Blank Tax POA wv-2848 PDF Template

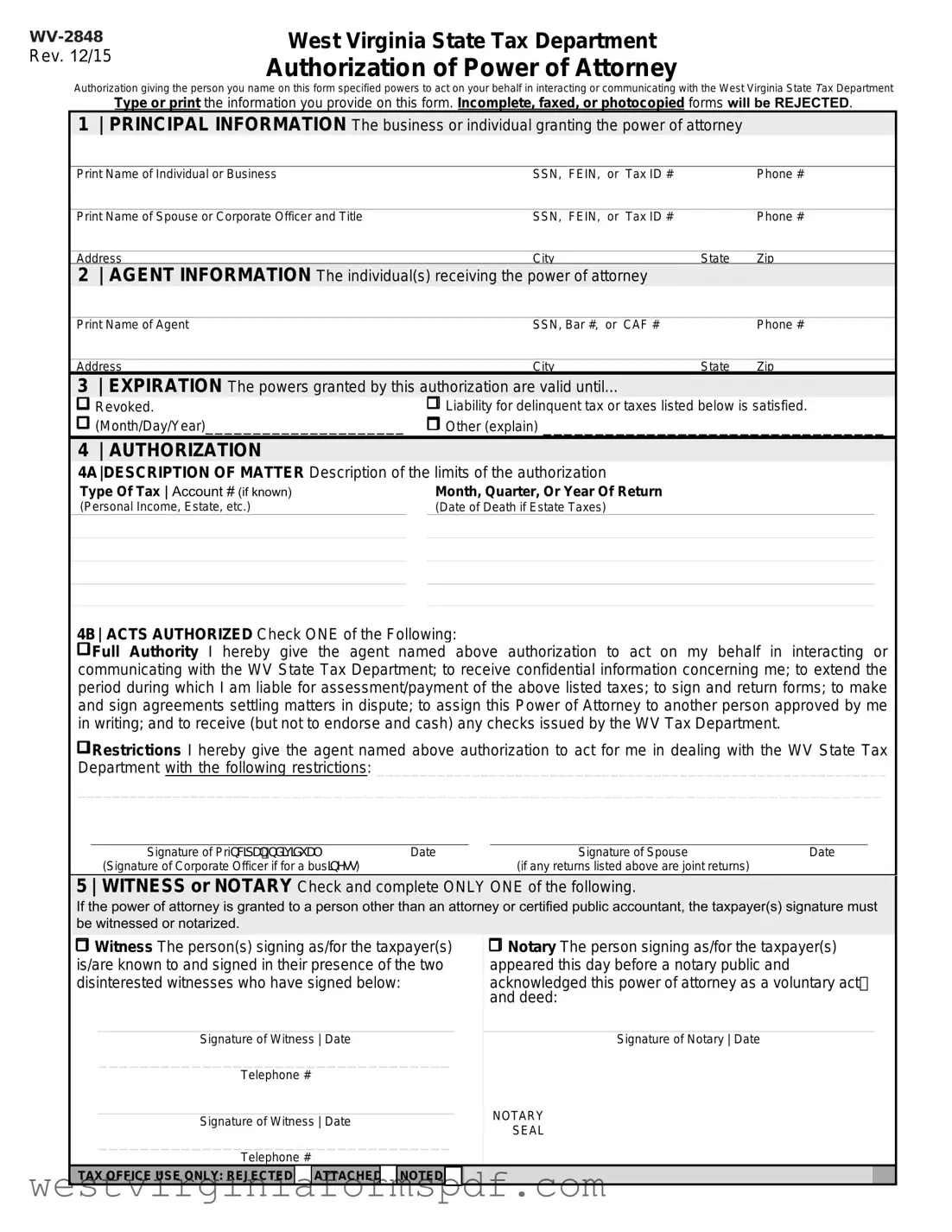

The Tax POA WV-2848 form is an essential document for individuals and businesses in West Virginia who need to authorize someone else to represent them before the West Virginia State Tax Department. This form allows taxpayers to designate a specific individual, such as a tax professional or attorney, to handle their tax matters, ensuring that their interests are effectively communicated and managed. By completing the WV-2848, taxpayers grant their representatives the authority to receive confidential information, make inquiries, and take necessary actions on their behalf. The form requires basic information about both the taxpayer and the representative, including names, addresses, and taxpayer identification numbers. Additionally, it outlines the specific tax matters and tax years for which the authorization is granted, providing clarity on the scope of representation. Understanding the nuances of the WV-2848 is crucial for anyone looking to navigate the complexities of tax representation in West Virginia, as it streamlines communication with tax authorities and helps ensure compliance with state tax laws.

