Blank West Virginia It 140X PDF Template

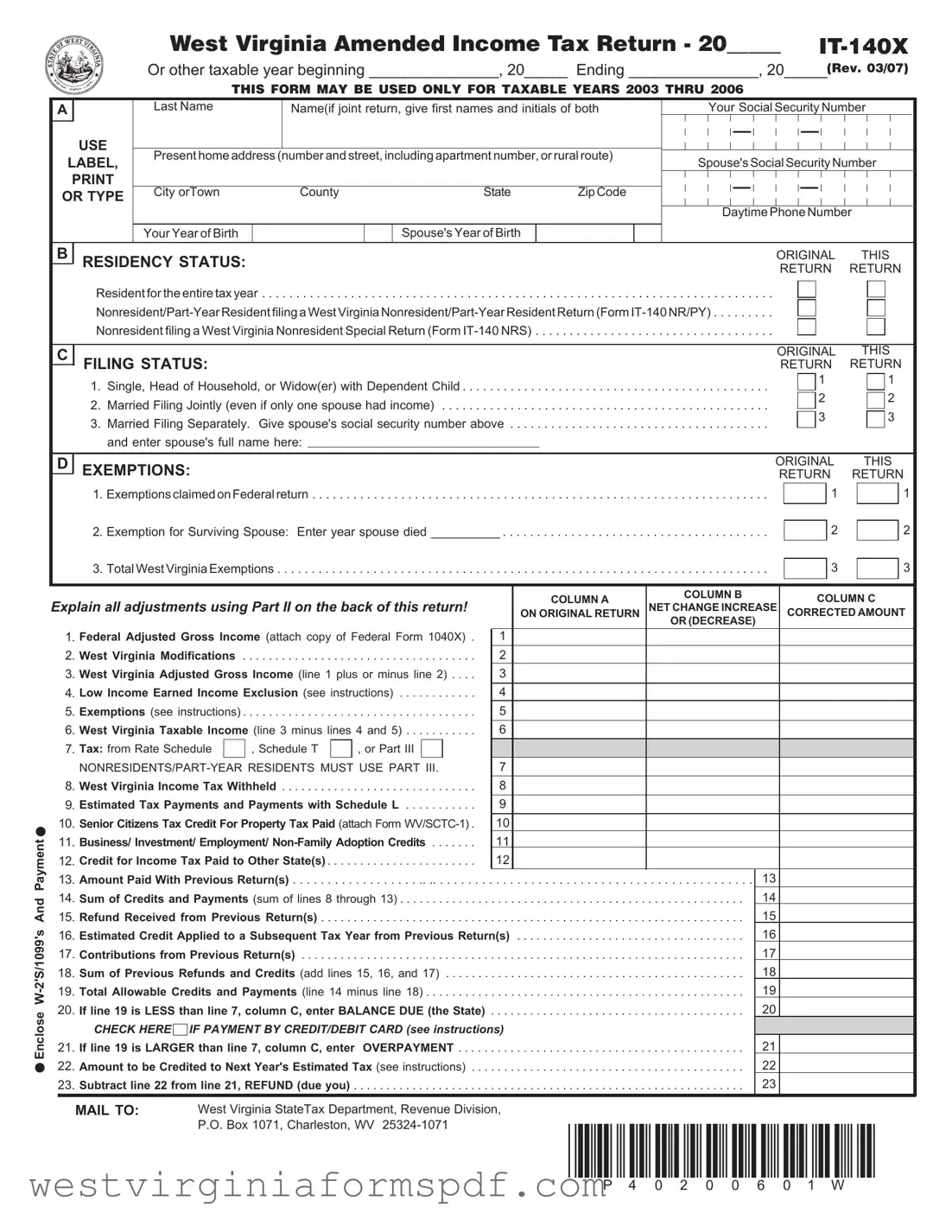

The West Virginia IT-140X form serves as an essential tool for individuals looking to amend their previously filed income tax returns for taxable years 2003 through 2006. This form allows taxpayers to correct mistakes or make adjustments related to their income, filing status, exemptions, and credits. It is designed for residents, nonresidents, and part-year residents, offering specific sections to address the unique circumstances of each filer. The IT-140X requires detailed information, including personal identification, residency status, and social security numbers. Taxpayers must also provide a breakdown of their federal adjusted gross income, any modifications, and the resulting West Virginia adjusted gross income. Additionally, the form outlines the process for calculating tax liabilities, claiming credits, and determining whether a balance is due or a refund is owed. Understanding how to accurately complete the IT-140X can help ensure compliance with state tax regulations while potentially recovering overpaid taxes.

