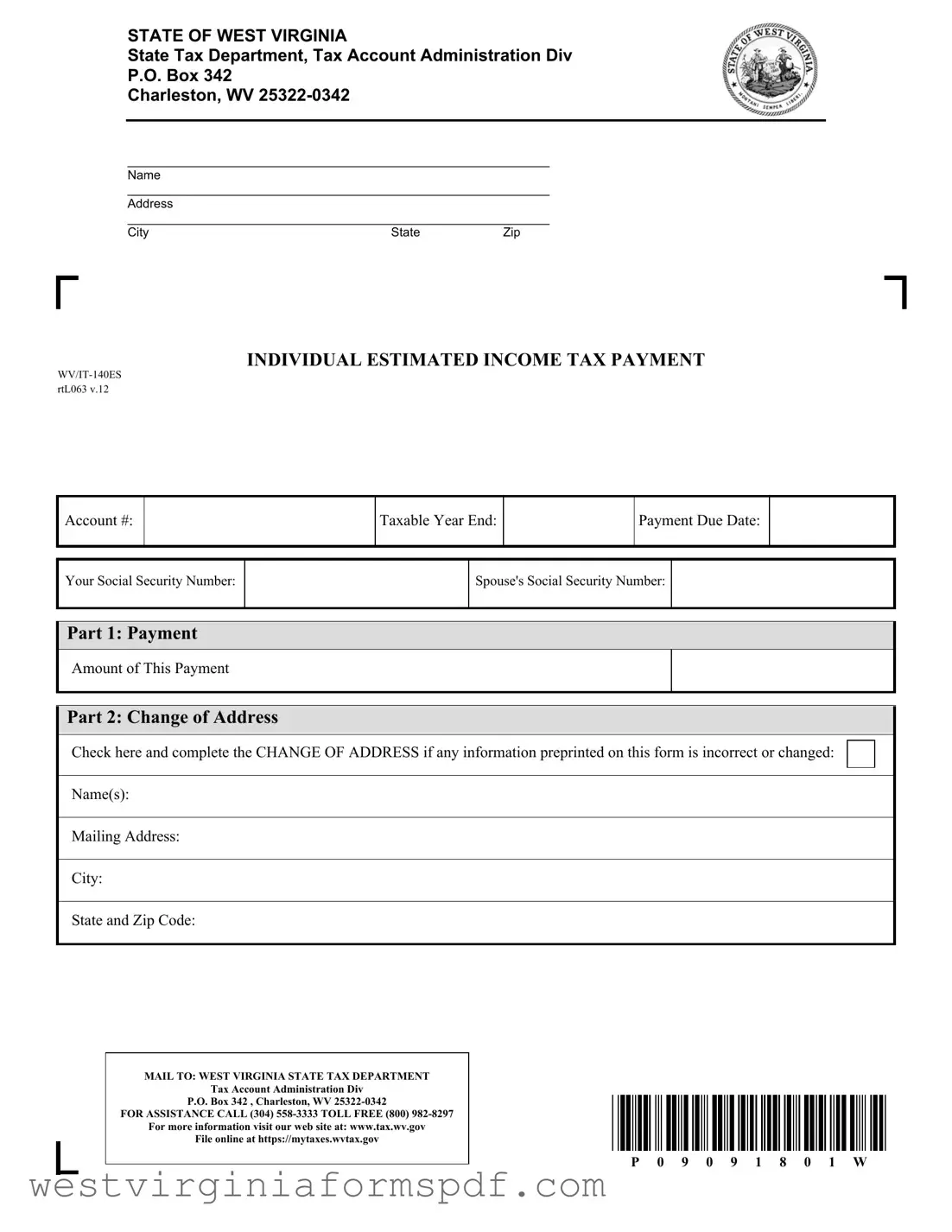

Blank West Virginia Estimated Tax PDF Template

The West Virginia Estimated Tax form, known as WV/IT-140ES, serves as a critical tool for individuals anticipating a tax liability of at least $600 when filing their annual income tax return. This form requires taxpayers to calculate their estimated tax payments, ensuring compliance with state tax obligations. It is essential to fill out the form accurately, including personal information such as Social Security numbers and any changes of address, to avoid delays or penalties. The form includes specific sections for indicating the payment amount and allows taxpayers to opt for higher payments if desired. Timely submission is crucial; payments must be mailed to the West Virginia State Tax Department by the designated due dates to prevent penalties. For those who do not follow the calendar year for tax purposes, additional instructions are provided to clarify payment schedules. Access to further guidance is readily available through the West Virginia State Tax Department’s website, where taxpayers can also find the necessary instruction brochure to assist in calculating their estimated tax. Proper completion and submission of the WV/IT-140ES form can significantly impact a taxpayer's financial obligations and overall compliance with state tax laws.

Browse More Forms

Wv State Income Tax - There are specific instructions on how to report income adjustments and deductions in the Wv Tax Form.

To facilitate a seamless vehicle sale, it is essential to utilize the proper documentation, such as the Motor Vehicle Bill of Sale form, which ensures that all necessary details are accurately captured and legally binding for both parties involved in the transaction.

Provider Credentialing Checklist - If the applicant is not a U.S. citizen, a copy of a visa or work permit must be included.

