Blank West Virginia Cf 1 PDF Template

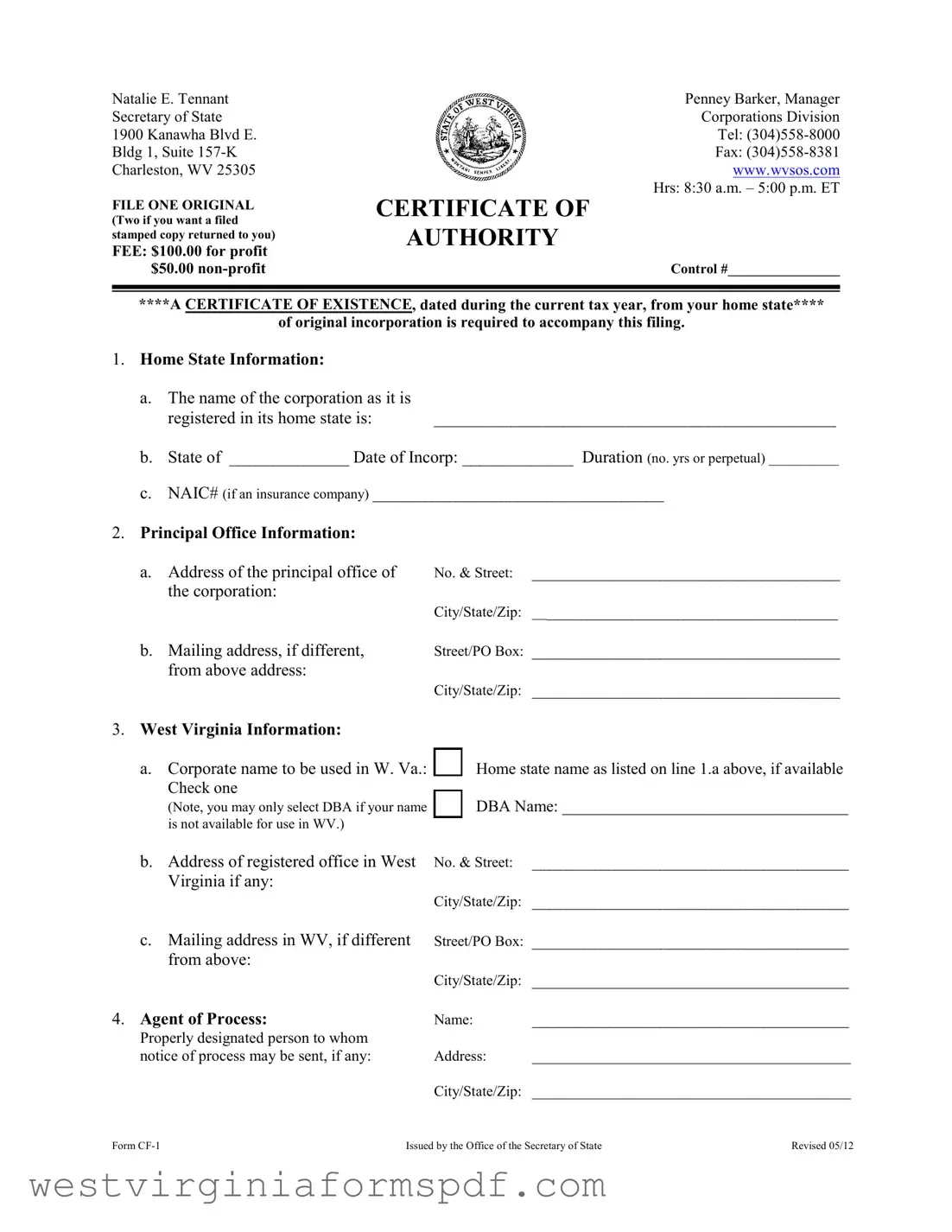

When establishing a business presence in West Virginia, understanding the intricacies of the CF-1 form is essential for smooth operations. This form, officially known as the Application for Certificate of Authority, serves as a gateway for corporations incorporated outside of West Virginia to legally conduct business within the state. To initiate this process, applicants must provide a variety of critical information, including the corporation's name as registered in its home state, the date of incorporation, and the duration of its existence. Additionally, the form requires details about the corporation's principal office, including its address and mailing information. Notably, businesses must also specify their intended purpose for operating in West Virginia and identify a registered agent who can receive legal documents on behalf of the corporation. For those seeking to operate as a profit or non-profit entity, the CF-1 form includes a clear designation of corporate status. Furthermore, it mandates the submission of a Certificate of Existence from the home state, ensuring that the corporation is in good standing. With a filing fee of $100 for profit corporations and $50 for non-profits, this form is not just a bureaucratic requirement but a crucial step in establishing a legitimate business presence in West Virginia.