Browse More Forms

Wv State Income Tax - Tax credits summarized on the IT-140 can significantly reduce the tax owed, so accuracy in reporting is essential in the credit calculation section.

Understanding the significance of a well-structured Commercial Lease Agreement is vital for businesses entering rental arrangements. The nuances of this contract help define critical elements such as payment obligations and property usage, ensuring both landlords and tenants are protected. For a thorough guide, consider reviewing this valuable resource on the Commercial Lease Agreement form.

How to Become a Resident of West Virginia - The form captures key tax return information such as federal adjusted gross income.

Form Attributes

| Fact Name | Description |

|---|---|

| Purpose | The IT-140X form is used to amend a previously filed West Virginia income tax return for the years 2003 through 2006. |

| Eligibility | This form can only be used after the original return has been filed. It is meant for residents and non-residents alike. |

| Filing Deadline | Taxpayers must file the IT-140X within 90 days of any federal changes to their income tax return. |

| Governing Law | This form is governed by West Virginia Code §11-10-1, which outlines the requirements for filing amended tax returns. |

Similar forms

The West Virginia IT-140X form, used for amending income tax returns, shares similarities with the Federal Form 1040X. Both forms serve the purpose of correcting previously filed tax returns. The IT-140X allows taxpayers to adjust their West Virginia income tax filings, while the 1040X is designed for federal tax amendments. Each form requires taxpayers to provide details about the changes made, including reasons for the amendments, and both forms must be filed within a specific timeframe after the original return was submitted.

To support individuals in navigating the complexities of employment verification, it is essential to utilize the appropriate documentation, such as the Texas Employment Verification form, which serves to confirm employment status and facilitate the process for state benefit applications.

Another related document is the West Virginia IT-140 NR/PY form, which is used by nonresidents and part-year residents to file their income tax returns. Like the IT-140X, this form addresses specific residency statuses and allows for adjustments based on the individual's income earned while residing in or out of West Virginia. Both forms require detailed information about income sources and tax calculations, ensuring that nonresidents are taxed fairly based on their West Virginia income.

The IRS Form 1040 is also comparable, as it serves as the primary individual income tax return in the United States. Similar to the IT-140X, the 1040 form collects comprehensive information about a taxpayer’s income, deductions, and credits. While the IT-140X is specific to West Virginia tax law, the 1040 form encompasses federal tax regulations. Both forms require taxpayers to report their filing status and exemptions, facilitating accurate tax calculations.

The West Virginia IT-140 form is another document that is closely related to the IT-140X. The IT-140 is the original income tax return form for West Virginia residents, while the IT-140X is the amended version. Taxpayers must initially file the IT-140 before they can use the IT-140X to make corrections or changes to their tax situation. Both forms follow similar structures and require the same types of information regarding income, deductions, and credits.

The Federal Form 1040-SR, designed for seniors, is similar in that it provides a simplified filing option for older taxpayers. Like the IT-140X, it allows for modifications and adjustments to be made. Both forms aim to accommodate specific taxpayer needs, ensuring that individuals can accurately report their financial situations and claim appropriate deductions or credits.

The West Virginia IT-140 NRS form is another relevant document, specifically for nonresidents filing a special return. This form shares the goal of accurately reporting income and taxes owed, similar to the IT-140X. Both forms require taxpayers to detail their income sources and calculate their tax liabilities based on West Virginia tax law, ensuring compliance for those who do not reside in the state full-time.

The IRS Form 1040-ES is also comparable, as it is used for estimated tax payments. Taxpayers may need to amend their estimated tax payments, similar to how they would amend their income tax returns with the IT-140X. Both forms require individuals to project their tax liabilities and report any changes to ensure they meet their tax obligations throughout the year.

The West Virginia IT-140S form is relevant for small businesses and self-employed individuals. This form, like the IT-140X, allows for adjustments to be made based on income earned from business activities. Both documents require detailed reporting of income, expenses, and deductions, ensuring that taxpayers accurately reflect their financial situations and comply with state tax regulations.

The IRS Form 8862 is similar in that it is used to claim the Earned Income Tax Credit (EITC) after a prior disallowance. Taxpayers who previously lost eligibility for this credit must provide specific information to claim it again, much like how the IT-140X requires taxpayers to explain changes in their income or exemptions. Both forms aim to ensure that individuals receive the credits they are eligible for while maintaining compliance with tax laws.

