Blank West Virginia Cd 3 PDF Template

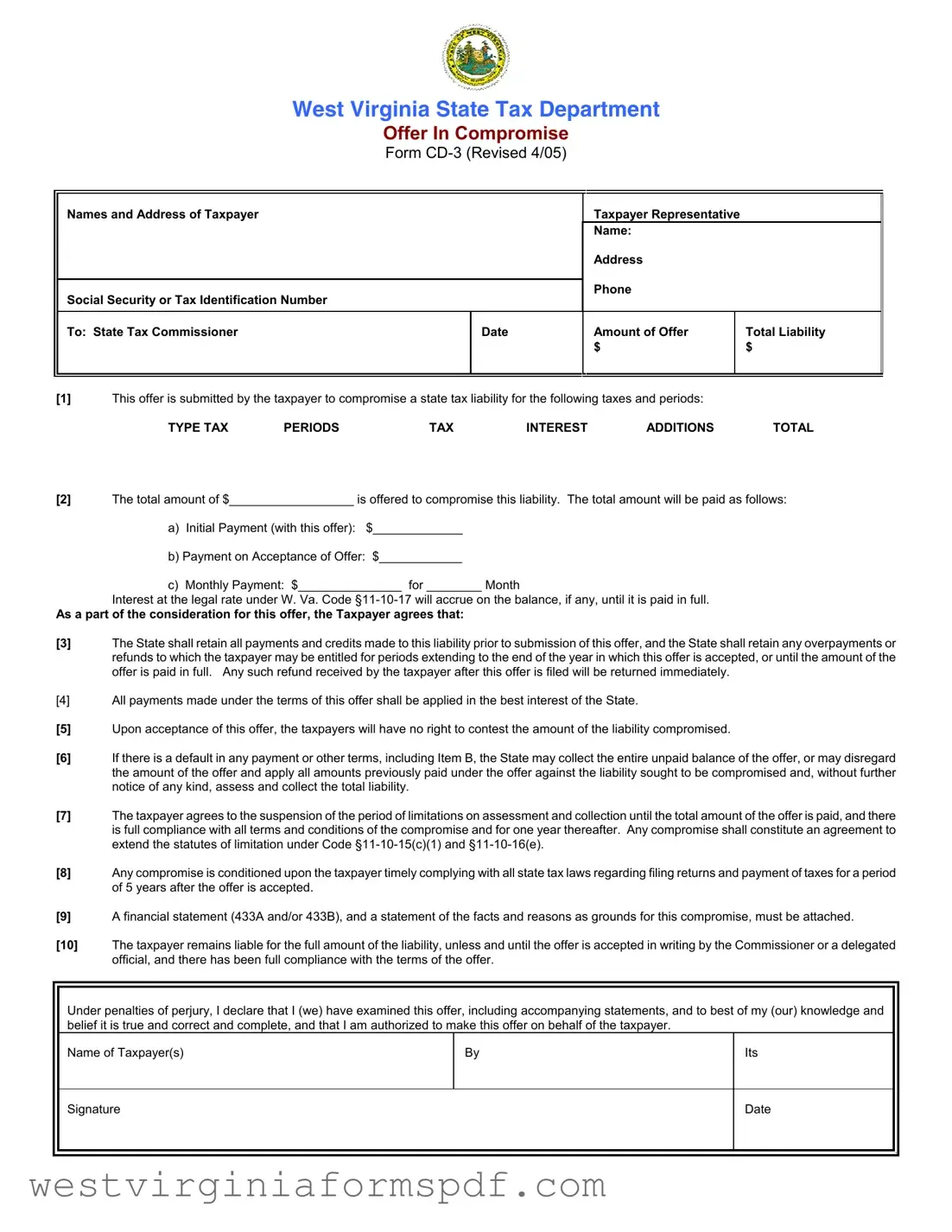

The West Virginia CD-3 form is a critical document for taxpayers seeking to resolve outstanding state tax liabilities through an Offer in Compromise. This form allows individuals to propose a reduced amount to settle their tax debts, particularly when there is uncertainty about the liability or the likelihood of full collection. The form requires detailed information, including the taxpayer's name, address, and identification number, as well as specifics about the tax types, periods, and total amounts owed. It outlines the payment structure for the offer, including an initial payment, an acceptance payment, and a proposed monthly payment plan. Taxpayers must also attach a financial statement and provide a rationale for their offer, demonstrating their inability to pay the full amount. Importantly, acceptance of the offer means the taxpayer agrees to suspend any contestation of the liability and adhere to future tax compliance for five years. Understanding the nuances of this form is essential for anyone looking to alleviate their tax burden effectively.