Browse More Forms

West Virginia Tax Forms - Refunds from previous filings need to be precisely reported to avoid discrepancies.

Provider Credentialing Checklist - The office practice information section allows for multiple office sites to be documented if needed.

For those seeking to understand the procedural aspects involved, the detailed California Affidavit of Service form guidelines can provide essential insights into how to properly document the delivery of legal papers.

How Long Does It Take to Get a Liquor License in Wv - All forms should be filled out carefully to prevent miscommunication during processing.

Form Attributes

| Fact Name | Description |

|---|---|

| Form Title | The form is officially known as the Tax Power of Attorney (POA) WV-2848. |

| Purpose | This form allows individuals to authorize another person to represent them before the West Virginia State Tax Department. |

| Governing Law | The use of this form is governed by West Virginia Code §11-10-5a. |

| Eligibility | Any taxpayer in West Virginia can use this form to appoint a representative. |

| Required Information | Taxpayers must provide their name, address, and Social Security number or tax identification number. |

| Representative Details | The form requires the representative's name, address, and phone number. |

| Revocation | Submitting a new WV-2848 form automatically revokes any previous authorizations. |

| Submission Method | The completed form can be submitted by mail or fax to the West Virginia State Tax Department. |

| Duration | The authorization remains in effect until revoked or the taxpayer's death. |

Similar forms

The IRS Form 2848, also known as the Power of Attorney and Declaration of Representative, allows individuals to authorize someone else to act on their behalf in tax matters. Similar to this form is the IRS Form 8821, which is the Tax Information Authorization. While Form 2848 grants the representative the authority to represent the taxpayer before the IRS, Form 8821 only allows the designated individual to receive and inspect the taxpayer's confidential information. This distinction is crucial for those who want to limit the powers of their representative strictly to information access without granting them the authority to act on their behalf.

Another document that resembles the Tax POA WV-2848 is the Durable Power of Attorney (DPOA). A DPOA allows an individual to designate someone to make decisions on their behalf, not just for tax matters but for a wide range of financial and legal issues. The key difference lies in the scope of authority. While the WV-2848 is specifically tailored for tax-related matters, a DPOA can cover various situations, including health care decisions, making it a broader tool for personal representation.

When dealing with package deliveries, understanding the importance of forms similar to the FedEx Release Form can be beneficial, especially for those who frequently receive shipments. This form, which allows FedEx to leave packages in designated locations, can prevent missed deliveries. For those looking to streamline their shipping experience further, resources available at smarttemplates.net provide useful templates and guidelines.

The Medical Power of Attorney is another similar document. This form empowers a designated individual to make health care decisions on behalf of someone else if they are unable to do so. Although it pertains to medical decisions rather than tax issues, the underlying principle of granting authority to another person is the same. It emphasizes the importance of having trusted individuals represent one's interests in specific areas of life.

Additionally, the Limited Power of Attorney is worth mentioning. This document allows a person to grant specific powers to another individual for a limited time or for a specific task. Unlike the broader powers granted by the WV-2848, a Limited Power of Attorney can be tailored to particular transactions, such as selling a property or managing a bank account. This targeted approach can be beneficial for those who want to maintain control while still delegating certain responsibilities.

The General Power of Attorney is another document that shares similarities with the WV-2848. This form grants broad powers to a representative to act on behalf of the principal in a variety of matters, including financial, legal, and tax issues. However, it is important to note that a General Power of Attorney can become invalid if the principal becomes incapacitated, whereas the WV-2848 remains effective as long as the taxpayer is alive and has not revoked it.

Moreover, the Corporate Resolution can be likened to the WV-2848 in the context of business entities. This document is used by corporations to authorize specific individuals to act on behalf of the company in various matters, including tax-related issues. While the WV-2848 is for individuals, a Corporate Resolution serves a similar purpose in a business setting, ensuring that the right people have the authority to handle tax matters on behalf of the corporation.

Lastly, the Consent to Release Information form is another document that shares a purpose with the WV-2848. This form allows taxpayers to authorize the IRS to disclose their tax information to a third party. While it does not provide the same level of authority as the WV-2848, it facilitates communication between the IRS and the designated individual. This can be especially useful for those who want to keep their representatives informed without granting them full power of attorney.

