Blank Wv 103 PDF Template

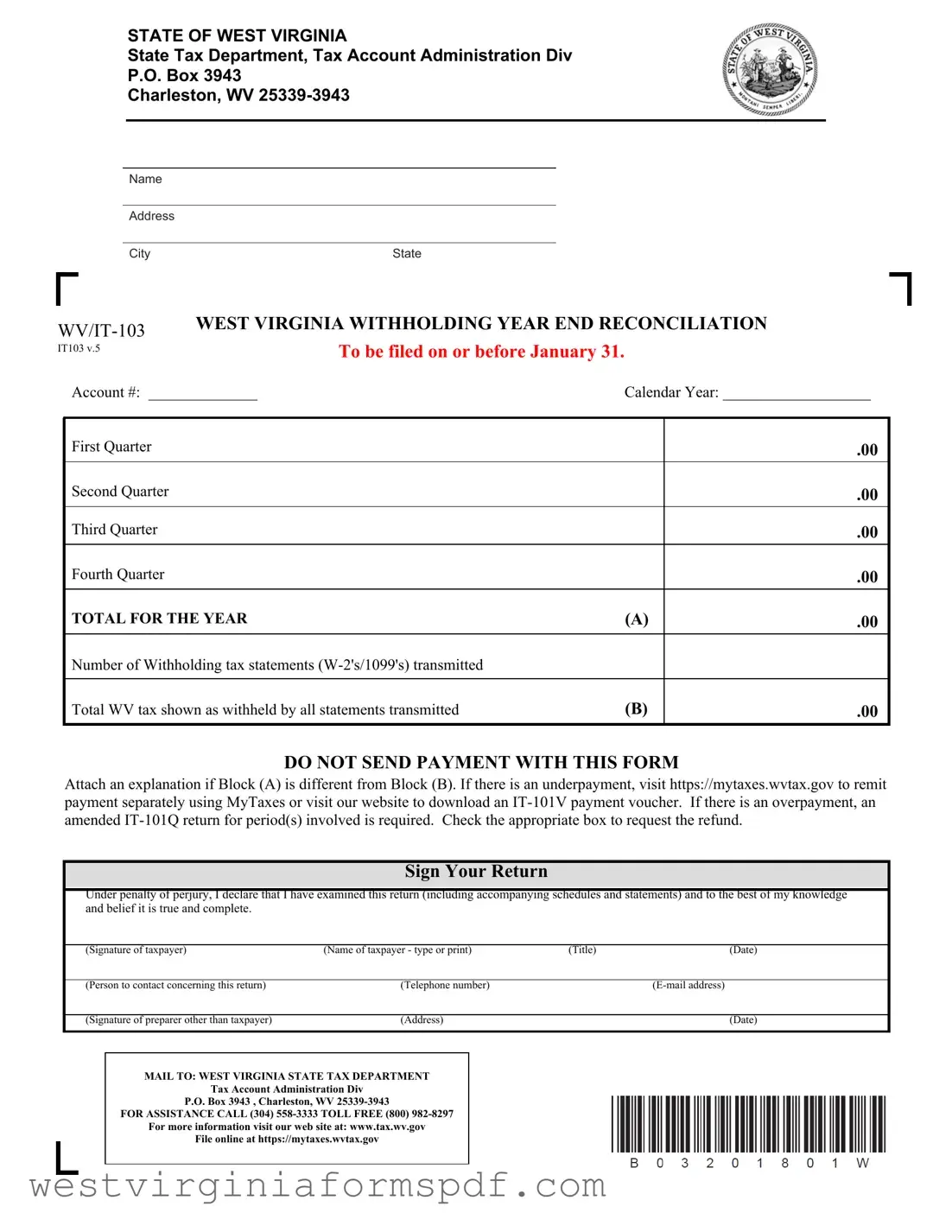

The WV 103 form, officially known as the West Virginia Withholding Year End Reconciliation, plays a crucial role for employers in the state of West Virginia. This form must be submitted by January 31 each year, ensuring that all withholding tax statements, such as W-2s and 1099s, are accurately reported to the West Virginia State Tax Department. Employers are required to provide a total of the withholding tax collected throughout the year, broken down into quarterly amounts. It is essential to note that no payment should accompany this form; rather, any discrepancies between the total withheld and the reported amounts must be explained in an attached statement. If an employer has underpaid or overpaid their taxes, the form outlines specific steps to rectify the situation, including how to remit payments or request refunds. Additionally, employers must furnish each employee with a Withholding Tax Statement by the end of January, and those with 25 or more employees must file their data electronically to avoid penalties. Changes in business status, such as selling the business or discontinuing operations, must also be reported using this form. Understanding the requirements and deadlines associated with the WV 103 form is vital for compliance and to avoid potential penalties.