Lastly, the West Virginia IT-140C form is relevant for claiming certain credits and adjustments. This form is used to report specific tax credits that may impact the overall tax liability, similar to how the IT-140X allows for adjustments based on changes in income or deductions. Both forms require a clear explanation of changes and the necessary documentation to support the claims made.

FAQ

What is the West Virginia IT-140X form?

The IT-140X form is an Amended Income Tax Return for West Virginia. It is specifically used to correct mistakes on previously filed tax returns for taxable years 2003 through 2006. If you need to make adjustments to your original return, this is the form to use.

When should I use the IT-140X form?

You should file the IT-140X if you have made changes to your Federal Adjusted Gross Income or if you need to correct any errors on your original West Virginia tax return. This includes changes due to audits, additional income, or new deductions.

How do I complete the IT-140X form?

To complete the form, follow these steps:

- Provide your personal information, including names, addresses, and Social Security numbers.

- Indicate your residency status and filing status.

- Detail any changes to your income and exemptions in the specified columns.

- Attach any necessary schedules or supporting documents for the changes you are making.

What if I filed a joint return originally?

If you originally filed a joint return and are now amending it, your spouse must also file a separate return if you choose to amend to filing separately. Make sure to include your spouse’s information on the form.

What types of changes can I make with the IT-140X?

You can make several types of changes, including:

- Adjustments to your Federal Adjusted Gross Income.

- Changes to your exemptions or credits.

- Corrections to your filing status.

Where do I send my completed IT-140X form?

Mail your completed IT-140X form to the West Virginia State Tax Department, Revenue Division, P.O. Box 1071, Charleston, WV 25324-1071. Ensure that you include all necessary attachments and documentation.

What happens if I miss the filing deadline?

If you miss the 90-day deadline to file your amended return after changes to your Federal return, you may face penalties or interest on any taxes owed. It’s essential to file as soon as possible to minimize any potential issues.

Can I e-file the IT-140X form?

Currently, the IT-140X form must be filed by mail. E-filing options may not be available for amended returns, so be sure to print and send your completed form through the postal service.

Documents used along the form

The West Virginia IT-140X form is an important document for amending your state income tax return. When filing this form, you may also need to submit several other documents to ensure your tax situation is accurately represented. Below is a list of commonly used forms and documents that accompany the IT-140X.

- West Virginia IT-140 NR/PY: This form is for nonresidents or part-year residents who need to file a West Virginia income tax return. It captures income earned in West Virginia during the applicable tax year.

- West Virginia IT-140 NRS: This form is specifically for nonresidents who have income from West Virginia sources. It helps calculate the tax owed on that income.

- IRS W-9 Form: This document is crucial for confirming a person's taxpayer identification number (TIN) and plays a vital role in income reporting. For more details, visit TopTemplates.info.

- Federal Form 1040X: This is the federal amended income tax return form. If your federal income tax return changes, you must file this form and attach it to your IT-140X.

- Schedule M: This schedule is used to report modifications to your federal adjusted gross income. If changes are made on your IT-140X, you may need to include this schedule.

- Schedule T: If you are subject to the Federal Alternative Minimum Tax, this schedule is required to compute your total West Virginia income tax.

- Form WV/SCTC-1: This form is used to claim the Senior Citizen Tax Credit for property taxes paid. If applicable, include this form with your IT-140X.

- Schedule E: This schedule is necessary for claiming credits for income taxes paid to other states. Attach this if you are making adjustments related to state tax credits.

Ensure you have all necessary documents ready when submitting your IT-140X form. This will help streamline the amendment process and avoid delays in processing your return.

Dos and Don'ts

When filling out the West Virginia IT-140X form, consider the following do's and don'ts:

- Do ensure that all names and social security numbers are typed or printed clearly.

- Do check your residency status accurately, as this affects your tax calculations.

- Do attach any necessary supporting documents, such as W-2s or 1099s, as required.

- Do review your calculations carefully to avoid errors that could delay processing.

- Do sign the form. An unsigned return will not be processed.

- Don't leave any sections blank. Fill out all required fields to ensure completeness.

- Don't forget to check the correct filing status; it must match your federal return.

- Don't use correction fluid or tape on the form; it can lead to processing issues.

- Don't submit the form late. Timeliness is crucial to avoid penalties.

- Don't forget to keep a copy of the completed form for your records.