Blank West Virginia Opt 1 PDF Template

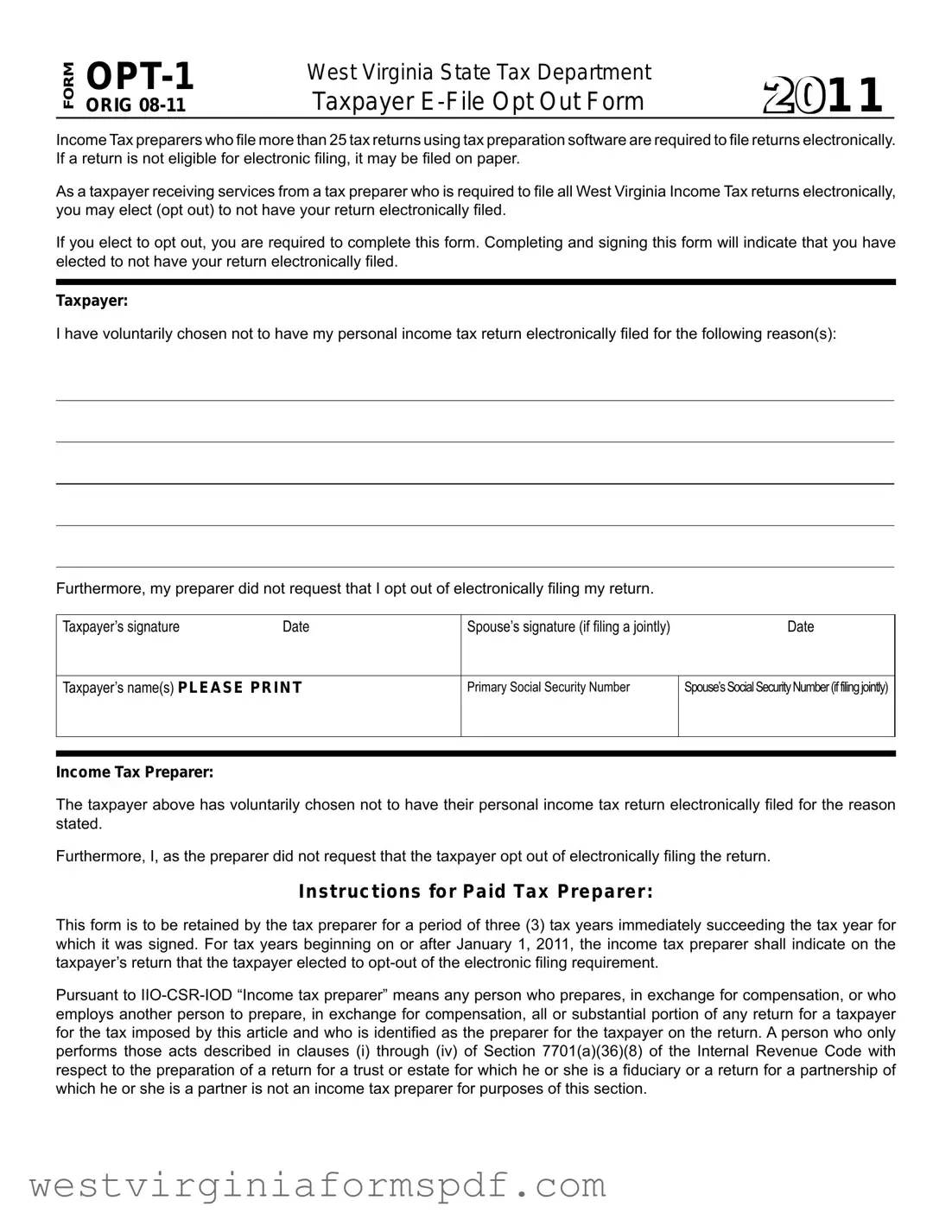

The West Virginia Opt 1 form serves a crucial role for taxpayers who prefer not to file their income tax returns electronically. It is specifically designed for individuals who receive tax preparation services from professionals required to file more than 25 returns electronically. By completing this form, taxpayers can formally opt out of electronic filing, ensuring their returns are submitted on paper instead. The form requires taxpayers to provide their names, Social Security numbers, and the reason for opting out, while also necessitating the signature of the tax preparer to confirm that the decision was made voluntarily and without solicitation. This process not only protects the taxpayer's choice but also mandates that the tax preparer retains the form for three years for compliance purposes. Additionally, the form includes a stipulation that the preparer must indicate on the taxpayer’s return that an opt-out election was made, thereby maintaining a clear record of the taxpayer's filing preference. Understanding the implications of the West Virginia Opt 1 form is essential for taxpayers who wish to navigate their filing options effectively and ensure compliance with state regulations.