FAQ

What is the Tax POA WV-2848 form?

The Tax POA WV-2848 form is a Power of Attorney document specifically designed for tax matters in the state of West Virginia. This form allows an individual, known as the principal, to authorize another person, referred to as the agent, to represent them before the West Virginia State Tax Department. The agent can handle various tax-related issues on behalf of the principal, including filing returns, discussing tax liabilities, and responding to inquiries from the tax department.

Who can be appointed as an agent using the WV-2848 form?

Any person can be appointed as an agent, provided they are over the age of 18 and capable of understanding the responsibilities involved. This could include:

- Family members

- Friends

- Tax professionals, such as accountants or attorneys

It is essential that the agent is trustworthy and knowledgeable about tax matters, as they will have access to sensitive financial information and the authority to make decisions on behalf of the principal.

How do I complete and submit the WV-2848 form?

Completing the WV-2848 form involves several steps:

- Provide your personal information, including your name, address, and Social Security number.

- Fill in the details of the agent you are appointing, including their name and contact information.

- Specify the tax matters for which the agent is authorized to act on your behalf.

- Sign and date the form to validate your request.

Once completed, you should submit the form to the West Virginia State Tax Department. It is advisable to keep a copy for your records and consider sending the form via a method that provides delivery confirmation.

Is there a time limit for the WV-2848 form?

The WV-2848 form does not have a specific expiration date. However, it is important to note that the authority granted to the agent remains in effect until the principal revokes it or the principal passes away. If changes occur, such as a change in the agent’s information or the principal’s wishes, a new form should be submitted to ensure that the tax department has the most current information.

Documents used along the form

The Tax Power of Attorney (POA) WV-2848 form is a crucial document that allows individuals to designate someone to represent them before the West Virginia State Tax Department. Alongside this form, several other documents may be required or beneficial for a comprehensive tax representation. Below is a list of commonly used forms and documents that often accompany the WV-2848.

- WV-40: West Virginia Personal Income Tax Return - This form is used to report personal income earned in West Virginia and calculate the amount of tax owed or the refund due.

- WV-IT-140: West Virginia Individual Income Tax Return - A more detailed version of the WV-40, this form is for individuals with more complex tax situations.

- WV-PT-100: West Virginia Property Tax Exemption Application - This application is used to request exemptions on property taxes for qualifying individuals, such as seniors or disabled veterans.

- WV-1: Employee's Withholding Exemption Certificate - Employees use this form to claim exemptions from withholding for state income tax purposes.

- IRS W-9 Form: This document is essential for confirming a person’s taxpayer identification number (TIN) and is often used in conjunction with other forms. For more details on how to fill it out, visit TopTemplates.info.

- Form 4868: Application for Automatic Extension of Time to File - This federal form allows taxpayers to request an extension for filing their federal income tax returns.

- Form 1040: U.S. Individual Income Tax Return - The primary federal form used by individuals to report their income and calculate taxes owed to the IRS.

- Form W-2: Wage and Tax Statement - Employers provide this form to employees, detailing wages earned and taxes withheld during the year.

- Form 1099: Miscellaneous Income - This form is issued to report various types of income other than wages, salaries, and tips, such as freelance earnings.

- Form 8821: Tax Information Authorization - This form allows taxpayers to authorize someone to receive their confidential tax information without granting them full power of attorney.

- Form 2848: Power of Attorney and Declaration of Representative - A federal form similar to the WV-2848, used to designate a representative for federal tax matters.

When navigating tax matters, having the appropriate forms and documents at hand can simplify the process. Each of these forms serves a unique purpose and may be necessary depending on individual circumstances. Ensuring you have the right documentation can help facilitate smoother communication and representation with tax authorities.

Dos and Don'ts

When filling out the Tax POA WV-2848 form, it is important to follow specific guidelines to ensure accuracy and compliance. Here are some do's and don'ts to consider:

- Do: Read the instructions carefully before starting the form.

- Do: Provide accurate information, including your full name, address, and taxpayer identification number.

- Do: Sign and date the form to validate it.

- Do: Keep a copy of the completed form for your records.

- Don't: Leave any required fields blank; this may delay processing.

- Don't: Use outdated versions of the form; always download the latest version.

- Don't: Forget to specify the tax matters you are authorizing representation for.

- Don't: Submit the form without verifying all information for accuracy.