Blank West Virginia Gsr 01 PDF Template

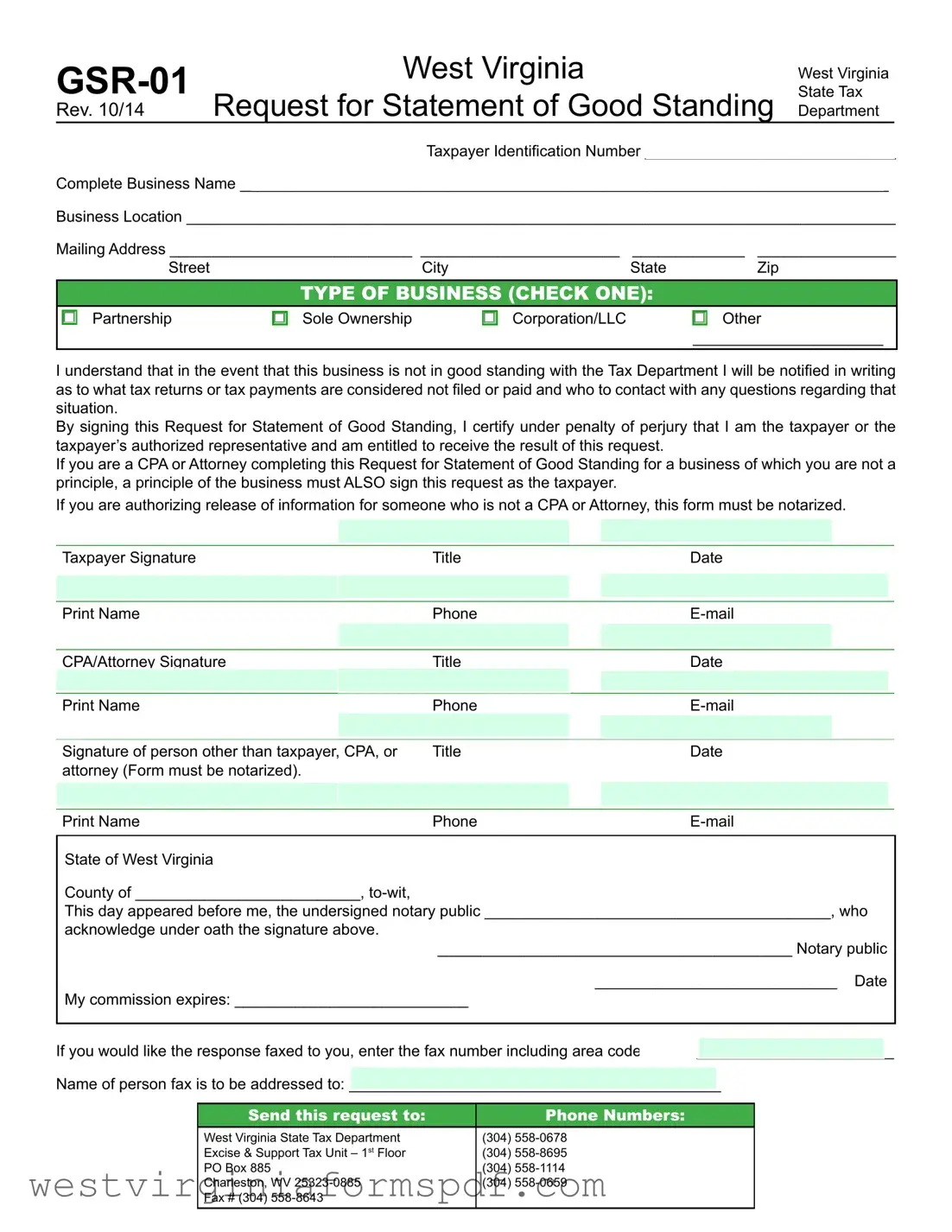

The West Virginia GSR-01 form, officially titled the Request for Statement of Good Standing, serves as a crucial document for businesses operating within the state. This form is primarily used to verify a business's compliance with state tax obligations. It requires essential information such as the taxpayer identification number, complete business name, and business location. Additionally, applicants must specify the type of business, selecting from options like partnership, sole ownership, or corporation/LLC. Acknowledging the importance of good standing, the form includes a declaration that notifies applicants of potential issues with tax filings or payments. By signing the form, the taxpayer or their authorized representative affirms their entitlement to the requested information and certifies the accuracy of the submission under penalty of perjury. Notably, if a CPA or attorney is completing the form on behalf of the business, a principal of the business must also sign. For those authorizing information release to individuals who are not licensed professionals, notarization is required. The form also provides contact information for the West Virginia State Tax Department, ensuring that applicants can easily reach out for further assistance or clarification.

