Valid Small Estate Affidavit Template for West Virginia State

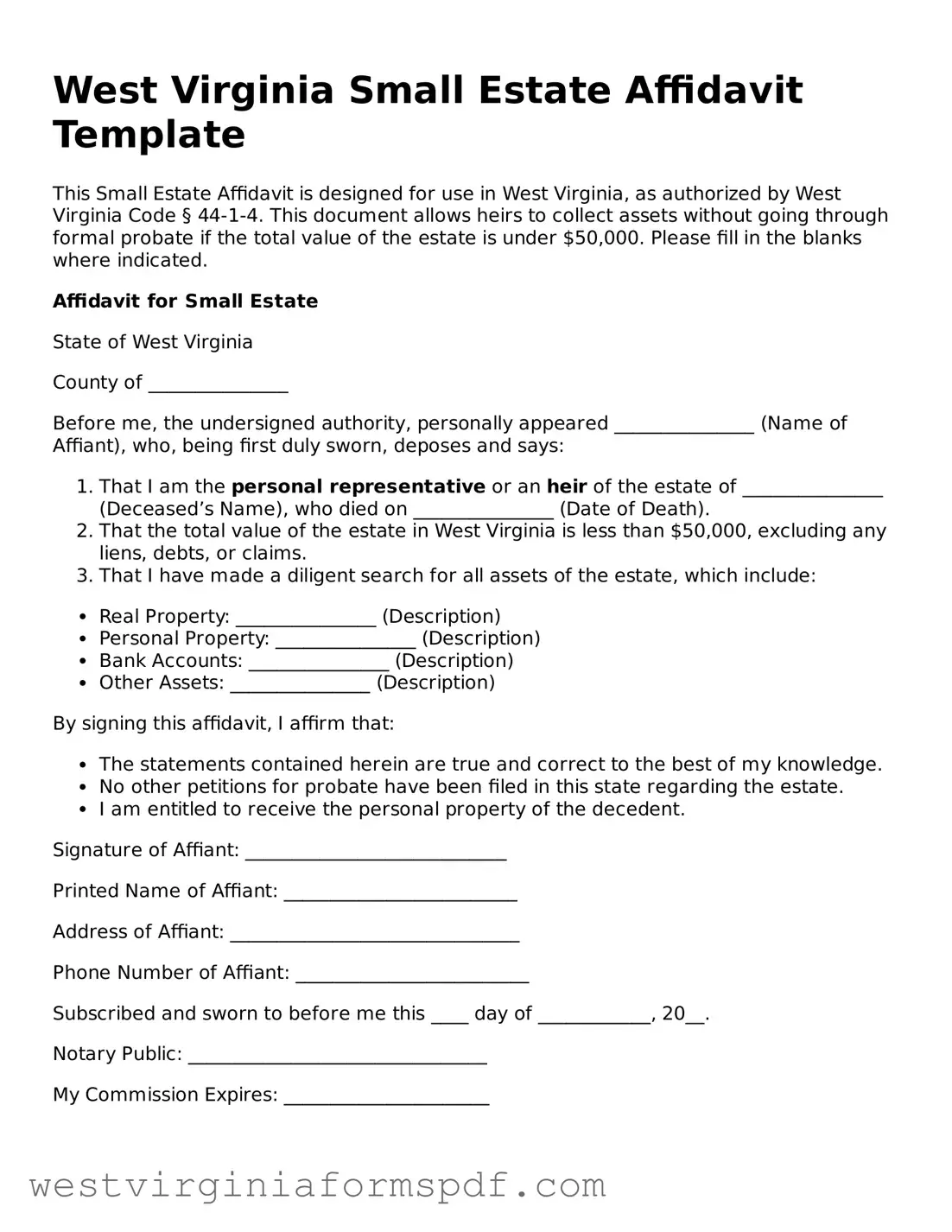

The West Virginia Small Estate Affidavit form serves as a crucial tool for individuals dealing with the estate of a deceased person when the total value of the estate falls below a certain threshold. This form simplifies the probate process, allowing heirs or beneficiaries to claim assets without the need for a formal probate proceeding. In West Virginia, the Small Estate Affidavit can be utilized when the value of the estate does not exceed $50,000, excluding any liens or encumbrances. To use this form, the affiant must be an heir, a beneficiary, or a person entitled to the estate's assets. The affidavit requires specific information, including the decedent's details, a list of assets, and the names of all heirs. By completing this form, individuals can facilitate the transfer of property and assets efficiently, ensuring that the decedent's wishes are honored while minimizing delays and costs associated with the probate process.