Browse More Forms

Wv Pte-100 Instructions 2022 - Organizations must receive this form to avoid withholding taxes from nonresident distributions.

West Virginia Business Registration - Specify the duration of your corporation, whether it is for a limited number of years or perpetual.

A Last Will and Testament form is a legal document that outlines how a person's assets and responsibilities should be handled after their death. It allows individuals to specify beneficiaries for their property and appoint guardians for minor children. To learn more about creating this essential document, visit TopTemplates.info, which provides valuable resources to help ensure that one's final wishes are respected.

West Virginia Cd 3 - Taxpayers should attach a financial statement along with the offer.

Form Attributes

| Fact Name | Description |

|---|---|

| Filing Deadline | The WV/IT-103 form must be filed by January 31 of the following year after the tax year ends. |

| Required Attachments | Employers must attach copies of W-2 forms or approved substitutes when submitting the WV/IT-103. |

| Electronic Filing Requirement | Employers with 25 or more employees are required to file W-2 data electronically to avoid penalties. |

| Payment Instructions | No payment should be sent with the WV/IT-103 form. Payments must be made separately if necessary. |

| Governing Law | The WV/IT-103 is governed by West Virginia Code §11-10-1 et seq., which outlines tax administration and compliance. |

Similar forms

The IRS Form W-2 is similar to the WV/IT-103 form in that both documents are used for reporting employee wages and tax withholdings. Employers must provide a W-2 to each employee by January 31 of the following year. This form details the total wages paid and the amount of federal, state, and other taxes withheld. Like the WV/IT-103, which summarizes withholding for the state of West Virginia, the W-2 must also be submitted to the appropriate tax authority, ensuring compliance with tax regulations.

Form 1099-MISC serves a similar purpose as the WV/IT-103, but it is used to report payments made to non-employees, such as independent contractors. Businesses must issue a 1099-MISC to any contractor paid $600 or more in a calendar year. This form includes information about the total payments made, which parallels the reporting of withholding tax on the WV/IT-103. Both forms are essential for accurate tax reporting and are due by January 31 of the following year.

The IRS Form 941 is another document that shares similarities with the WV/IT-103. This quarterly form is used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. While the WV/IT-103 is an annual reconciliation, Form 941 requires employers to report these figures quarterly, providing a more frequent overview of tax withholdings. Both forms help ensure that the correct amounts are reported to tax authorities.

The IRS Form 1040 is a personal income tax return that individuals file annually. It is similar to the WV/IT-103 in that both documents summarize tax information for the year. While the WV/IT-103 focuses on withholding taxes from employees, the Form 1040 encompasses all sources of income and deductions for an individual taxpayer. Both forms ultimately contribute to the accurate reporting of tax obligations to the respective tax authorities.

The WV/IT-101V payment voucher is related to the WV/IT-103 as it is used to remit any tax payments owed. If an employer finds that they have underpaid their withholding taxes, they must use the IT-101V to submit payment separately. This document ensures that payments are processed correctly and helps maintain compliance with tax obligations, similar to the reconciliation provided by the WV/IT-103.

The IRS Form 940 is used for reporting annual Federal Unemployment Tax Act (FUTA) taxes. This form is similar to the WV/IT-103 in that both documents summarize tax liabilities for a specific period. While the WV/IT-103 focuses on state withholding taxes, Form 940 deals with federal unemployment taxes. Both forms are necessary for employers to ensure they are meeting their tax responsibilities.

In addition to these forms, understanding the requirements for homeschooling can be equally important for parents looking to pursue that path. The Arizona Homeschool Letter of Intent form is a necessary document for parents or guardians opting to homeschool their child within the state. This form initiates the process of officially recognizing a homeschool arrangement, ensuring compliance with state education regulations. For those ready to start homeschooling in Arizona, filling out the form correctly is the first critical step. Click the button below to begin the process. More information can be found at arizonapdf.com/homeschool-letter-of-intent/.