Browse More Forms

Wv Employee Withholding Form - Follow the mailing instructions carefully to ensure that your payment is received on time.

West Virginia State Tax Department - The form includes a checklist for specific business activities that qualify for the permit.

Completing the Trader Joe's application form is essential for anyone interested in working with this popular grocery chain, and more information can be found at the Trader Joe's application form. This document requires applicants to provide personal information, detail their employment history, and state their availability. It plays a crucial role in the hiring process by allowing potential candidates to present their qualifications and motivation for joining the Trader Joe's team.

Provider Credentialing Checklist - New applicants need to provide a W-9 form for verification of their tax identification number.

Form Attributes

| Fact Name | Description |

|---|---|

| Form Purpose | The GSR-01 form is used to request a Statement of Good Standing from the West Virginia State Tax Department. This document verifies that a business is compliant with state tax obligations. |

| Governing Law | This form is governed by the West Virginia Code, specifically under the provisions related to business taxation and compliance. |

| Signature Requirements | To submit the GSR-01 form, the taxpayer or their authorized representative must sign it. If a CPA or attorney completes the form on behalf of the business, a principal must also sign. |

| Notarization | If the form is completed by someone who is not a CPA or attorney, it must be notarized to validate the authorization for information release. |

Similar forms

The West Virginia GSR-01 form is similar to the Certificate of Good Standing, often used in various states. This document confirms that a business entity is legally registered and compliant with state regulations. Like the GSR-01, it requires basic business information and often needs to be signed by an authorized representative. Both documents serve to assure clients, partners, and financial institutions that the business is in good standing and can operate without legal issues.

Another comparable document is the Business License Renewal Application. This form is essential for businesses to maintain their operational permits. Similar to the GSR-01, it requires detailed business information and may involve a fee. Both documents emphasize the importance of compliance with state laws and regulations, ensuring that businesses remain accountable and transparent in their operations.

The Articles of Incorporation also share similarities with the GSR-01 form. This document officially establishes a corporation in the state and includes essential details like the business name and registered agent. While the GSR-01 verifies good standing, the Articles of Incorporation serve as proof of the business's legal existence. Both documents require accurate information and often need signatures from authorized individuals.

The Annual Report is another document that aligns with the GSR-01. This report provides a snapshot of a business's financial status and operational activities over the past year. Like the GSR-01, it must be filed with the state and includes information about the business's leadership and structure. Both documents help ensure that businesses remain compliant and transparent in their dealings.

Similar to the GSR-01 is the Certificate of Existence. This document is issued by the state and confirms that a business is active and compliant with all necessary regulations. Both the Certificate of Existence and the GSR-01 require the business to be in good standing and often serve similar purposes when dealing with banks or other institutions.

The Tax Clearance Certificate is another document that shares characteristics with the GSR-01. This certificate indicates that a business has settled all tax obligations with the state. Both documents serve as proof of compliance and are often required for various business transactions, ensuring that a business is up-to-date with its financial responsibilities.

The Operating Agreement for LLCs is also similar to the GSR-01 form. This internal document outlines the management structure and operating procedures of a limited liability company. While the GSR-01 focuses on good standing, the Operating Agreement ensures that the business operates according to its defined rules. Both documents require accurate representation of the business's structure and can be essential for legal and financial matters.

For business owners seeking to establish clear leasing terms, understanding the intricacies of a California Commercial Lease Agreement template is vital. This document not only protects the interests of both landlords and tenants but also ensures mutual comprehension of rental expectations, thereby facilitating a smoother transaction process.

The Partnership Agreement is akin to the GSR-01 as well. This document outlines the terms and conditions of a partnership, including roles and responsibilities of each partner. Like the GSR-01, it must be signed by all parties involved. Both documents help clarify the business's operational framework and ensure that all parties are aware of their obligations.

Finally, the Business Registration Form is similar to the GSR-01. This form is often the first step in officially establishing a business within a state. It collects vital information about the business, much like the GSR-01. Both documents require accurate details and are crucial for maintaining compliance with state regulations.