Browse More Forms

Wv Pte-100 Instructions 2022 - A separate WV/NRW-4 must be submitted for each organization that generates West Virginia source income.

The California Articles of Incorporation form is a document that officially registers a corporation with the state, marking the beginning of its legal existence. It's a vital step for any business looking to structure itself as a corporation within California. This form covers essential details such as the corporation's name, purpose, and information about its shares and initial agents, and more information can be found at https://onlinelawdocs.com/california-articles-of-incorporation/.

West Virginia Business Registration - Consult with the office if you have detailed questions during your application process.

Form Attributes

| Fact Name | Details |

|---|---|

| Form Purpose | The West Virginia CD-3 form is used by taxpayers to submit an offer in compromise for state tax liabilities. |

| Governing Law | This form is governed by W. Va. Code §11-10-5q(c), which allows the State Tax Commissioner to compromise tax liabilities. |

| Payment Terms | Offers must include an initial payment, a payment upon acceptance, and a monthly payment plan, if applicable. |

| Compliance Requirement | Taxpayers must comply with all state tax laws for five years after the offer is accepted to maintain the agreement. |

| Documentation Needed | A financial statement (Forms 433A and/or 433B) and a statement of grounds for the compromise must accompany the offer. |

Similar forms

The West Virginia Offer in Compromise Form CD-3 shares similarities with the IRS Form 656, which is also used for offers in compromise at the federal level. Both forms allow taxpayers to propose a reduced amount to settle their tax debts. The IRS Form 656 requires taxpayers to submit financial information to demonstrate their inability to pay the full tax liability, similar to the financial disclosures needed in the CD-3. Both forms also stipulate that taxpayers must comply with tax laws for a specified period after acceptance of the offer.

Another document that resembles the CD-3 is the IRS Form 433-A, Collection Information Statement for Individuals. This form collects detailed financial information from taxpayers, including income, expenses, and assets. Like the CD-3, it is a critical part of the offer process. Taxpayers must provide this form to support their claims of financial hardship and inability to pay their tax liabilities in full.

The IRS Form 433-B, Collection Information Statement for Businesses, is also similar to the CD-3. This form is used by businesses to provide financial information that supports an offer in compromise. Both forms require a comprehensive overview of the taxpayer's financial situation, ensuring that the tax authorities can assess the taxpayer's ability to pay and the reasonableness of the offer made.

The California Offer in Compromise Form is another comparable document. Like the West Virginia CD-3, it allows taxpayers to settle tax liabilities for less than the full amount owed. The California form also requires a financial statement and a detailed explanation of why the offer should be accepted, mirroring the requirements set forth in the CD-3.

The New York State Offer in Compromise Form is similar in purpose and structure to the West Virginia CD-3. It allows taxpayers to negotiate a lower tax liability due to financial hardship. Both forms require detailed financial disclosures and stipulate that taxpayers must comply with tax laws for a designated period after the offer is accepted.

Understanding the various forms related to tax compromise is essential for taxpayers, and one document that stands out is the New York Boat Bill of Sale form. This form is not only critical for boat transactions in New York, but it also emphasizes the importance of accurate documentation and compliance, much like other financial forms. For further details on how to properly complete legal documents, you can visit https://smarttemplates.net.

The Illinois Offer in Compromise Form is another document that functions similarly to the CD-3. It provides taxpayers with an opportunity to settle their tax debts for less than the total amount owed. Both forms require the submission of financial statements and a commitment to comply with future tax obligations.

The Texas Offer in Compromise Form is also akin to the West Virginia CD-3. This form permits taxpayers to propose a settlement amount that is less than their total tax liability. Like the CD-3, it requires a financial statement and outlines the conditions for acceptance, including compliance with tax laws in the future.

The Florida Offer in Compromise Form shares similarities with the CD-3 as well. This form allows taxpayers to negotiate a reduced tax liability due to their financial circumstances. Both forms require taxpayers to provide comprehensive financial information and agree to comply with tax laws after acceptance of the offer.

The Massachusetts Offer in Compromise Form is another document that resembles the CD-3. It allows taxpayers to propose a lower amount to settle their tax debts. Similar to the West Virginia form, it requires financial disclosures and outlines the conditions under which the offer will be accepted.

Lastly, the Pennsylvania Offer in Compromise Form is similar to the West Virginia CD-3. This form enables taxpayers to settle their tax liabilities for less than the full amount owed. Both forms require a financial statement and emphasize the importance of future compliance with tax obligations as part of the acceptance process.