Finally, the WV/IT-105 is a specification document that provides guidelines for filing W-2s and 1099s electronically. This form is similar to the WV/IT-103 in that both are involved in the reporting process for tax withholdings. The IT-105 outlines the requirements for electronic submission, which is mandatory for employers filing for 25 or more employees, thereby facilitating compliance with state tax laws and ensuring accurate reporting.

FAQ

What is the purpose of the WV 103 form?

The WV 103 form, also known as the West Virginia Withholding Year End Reconciliation, is used by employers to report the total amount of state income tax withheld from employees throughout the calendar year. This form must be submitted to the West Virginia State Tax Department by January 31 of the following year. It ensures that the state has accurate records of the withholding taxes collected and allows for any necessary adjustments or refunds.

Who is required to file the WV 103 form?

Employers who withhold state income tax from their employees’ wages are required to file the WV 103 form. This includes businesses that issue W-2 forms or approved substitutes to their employees. If an employer has 25 or more employees, they must file their data electronically. It is important to comply with this requirement to avoid penalties.

What should I do if there is a discrepancy between Block (A) and Block (B) on the form?

If there is a difference between the total amount withheld reported in Block (A) and the total amount shown in Block (B), you need to attach an explanation to the form. This could include reasons for underreporting or overreporting. If you owe additional taxes, visit the MyTaxes website to remit payment separately. If you have overpaid, you will need to file an amended IT-101Q return for the relevant periods to request a refund.

How can I file the WV 103 form?

The WV 103 form can be filed online through the MyTaxes portal. Employers are encouraged to upload their W-2 forms electronically for efficiency. If you prefer to file by mail, print the completed form and send it to the West Virginia State Tax Department at the address provided on the form. Ensure that you do not send any payment with the form, as payments must be made separately if applicable.

Documents used along the form

The WV/IT-103 form is an essential document for employers in West Virginia to report withholding tax information. Along with this form, there are several other documents that may be required to ensure compliance with state tax regulations. Below is a list of five commonly used forms and documents that accompany the WV/IT-103 form.

- Form W-2: This form is a Withholding Tax Statement that employers must provide to each employee by January 31 of the following year. It details the amount of wages paid and the taxes withheld during the year. A copy of each W-2 must be submitted to the State Tax Department along with the WV/IT-103.

- Form 1099: Similar to the W-2, this form is used to report various types of income other than wages, salaries, and tips. Employers must issue 1099 forms to independent contractors and other non-employee compensation recipients. These forms also need to be submitted to the State Tax Department.

- Affidavit of Service Form: To ensure legal document delivery, familiarize yourself with our important Affidavit of Service guidelines that highlight necessary procedures and verification methods.

- IT-101V Payment Voucher: If there is an underpayment of taxes, this voucher is necessary for remitting payment separately. It provides a way for taxpayers to submit payments electronically or via mail, ensuring that all obligations are met in a timely manner.

- IT-105 Specifications: This document outlines the guidelines for filing W-2 and 1099 forms electronically. Employers who file for twenty-five or more employees must comply with these specifications to avoid penalties associated with non-electronic filing.

- Employer's Withholding Change Order: This form is used to report any changes in an employer's withholding tax obligations. It is important for updating the State Tax Department about changes such as business closure or changes in filing status.

Employers should ensure that they complete and submit these forms accurately and on time to avoid penalties and ensure compliance with state tax laws. Each document plays a critical role in the overall tax reporting process and helps maintain transparency between employers and the state tax authorities.

Dos and Don'ts

When filling out the WV 103 form, it is crucial to follow certain guidelines to ensure accuracy and compliance. Below is a list of things you should and shouldn't do while completing this form.

- Do ensure that all personal and business information is accurate and up-to-date.

- Do double-check the total amounts reported in Block (A) and Block (B) for consistency.

- Do submit the form by the deadline of January 31 to avoid potential penalties.

- Do sign the form to validate your submission and declare its accuracy under penalty of perjury.

- Don't send payment with the form; remit any payments separately as instructed.

- Don't alter your tax returns to indicate changes; use the appropriate sections of the form instead.

- Don't forget to provide a contact person’s information for any follow-up questions regarding the form.

- Don't neglect to file electronically if you are reporting for twenty-five or more employees.

By adhering to these guidelines, individuals and businesses can navigate the process of completing the WV 103 form more effectively, ensuring compliance with state tax regulations.