FAQ

-

What is the GSR-01 form?

The GSR-01 form, also known as the Request for Statement of Good Standing, is a document used in West Virginia to request confirmation that a business is in good standing with the State Tax Department. This statement is often necessary for various business activities, such as securing loans or contracts.

-

Who needs to complete the GSR-01 form?

Any business entity operating in West Virginia may need to complete the GSR-01 form. This includes partnerships, sole proprietorships, corporations, and limited liability companies (LLCs). If you are a representative, such as a CPA or attorney, you can fill out the form on behalf of the business, but the business principal must also sign it.

-

What information is required on the form?

The GSR-01 form requires several key pieces of information:

- Taxpayer Identification Number

- Complete Business Name

- Business Location

- Mailing Address

- Type of Business

Additionally, signatures from the taxpayer and any authorized representatives are necessary.

-

What happens if the business is not in good standing?

If the business is not in good standing, the Tax Department will notify the requester in writing. This notification will detail which tax returns or payments are missing and provide contact information for further inquiries.

-

Is notarization required for the form?

Yes, notarization is required if someone other than the taxpayer, CPA, or attorney is completing the form. This ensures that the request is legitimate and authorized.

-

How do I submit the GSR-01 form?

You can submit the GSR-01 form by mailing it to the West Virginia State Tax Department at the address provided on the form. Alternatively, you may choose to fax it to the designated fax number.

-

Can I receive the response via fax?

Yes, if you would like to receive the response via fax, you can provide a fax number on the form. Make sure to include the area code and the name of the person to whom the fax should be addressed.

-

What should I do if I have questions about the form?

If you have questions regarding the GSR-01 form, you can contact the West Virginia State Tax Department directly. They have several phone numbers listed for different units, and you can reach out to them for assistance.

-

When should I expect a response after submitting the form?

The response time can vary, but you should allow several days for processing. If you need the statement urgently, consider following up with the Tax Department to check on the status of your request.

Documents used along the form

The West Virginia GSR 01 form is essential for businesses seeking a Statement of Good Standing from the West Virginia State Tax Department. However, there are several other forms and documents that may be required in conjunction with this request. Each of these documents serves a unique purpose and can help streamline the process for businesses. Below is a list of commonly used forms and documents.

- Business Registration Certificate: This document proves that a business is registered with the West Virginia Secretary of State. It is often required to demonstrate the legitimacy of the business entity.

- Annual Report: Businesses in West Virginia must file an annual report to maintain good standing. This report provides updated information about the business, including ownership and financial status.

- Tax Clearance Certificate: This certificate verifies that a business has paid all state taxes owed. It is frequently requested when applying for licenses or permits.

- Operating Agreement: For LLCs, this internal document outlines the management structure and operating procedures of the business. It may be requested to clarify ownership and responsibilities.

- Bylaws: Corporations must have bylaws that detail the rules governing the management of the company. These documents may be necessary to establish the organization’s governance structure.

- FedEx Release Form: This essential document allows recipients to authorize delivery services to leave packages securely when they are not home. For more information, you can visit smarttemplates.net.

- Power of Attorney: If someone other than the business owner is filing the GSR 01 form, a Power of Attorney may be needed. This document authorizes the representative to act on behalf of the business.

- Notarized Authorization Form: If the request for a Statement of Good Standing is being made by someone other than the business owner or authorized representative, a notarized authorization form is required to validate the request.

Understanding these additional documents can help ensure that your request for the GSR 01 form is processed smoothly. Always check the specific requirements for your business type and situation to avoid delays.

Dos and Don'ts

When filling out the West Virginia GSR-01 form, it is crucial to approach the task with care and attention to detail. Here is a list of things you should and shouldn't do:

- Do ensure that all required fields are filled out completely. Missing information can lead to delays or complications.

- Do double-check the Taxpayer Identification Number. Accuracy is essential for processing your request smoothly.

- Do sign the form as required. If you are not the taxpayer, ensure that the taxpayer also signs the form.

- Do provide a valid mailing address. This ensures that you receive any correspondence from the Tax Department promptly.

- Don't forget to select the correct type of business. This is an important classification that affects how your request is processed.

- Don't submit the form without notarization if required. If someone other than the taxpayer is signing, notarization is necessary.

- Don't ignore the contact information. Providing your phone number and email allows for quicker communication if any issues arise.