Browse More Forms

Wv Ss Fair - Sources were validated through cross-referencing data with government publications and consulting experts in the field.

The California Articles of Incorporation form is a document that officially registers a corporation with the state, marking the beginning of its legal existence. It's a vital step for any business looking to structure itself as a corporation within California. This form covers essential details such as the corporation's name, purpose, and information about its shares and initial agents. For further guidance on completing this form, you can visit onlinelawdocs.com/california-articles-of-incorporation/.

West Virginia Business Registration - List all officers and directors of the corporation along with their addresses.

Form Attributes

| Fact Name | Description |

|---|---|

| Purpose of Form | The West Virginia OPT-1 form allows taxpayers to opt out of electronic filing of their income tax returns when their preparer is required to file electronically. |

| Eligibility Criteria | This form is specifically for taxpayers whose income tax preparers file more than 25 returns using tax preparation software and who wish to file on paper instead. |

| Governing Law | The use of the OPT-1 form is governed by West Virginia Code §11-10-5 and related regulations, which outline electronic filing requirements for tax preparers. |

| Retention Requirement | Tax preparers must retain the completed OPT-1 form for three tax years following the year it was signed to comply with state regulations. |

| Taxpayer's Declaration | By signing the form, the taxpayer declares their voluntary choice not to file electronically and confirms that the preparer did not request this option. |

Similar forms

The West Virginia Opt 1 form is similar to the IRS Form 8948, which is the Preparer Explanation for Not Filing Electronically. This form is used by tax preparers to explain why a taxpayer's return is not filed electronically. Both forms serve the purpose of documenting a taxpayer's choice to opt out of electronic filing. They require signatures from both the taxpayer and the preparer, ensuring that there is a mutual understanding of the decision made regarding the filing method.

Another document that resembles the West Virginia Opt 1 form is the IRS Form 4868, which is the Application for Automatic Extension of Time to File U.S. Individual Income Tax Return. While the primary function of Form 4868 is to request an extension for filing, it also requires the taxpayer to provide information about their filing preferences. Both forms involve the taxpayer's active participation in the filing process, as they must indicate their choices and provide necessary signatures.

The California Form 540, which is the California Resident Income Tax Return, also shares similarities with the West Virginia Opt 1 form. Taxpayers filing Form 540 can choose to file electronically or on paper. Just like the Opt 1 form, the California form includes sections where taxpayers can indicate their preferences and reasons for their choices. Both documents emphasize the importance of taxpayer consent in the filing process.

The New York State IT-201 form, used for filing personal income tax returns, is another document that has a parallel structure to the West Virginia Opt 1 form. Taxpayers using IT-201 can opt for electronic filing or paper filing. The form includes sections for the taxpayer to provide their personal information and preferences. Both forms require the taxpayer's signature, ensuring that they are aware of and agree to the chosen filing method.

Understanding the importance of properly managing your affairs, a Last Will and Testament form is crucial for ensuring your wishes are respected after you pass away. Just like the various tax forms that allow for personal choice in filing methods, creating a will empowers individuals to designate beneficiaries and appoint guardians for their minors, much like how systems are set in place for transparency and autonomy in tax matters. For more comprehensive guidance on this essential document, you can visit TopTemplates.info.

Lastly, the IRS Form 1040, which is the U.S. Individual Income Tax Return, also has similarities with the West Virginia Opt 1 form. Taxpayers can choose how to file their 1040, either electronically or by mail. The 1040 form includes sections where taxpayers can indicate their preferences. Both forms require the taxpayer to actively participate in the decision-making process regarding how their tax return will be submitted.

FAQ

What is the West Virginia Opt 1 form?

