Valid Transfer-on-Death Deed Template for West Virginia State

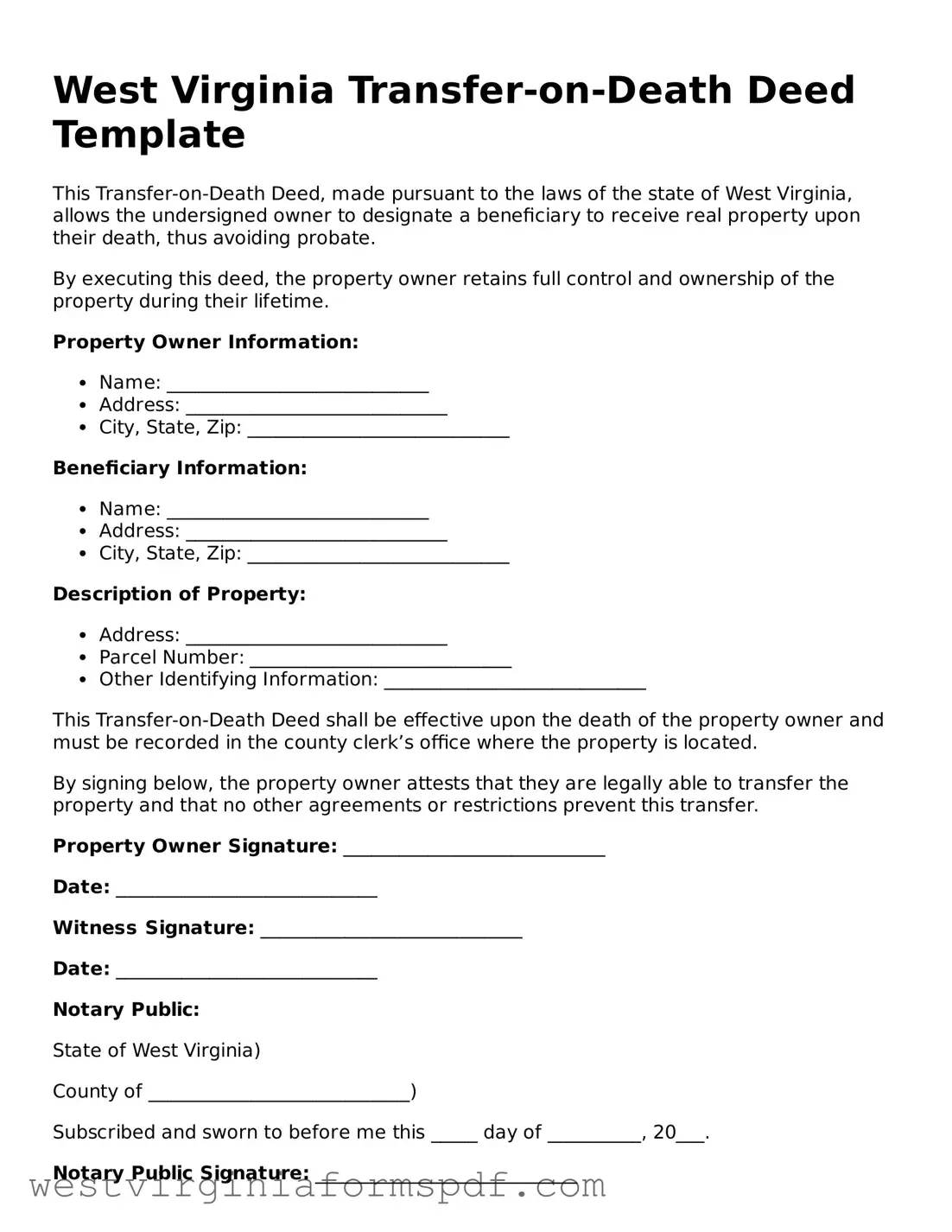

The Transfer-on-Death Deed (TODD) form in West Virginia provides an efficient way for property owners to transfer real estate to designated beneficiaries upon their death, bypassing the often lengthy probate process. This legal instrument allows individuals to retain full ownership and control of their property during their lifetime, ensuring that they can sell or mortgage it without restrictions. Upon the owner's death, the property automatically transfers to the named beneficiaries, simplifying the transition of assets. The form requires specific information, including the names of the beneficiaries and a clear description of the property. Importantly, the TODD must be properly executed and recorded to be effective, making adherence to procedural guidelines essential. This deed serves as a valuable estate planning tool, offering peace of mind and clarity for property owners and their heirs alike.

Consider Other Common Templates for West Virginia

Living Will Form West Virginia - Your document should be stored in a place accessible to your family and healthcare providers for easy reference.

A Last Will and Testament form is a legal document that outlines how a person's assets and responsibilities should be handled after their death. It allows individuals to specify beneficiaries for their property and appoint guardians for minor children. For those looking to create or understand this essential document, resources such as TopTemplates.info can provide valuable guidance, ensuring that one's final wishes are respected.

Buying a House on Contract Template - The document outlines the responsibilities regarding property taxes and HOA fees.