Consider Other Common Templates for West Virginia

How to Get a Power of Attorney in Virginia - Think of the Durable Power of Attorney as a safety net for your financial well-being.

The Employment Application PDF form not only allows candidates to highlight their qualifications but also provides a reliable platform for employers to assess potential hires fairly. By using this standardized form, applicants can present their skills and experiences systematically, which streamlines the hiring process. For those interested in creating or utilizing an effective application, resources like https://toptemplates.info/ can be immensely helpful.

Mpoa Meaning - This power does not extend to making medical decisions unless explicitly stated.

File Attributes

| Fact Name | Description |

|---|---|

| Purpose | The West Virginia Small Estate Affidavit allows individuals to settle small estates without the need for formal probate proceedings. |

| Eligibility | This affidavit can be used when the total value of the estate is $50,000 or less, excluding certain assets. |

| Governing Law | The use of the Small Estate Affidavit is governed by West Virginia Code § 44-1-1 through § 44-1-4. |

| Required Information | The affidavit must include details such as the decedent's name, date of death, and a list of assets and liabilities. |

| Filing Process | The completed affidavit must be filed with the appropriate county clerk's office to initiate the transfer of assets. |

| Signature Requirement | The affidavit must be signed by the affiant, who is typically an heir or beneficiary of the estate. |

Similar forms

The West Virginia Small Estate Affidavit is akin to the Affidavit of Heirship, which is often utilized in estate planning. This document allows heirs to assert their rights to inherit property when a decedent has passed away without a will. Similar to the Small Estate Affidavit, it simplifies the transfer of assets and can expedite the process of establishing ownership without the need for formal probate proceedings. Both documents serve to streamline the distribution of assets, ensuring that heirs can access their inheritance with minimal delay.

Another document that shares similarities is the Small Estate Affidavit used in other states, such as Texas. While each state has its specific requirements, the underlying purpose remains the same: to allow heirs to claim assets without going through the full probate process. The Texas version, for instance, requires a sworn statement detailing the value of the estate and the relationships of the heirs, much like West Virginia’s form, which also requires a declaration of asset values and heirship.

The Declaration of Trust is another document that bears resemblance to the Small Estate Affidavit. This document is often used to manage and distribute assets held in a trust upon the death of the grantor. Like the Small Estate Affidavit, it facilitates the transfer of property without the need for probate, allowing for a smoother transition of assets to beneficiaries. Both documents aim to reduce the administrative burden on heirs and ensure that the decedent’s wishes are honored.

The Last Will and Testament also parallels the Small Estate Affidavit in its role within estate planning. While a will typically requires probate, it outlines the distribution of assets and appoints an executor to manage the estate. The Small Estate Affidavit, on the other hand, is a more streamlined approach for smaller estates, allowing for quicker access to assets without the formalities of probate. Both documents are essential for ensuring that a decedent's wishes are respected and that heirs receive their rightful inheritance.

When considering the implications of estate management, it's essential to recognize the potential risks involved in these processes. For those looking to safeguard their interests while navigating estate claims, understanding documents like the California Release of Liability form is critical. This form can help protect parties involved by waiving certain rights and acknowledging the inherent risks associated with estate proceedings. More information can be found at https://smarttemplates.net/fillable-california-release-of-liability/.

Power of Attorney documents, particularly those that include provisions for estate management, share common ground with the Small Estate Affidavit. A Power of Attorney allows an individual to make financial decisions on behalf of another, which can include handling estate matters. While the Small Estate Affidavit is used post-death to claim assets, both documents facilitate the management of an estate and can ease the burden on heirs during a difficult time.

The Affidavit of Debt is another related document, particularly in situations where a decedent has outstanding debts. This affidavit allows heirs to claim assets while acknowledging the debts owed by the estate. Similar to the Small Estate Affidavit, it requires a sworn statement and can help in settling the estate efficiently, ensuring that creditors are paid while allowing heirs to receive their inheritance without unnecessary delays.