The West Virginia Opt 1 form, also known as the Taxpayer E-File Opt Out Form, allows taxpayers to choose not to have their income tax return filed electronically by their tax preparer. This form is necessary for those who are required to file electronically but prefer to opt out for personal reasons.

Who needs to use the Opt 1 form?

This form is primarily for taxpayers whose income tax preparer is required to file more than 25 tax returns electronically. If you fall into this category and wish to opt out of electronic filing, you must complete this form.

What information do I need to provide on the form?

You will need to provide the following details on the Opt 1 form:

- Your name and Social Security Number.

- Your spouse's name and Social Security Number (if filing jointly).

- Your reason for opting out of electronic filing.

- Signatures of both you and your spouse (if applicable).

Why would someone choose to opt out of electronic filing?

There can be various reasons for opting out, including concerns about privacy, a preference for paper records, or a belief that electronic filing may not be suitable for their specific situation. The form allows you to state your reason for opting out.

What happens after I submit the Opt 1 form?

Your tax preparer must retain the completed form for three tax years following the year it was signed. They will also indicate on your tax return that you have opted out of electronic filing.

Is there a deadline for submitting the Opt 1 form?

Can my tax preparer pressure me to file electronically?

Your tax preparer should not pressure you to file electronically. If you wish to opt out, you have the right to do so by completing the Opt 1 form. The preparer must respect your decision.

What should I do if I have questions about the form?

If you have questions about the Opt 1 form or the process, consider reaching out to your tax preparer for clarification. They should be able to assist you with any concerns you may have.

Is there a fee for using the Opt 1 form?

There is no fee associated with completing the Opt 1 form itself. However, your tax preparer may charge a fee for their services in preparing your tax return, regardless of whether you file electronically or on paper.

Where can I obtain the Opt 1 form?

The Opt 1 form can typically be obtained from the West Virginia State Tax Department's website or directly from your tax preparer. Ensure you have the most recent version of the form to avoid any issues.

Documents used along the form

The West Virginia Opt 1 form is an important document for taxpayers who choose not to have their income tax returns filed electronically. Along with this form, there are several other documents that may be needed to complete the tax filing process. Here’s a list of some of these forms and documents, along with a brief description of each.

- West Virginia Personal Income Tax Return (Form IT-140): This is the main form used to report personal income and calculate the tax owed to the state of West Virginia.

- California Commercial Lease Agreement: For businesses entering rental agreements, the necessary California commercial lease agreement documentation is essential for proper compliance and understanding of rental terms.

- West Virginia Schedule A (Form IT-140S): This form is used to claim itemized deductions for state income tax purposes, which can help reduce the overall taxable income.

- Federal Form 1040: The standard federal income tax return form that individuals use to report their income, claim deductions, and calculate their tax liability to the IRS.

- West Virginia Schedule B (Form IT-140B): This form is for reporting interest and dividends, which must be included in the income calculation for state taxes.

- West Virginia Schedule C (Form IT-140C): Used by self-employed individuals to report income and expenses from their business activities.

- West Virginia Schedule D (Form IT-140D): This form is used to report capital gains and losses from the sale of assets, which can affect the taxable income.

- W-2 Form: Issued by employers, this form shows the total wages earned and taxes withheld for the year, which is necessary for accurate tax reporting.

- 1099 Forms: These forms report various types of income received outside of traditional employment, such as freelance work or interest income.

- Taxpayer Identification Number (TIN): This is a unique number assigned to individuals for tax purposes, often required when filing tax returns and other related documents.

Understanding these forms and documents can help streamline the tax filing process. It’s always a good idea to gather all necessary paperwork before starting your return, ensuring everything is accurate and complete.

Dos and Don'ts

When filling out the West Virginia Opt 1 form, certain practices can facilitate the process while others may hinder it. Below is a list of things you should and shouldn't do.

- Do read the instructions carefully before starting.

- Do provide accurate personal information, including Social Security numbers.

- Do ensure that both taxpayer and spouse sign the form if filing jointly.

- Do keep a copy of the completed form for your records.

- Do submit the form to your tax preparer promptly.

- Don't leave any required fields blank.

- Don't forget to indicate the reason for opting out of electronic filing.

- Don't submit the form after the tax filing deadline.

- Don't rely on your tax preparer to fill out the form for you.