Browse More Forms

Provider Credentialing Checklist - Applicants must provide their social security number as part of the application process.

Filling out the Trader Joe's application form is crucial for those aspiring to join the popular grocery chain, as it provides an opportunity for candidates to present their qualifications. The form includes necessary sections such as personal information, employment history, and availability. To get started, applicants can access the Trader Joe's application form and ensure they submit a polished and complete application, enhancing their chances of employment.

Wv 2848 - The powers given may include negotiating settlements with the tax department.

West Virginia State Tax Department - Exemptions are based on legal statutes that define eligibility criteria.

Form Attributes

| Fact Name | Details |

|---|---|

| Governing Law | West Virginia Code §33-3-3 governs the Certificate of Authority application process. |

| Filing Fee | $100.00 for profit corporations, $50.00 for non-profit corporations. |

| Certificate of Existence | A current Certificate of Existence from the home state is required for filing. |

| Contact Information | Penney Barker, Manager, Corporations Division, Tel: (304) 558-8000. |

| Office Hours | Available Monday to Friday, 8:30 a.m. – 5:00 p.m. ET. |

| Submission Requirements | Submit one original application; two if a stamped copy is requested. |

| Scrap Metal Dealers | If applicable, complete the Scrap Metal Dealer Registration Form (Form SMD-1). |

| Name Reservation | A name reservation can be held for 120 days for a $15 fee. |

Similar forms

The West Virginia CF-1 form is similar to the Certificate of Incorporation, which is a foundational document for a corporation. This certificate officially establishes a corporation's existence in its home state. Like the CF-1, it requires essential information about the corporation, including its name, purpose, and registered agent. Both documents serve as proof of the corporation's legal status and are necessary for conducting business within their respective jurisdictions.

Another document akin to the CF-1 is the Articles of Organization, which is used for forming Limited Liability Companies (LLCs). This document outlines the basic structure of the LLC, including its name, registered agent, and management structure. Similar to the CF-1, the Articles of Organization must be filed with the state and include information that verifies the legitimacy of the business entity. Both documents ensure that the business is recognized legally and can operate within the state.

The Certificate of Good Standing is also comparable to the CF-1. This document verifies that a corporation is compliant with state regulations and has met all necessary requirements, such as filing annual reports and paying taxes. Just as the CF-1 requires a Certificate of Existence from the home state, the Certificate of Good Standing serves as evidence that the corporation is in good standing and can legally conduct business in West Virginia.

The Business License Application is another document that shares similarities with the CF-1. This application is necessary for businesses to obtain the licenses required to operate legally within a specific jurisdiction. Like the CF-1, the Business License Application collects vital information about the business, including its name, address, and type of services offered. Both documents are essential for ensuring that a business complies with local regulations.

For those interested in leasing commercial property, understanding the nuances of the Commercial Lease Agreement process is vital. This legally binding document outlines the obligations of both landlords and tenants, ensuring clarity in rental arrangements. To explore the specifics of this important agreement, visit the California Commercial Lease Agreement overview.

In addition, the Foreign Qualification Application is relevant to the CF-1. This document allows a business incorporated in one state to operate legally in another state. Similar to the CF-1, the Foreign Qualification Application requires details about the business, including its name, registered agent, and the state of incorporation. Both documents ensure that the business is recognized and permitted to conduct activities outside its home state.

The Annual Report is another document that resembles the CF-1. Corporations are often required to file this report to provide updated information about their business, including changes in officers or registered agents. Like the CF-1, the Annual Report helps maintain the corporation's good standing with the state and ensures compliance with ongoing regulatory requirements.

Lastly, the DBA (Doing Business As) Registration is similar to the CF-1 in that it allows a business to operate under a name different from its legal name. This document requires the business to provide information about the assumed name, the legal name, and the nature of the business. Both the DBA Registration and the CF-1 are essential for ensuring that the business is recognized under its operating name and complies with state naming regulations.