Form Attributes

| Fact Name | Details |

|---|---|

| Purpose | The West Virginia Estimated Tax form is used for individuals who expect to owe at least $600 in state tax when filing their annual income tax return. |

| Governing Law | This form is governed by West Virginia Code § 11-21-2, which outlines the requirements for estimated tax payments. |

| Payment Instructions | Taxpayers must determine their estimated tax using the instruction brochure (Form IT-140ESI) available on the West Virginia State Tax Department website. |

| Mailing Address | Completed forms and payments should be mailed to: West Virginia State Tax Department, Tax Account Administration Division, P.O. Box 342, Charleston, WV 25322-0342. |

Similar forms

The West Virginia Estimated Tax form shares similarities with the IRS Form 1040-ES, which is used for federal estimated tax payments. Both forms require taxpayers to estimate their tax liability for the year and make periodic payments based on that estimate. Each form includes a section for the taxpayer to report their payment amount and provides instructions for calculating estimated taxes. Additionally, both forms emphasize the importance of making timely payments to avoid penalties.

Another comparable document is the California Estimated Tax form (Form 540-ES). Like the West Virginia form, it is designed for individuals who expect to owe tax when filing their annual return. Both forms require the taxpayer to provide personal information, including Social Security numbers, and allow for adjustments to the payment amount. The California form also outlines due dates for payments, similar to the West Virginia instructions.

The New York State Estimated Income Tax form (Form IT-2105) is also similar to the West Virginia form. Both documents serve the same purpose: to collect estimated taxes from individuals who expect to owe a certain amount at the end of the tax year. Each form includes a section for reporting changes in address, ensuring that tax authorities can maintain accurate records. Additionally, both forms provide clear mailing instructions for submitting payments.

In addition to these forms, you may find resources online that offer further guidance on filling out the necessary paperwork, such as smarttemplates.net, ensuring that you have all the tools needed for accurate and timely submissions.

The Florida Estimated Tax form (Form DR-501) is another document that resembles the West Virginia form. It is used by individuals in Florida to estimate their tax liability and make payments accordingly. Both forms require taxpayers to calculate their expected tax and provide a payment table for recording amounts. Furthermore, both documents stress the importance of paying the minimum required amount to avoid penalties.

Lastly, the Pennsylvania Estimated Income Tax form (Form REV-421) is akin to the West Virginia Estimated Tax form. Both forms are utilized by individuals to report and pay estimated taxes. They require similar personal information, including names and addresses, and provide clear instructions for determining estimated tax amounts. Each form also highlights the necessity of submitting payments by specific due dates to prevent penalties.

FAQ

What is the West Virginia Estimated Tax form and who needs to use it?

The West Virginia Estimated Tax form, known as WV/IT-140ES, is designed for individuals who expect to owe at least $600 in state taxes when they file their annual income tax return. If you anticipate owing this amount, you are required to make estimated tax payments throughout the year. This helps ensure that you do not face a large tax bill when filing your return. It is important to calculate your estimated tax accurately to avoid penalties.

How do I determine my estimated tax amount?

To determine your estimated tax, you will need to use the instruction brochure available at the West Virginia State Tax Department's website. This brochure, known as Form IT-140ESI, provides guidance on how to calculate your estimated tax based on your expected income and deductions. Follow the instructions carefully, and make sure to write the calculated payment amount on your WV/IT-140ES form.

When are the estimated tax payments due?

Estimated tax payments are typically due quarterly. If you are a calendar year taxpayer, the due dates for your payments are as follows:

- April 15 - for the first quarter

- June 15 - for the second quarter

- September 15 - for the third quarter

- January 15 of the following year - for the fourth quarter

If you are not a calendar year taxpayer, you should refer to the instructions provided with the form to determine your specific due dates.

What should I do if my address changes?

If you have a change of address, it is important to update your information to ensure that you receive all tax-related correspondence. On the West Virginia Estimated Tax form, there is a section labeled "Change of Address." Check the box provided and complete the required fields with your new name and mailing address. This will help the State Tax Department keep your records accurate and up to date.

Documents used along the form

When filing your West Virginia Estimated Tax form, several other documents may be necessary to ensure everything is in order. Each of these documents plays a crucial role in the tax process, helping you provide accurate information to the state tax department.

- Form WV/IT-140ESI: This instruction brochure helps you calculate your estimated tax payments. It provides detailed guidance on how to determine your tax liability based on your expected income.

- Form WV/IT-140: This is the standard individual income tax return form used to report your actual income and tax liability for the year. You will file this form after the tax year ends.

- Form WV/IT-140G: If you are claiming a credit for taxes paid to another state, this form is necessary. It helps you report any taxes you’ve already paid elsewhere, which can reduce your West Virginia tax burden.

- Form WV/IT-140ES Payment Voucher: This voucher is used to submit your estimated tax payments. It ensures that your payments are properly credited to your account.

- Vehicle Purchase Agreement Form: When purchasing a vehicle, it is crucial to utilize the necessary Vehicle Purchase Agreement resources to ensure all terms are clearly documented and understood.

- Form WV/IT-150: This form is for non-residents and part-year residents who need to report income earned in West Virginia. It is essential for those who do not live in the state full-time but have taxable income there.

- Change of Address Form: If your address has changed since you last filed, this form ensures that the tax department has your current information. Keeping your address updated is important for receiving tax documents and correspondence.

Gathering these documents can help streamline the filing process and ensure compliance with state tax regulations. Being organized will make it easier to manage your estimated tax payments and any related filings.

Dos and Don'ts

When filling out the West Virginia Estimated Tax form, following certain guidelines can help ensure accuracy and compliance. Here are seven things to do and avoid:

- Do check that your personal information is correct, including your name and address.

- Do calculate your estimated tax accurately using the provided instruction brochure.

- Do write the payment amount clearly on the form to avoid processing delays.

- Do mail your payment by the due date to avoid penalties.

- Do keep a copy of the completed form for your records.

- Don't forget to include both your Social Security number and your spouse's, if applicable.

- Don't ignore the instructions for non-calendar year taxpayers if that applies to you.