blank.

- Don't forget to sign and date the form.

- Don't use a signature that is different from your usual one.

- Don't submit the form without having it witnessed or notarized if required.

- Don't assume that your previous authorizations are still valid; this form revokes earlier ones.

By following these guidelines, you can help ensure that your power of attorney is set up correctly and efficiently.