File Attributes

| Fact Name | Description |

|---|---|

| Purpose | The West Virginia Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | This deed is governed by West Virginia Code § 36-12-1 through § 36-12-8. |

| Requirements | The deed must be signed by the property owner and notarized to be valid. |

| Revocation | Property owners can revoke the deed at any time before their death, ensuring flexibility in estate planning. |

| Beneficiary Rights | Beneficiaries do not have any rights to the property until the owner passes away, maintaining the owner's control during their lifetime. |

Similar forms

The West Virginia Transfer-on-Death Deed (TODD) form shares similarities with a Last Will and Testament. Both documents serve to transfer property upon the death of the owner. However, while a will typically goes through probate, potentially delaying the distribution of assets, a TODD allows for immediate transfer of property to beneficiaries without the need for probate. This can simplify the process and reduce costs for the heirs involved.

Understanding the nuances of property transfer is essential, particularly when considering tools like the West Virginia Transfer-on-Death Deed (TODD), which simplifies the process. For those looking to incorporate their business in California, it's crucial to also be aware of documents like the Articles of Incorporation, which can be found at https://onlinelawdocs.com/california-articles-of-incorporation/, as they are vital for establishing legal entities while ensuring clear intentions for asset transfers.

FAQ

What is a Transfer-on-Death Deed in West Virginia?

A Transfer-on-Death Deed (TODD) is a legal document that allows a property owner to designate one or more beneficiaries to receive their property upon their death, without the need for probate. This deed is particularly useful for simplifying the transfer of real estate and avoiding the often lengthy and costly probate process. In West Virginia, the TODD must be properly executed and recorded to be valid.

Who can create a Transfer-on-Death Deed?

Any individual who owns real estate in West Virginia can create a Transfer-on-Death Deed. This includes homeowners, property investors, and anyone holding title to real property. It’s important to note that the individual must be of sound mind and at least 18 years old when executing the deed. If the property is owned jointly, all owners must agree to the transfer.

How do I properly execute a Transfer-on-Death Deed?

To execute a Transfer-on-Death Deed in West Virginia, follow these steps:

- Obtain the official form for the Transfer-on-Death Deed.

- Fill out the form with the required information, including the names of the beneficiaries.

- Sign the deed in the presence of a notary public.

- Record the deed with the county clerk's office where the property is located.

Make sure to keep a copy of the recorded deed for your records. Failure to record the deed may result in it being invalidated.

Can I change or revoke a Transfer-on-Death Deed after it has been created?

Yes, you can change or revoke a Transfer-on-Death Deed at any time before your death. To do this, you must execute a new deed that explicitly revokes the previous one or simply create a new TODD that updates the beneficiaries. It’s crucial to record any changes with the county clerk to ensure they are legally recognized.

What happens if the beneficiary predeceases me?

If a beneficiary named in your Transfer-on-Death Deed dies before you do, the property will not automatically pass to that beneficiary's heirs. Instead, it is advisable to designate alternate beneficiaries in the deed. If no alternate is specified, the property will pass according to your will or, if there is no will, according to West Virginia's intestacy laws.

Documents used along the form

When preparing a West Virginia Transfer-on-Death Deed, several other documents may be necessary to ensure a smooth transfer process. Each of these documents serves a specific purpose in clarifying ownership and intent.

- Property Deed: This document establishes the current ownership of the property. It includes details about the property, such as its legal description and the names of the current owners.

- Affidavit of Heirship: This document is used to declare the heirs of a deceased person. It helps to clarify who inherits the property if the original owner passes away.

- Will: A will outlines the wishes of a person regarding the distribution of their assets after death. It may impact how the Transfer-on-Death Deed is executed if there are conflicting instructions.

- Affidavit of Service Form: To ensure the proper delivery of legal documents, you can refer to the detailed Affidavit of Service form guidelines for accurate submission and compliance.

- Change of Beneficiary Form: If the owner wishes to update the designated beneficiary on the Transfer-on-Death Deed, this form is necessary. It ensures that the correct individual receives the property upon the owner's death.

- Title Insurance Policy: This document protects the new owner from any claims against the property. It ensures that the title is clear and that there are no undisclosed issues that could affect ownership.

- Notice of Transfer-on-Death Deed: This document is filed with the county clerk's office to formally record the Transfer-on-Death Deed. It serves as public notice of the intended transfer of property upon the owner's death.

Each of these documents plays a crucial role in the property transfer process. Ensuring that all necessary paperwork is in order can help prevent complications and provide peace of mind for all parties involved.

Dos and Don'ts

When completing the West Virginia Transfer-on-Death Deed form, it is essential to follow certain guidelines to ensure accuracy and compliance. Below is a list of dos and don'ts to consider during this process.

- Do provide accurate information about the property, including its legal description.

- Do include the names and addresses of all parties involved, especially the beneficiaries.

- Do sign the form in the presence of a notary public to validate the document.

- Do keep a copy of the completed deed for your records after filing.

- Don't leave any sections blank; incomplete forms may be rejected.

- Don't use ambiguous language that could lead to confusion about the intent.

- Don't forget to check local filing requirements, as they may vary.

- Don't neglect to inform the beneficiaries about the deed and its implications.