FAQ

What is the West Virginia CD-3 form used for?

The West Virginia CD-3 form is an Offer in Compromise form. Taxpayers use it to propose a settlement for their state tax liabilities. This form is specifically for cases where there is doubt about the taxpayer's ability to pay the full amount owed. By submitting this form, taxpayers can negotiate a lower amount to settle their tax debts, which can help them manage their financial situation more effectively.

What information do I need to provide on the CD-3 form?

When filling out the CD-3 form, you will need to provide several key pieces of information:

- Your name, address, and taxpayer identification number.

- The type of taxes and the periods for which you owe money.

- The total liability amount, including taxes, interest, and any additions.

- A breakdown of your offer, including initial payment, payment upon acceptance, and any monthly payments.

- A financial statement (Forms 433A and/or 433B) that details your assets, income, and expenses.

Make sure to include a statement explaining why you believe your offer should be accepted. This helps the state understand your situation better.

What happens after I submit the CD-3 form?

Once you submit the CD-3 form, the state will review your offer. They will consider factors such as your ability to pay and whether accepting your offer is in the best interest of the state. During this review process, the state may continue collection efforts unless they determine that your offer is valid. If your offer is accepted, you will need to comply with the terms outlined in the agreement, including making the agreed payments and adhering to future tax obligations.

What are the consequences if I don't comply with the terms of the offer?

If you fail to comply with the terms of your offer, the state has the right to collect the entire unpaid balance of your tax liability. This means they can disregard your offer and pursue the full amount owed. Additionally, you will lose any benefits associated with the compromise, such as the suspension of collection efforts. It’s crucial to ensure you meet all payment deadlines and comply with future tax laws to avoid these consequences.

Documents used along the form

The West Virginia CD-3 form is a crucial document for taxpayers looking to settle their tax liabilities through an offer in compromise. To effectively navigate this process, several other forms and documents may be required. Below is a list of these documents, each described for clarity.

- Form 433-A: This is the Collection Information Statement for Individuals. It provides detailed information about an individual's financial situation, including income, expenses, assets, and liabilities. This form helps the tax authority assess the taxpayer's ability to pay the tax liability.

- IRS W-9 Form: Accurate completion of the TopTemplates.info can ensure proper identification and reporting of income, which is vital for compliance with tax regulations.

- Form 433-B: This is the Collection Information Statement for Businesses. Similar to Form 433-A, it collects financial data specific to a business, including its income, expenses, and overall financial health, to evaluate the offer in compromise.

- Power of Attorney (POA): If someone other than the taxpayer submits the offer, a POA must be included. This document authorizes the representative to act on behalf of the taxpayer in dealings with the tax authority.

- Financial Statements: These documents provide a comprehensive overview of the taxpayer's financial status. They may include bank statements, pay stubs, and other relevant financial records that support the offer in compromise.

- Statement of Facts: This is a narrative explaining the reasons for the offer in compromise. It should detail why the taxpayer believes the state cannot collect more than the offered amount, providing a compelling case for acceptance.

- Tax Returns: All relevant tax returns must be filed before submitting an offer in compromise. This ensures that the taxpayer is in compliance with all filing requirements, which is a prerequisite for consideration.

- Payment Plan Proposal: If applicable, this document outlines how the taxpayer intends to make payments toward the offered amount. It should specify the initial payment and any installment amounts, demonstrating the taxpayer's commitment to fulfilling the offer.

Gathering these documents is essential for a successful offer in compromise. Each form and statement plays a vital role in presenting a clear and comprehensive picture of the taxpayer's financial situation, ultimately aiding in the negotiation process with the tax authority.

Dos and Don'ts

When filling out the West Virginia CD-3 form, there are several important considerations to keep in mind. Below is a list of things you should and shouldn't do to ensure your submission is complete and effective.

- Do provide your full name, address, and taxpayer identification number at the top of the form.

- Do list all tax liabilities you wish to compromise, including specific types, periods, and amounts.

- Do attach a financial statement (Form 433-A and/or 433-B) along with documentation to support your claims.

- Do clearly explain why the state should accept your offer in the additional statement section.

- Don't submit the form without ensuring all tax returns are filed and up to date.

- Don't forget to sign and date the form; if someone else signs, include a power of attorney.

- Don't propose an offer that includes amounts already paid or collected on the liability.

- Don't extend the payment period beyond two years; shorter payment terms are preferred.