FAQ

What is the West Virginia CF-1 form and when do I need it?

The West Virginia CF-1 form is an application for a Certificate of Authority, which allows a corporation formed in another state to conduct business in West Virginia. This form is essential if your corporation plans to operate in West Virginia and is not incorporated there. You will need to submit this form along with a Certificate of Existence from your home state, dated during the current tax year, as part of the application process.

What are the fees associated with filing the CF-1 form?

The fee for filing the CF-1 form varies depending on the type of corporation. For profit corporations, the filing fee is $100. Non-profit corporations are charged a reduced fee of $50. If you would like a filed-stamped copy of your application returned to you, it is advisable to submit two original applications along with your payment.

What information is required to complete the CF-1 form?

Completing the CF-1 form requires several pieces of information:

- The name of your corporation as registered in its home state.

- The state of incorporation and the date of incorporation.

- The address of your principal office and any mailing address if different.

- The corporate name to be used in West Virginia.

- The name and address of your registered agent in West Virginia.

- The proposed purpose of your business in West Virginia.

- Details about your officers and directors.

Additionally, if your corporation is a scrap metal dealer, you will need to complete a separate registration form.

How do I ensure my corporate name is available in West Virginia?

Before filing the CF-1 form, it is crucial to check the availability of your corporate name in West Virginia. You can do this by contacting the Corporations Division at (304) 558-8000. If your desired name is available, you may reserve it for 120 days by submitting an application for name reservation along with a $15 fee. Remember, your corporate name must be distinguishable from any existing names in the state, so take care to review this requirement thoroughly.

Documents used along the form

The West Virginia CF 1 form is essential for businesses seeking to operate in the state. Along with this form, there are several other documents that may be required or beneficial during the application process. Below is a list of commonly used forms and documents that accompany the CF 1 form, each described briefly for clarity.

- Certificate of Existence/Good Standing: This document verifies that a corporation is legally registered and compliant with state regulations in its home state. It must be dated during the current tax year.

- Board Resolution for DBA Name: If the corporation's original name is not available in West Virginia, a resolution from the board of directors adopting a "Doing Business As" (DBA) name is necessary.

- Scrap Metal Dealer Registration Form (Form SMD-1): Required for businesses classified as scrap metal dealers, this form must be completed and submitted alongside the CF 1 form.

- Application for Name Reservation: This optional form allows a business to reserve a corporate name for 120 days, ensuring that the name is not taken by another entity during the application process.

- IRS W-9 Form: This form is essential for confirming taxpayer identification numbers (TIN) with the IRS, especially when dealing with income payments or financial transactions. Understanding how to accurately fill out the TopTemplates.info can greatly simplify tax reporting and compliance.

- Certificate of Authority from the Insurance Commissioner: For insurance companies, this document must be submitted to confirm that the company is authorized to operate in West Virginia.

- Articles of Incorporation: This foundational document outlines the corporation's structure and purpose. It is often required to establish the business's legal identity.

- Operating Agreement: While not always required, this internal document outlines the management structure and operating procedures of the business, particularly for LLCs.

- Bylaws: For corporations, bylaws detail the rules and procedures for governance, including the roles of directors and officers, and are essential for compliance.

- Employer Identification Number (EIN): This number, issued by the IRS, is necessary for tax purposes and is often required for opening a business bank account.

- Filing Fee Payment: A payment must accompany the CF 1 form, with fees varying based on whether the corporation is for-profit or non-profit.

Understanding these documents can streamline the process of applying for a Certificate of Authority in West Virginia. Being well-prepared will help ensure compliance and facilitate smoother operations as your business establishes itself in the state.

Dos and Don'ts

When filling out the West Virginia CF-1 form, follow these important guidelines:

- Do check the availability of your corporate name in West Virginia before submitting the form.

- Do include a Certificate of Existence from your home state, dated during the current tax year.

- Do ensure that the name matches exactly with the good standing certificate.

- Do provide a valid email address for future correspondence.

- Do list all officers and directors, including their addresses.

- Don't submit an incomplete application; it will be returned.

- Don't forget to include a resolution if using a DBA name.

Adhering to these points will help ensure a smooth filing process. Take action promptly to avoid delays.