In some cases, the Probate Waiver can be likened to the Small Estate Affidavit. This document is used by heirs to waive the formal probate process, allowing for a more informal transfer of assets. While it may not be as widely recognized as the Small Estate Affidavit, it serves a similar purpose in simplifying the distribution of an estate, especially when all heirs agree on how to handle the decedent’s assets.

The Transfer on Death Deed (TOD) is another document that can be compared to the Small Estate Affidavit. A TOD allows property owners to designate beneficiaries who will automatically inherit real estate upon the owner's death. This method bypasses probate entirely, similar to how the Small Estate Affidavit allows for a straightforward transfer of assets. Both documents serve to expedite the process of asset distribution and reduce the complexities associated with probate.

Lastly, the Certificate of Trust is a document that can also be seen as similar to the Small Estate Affidavit. It serves as proof of the existence of a trust and outlines its terms. When a trust is involved, this certificate can help beneficiaries access trust assets without going through probate, much like the Small Estate Affidavit helps heirs claim assets from a small estate. Both documents aim to simplify the transfer of assets and provide clarity regarding the distribution process.

FAQ

What is the West Virginia Small Estate Affidavit form?

The West Virginia Small Estate Affidavit form is a legal document that allows individuals to settle the estate of a deceased person without going through the formal probate process. This form is specifically designed for estates that meet certain criteria, typically involving a total value of assets that does not exceed $50,000. By using this affidavit, heirs or beneficiaries can claim the deceased's assets more efficiently and with less expense.

Who is eligible to use the Small Estate Affidavit?

Eligibility for the Small Estate Affidavit is generally limited to individuals who are either heirs or beneficiaries of the deceased. To qualify, the following conditions must be met:

- The total value of the deceased's estate must be $50,000 or less.

- The deceased must have been a resident of West Virginia at the time of their death.

- No other probate proceedings should be pending for the estate.

If these conditions are satisfied, individuals can use the Small Estate Affidavit to access and distribute the deceased's assets without the need for a lengthy probate process.

How do I complete the Small Estate Affidavit form?

Completing the Small Estate Affidavit involves several steps:

- Gather necessary information about the deceased, including their full name, date of death, and details of their assets.

- Obtain the Small Estate Affidavit form, which can be found online or at local courthouse offices.

- Fill out the form accurately, providing all required information and signatures from eligible heirs or beneficiaries.

- File the completed affidavit with the appropriate county clerk's office.

Once filed, the affidavit serves as a legal declaration that allows the heirs to claim the deceased's assets without further legal proceedings.

What happens after I file the Small Estate Affidavit?

After filing the Small Estate Affidavit, the county clerk will review the document to ensure it meets all legal requirements. If approved, the affidavit becomes a legal instrument that allows heirs to access the deceased's assets. Heirs can then present the affidavit to banks, financial institutions, or other entities holding the deceased's assets to facilitate the transfer. It is important to keep a copy of the filed affidavit for your records, as you may need to provide it during the asset distribution process.

Documents used along the form

When dealing with the West Virginia Small Estate Affidavit, several other documents may be necessary to ensure a smooth process. These forms help clarify ownership, establish rights, and facilitate the transfer of assets. Below is a list of commonly used documents that accompany the Small Estate Affidavit.

- Death Certificate: This document serves as official proof of the decedent's passing and is typically required to initiate the estate settlement process.

- Will: If the deceased left a will, it may need to be submitted to establish the decedent's wishes regarding asset distribution.

- List of Assets: A detailed inventory of the decedent's assets, including property, bank accounts, and personal belongings, helps clarify what is subject to the Small Estate Affidavit.

- Affidavit of Heirship: This document confirms the identity of the heirs and their relationship to the decedent, which can be crucial in the absence of a will.

- Tax Returns: Copies of the decedent's recent tax returns may be necessary to address any outstanding tax obligations or to confirm income sources.

- ATV Bill of Sale: This form officially records the sale and transfer of an all-terrain vehicle in California, ensuring a recognized ownership change. For more details, visit All California Forms.

- Bank Account Statements: These statements help identify the decedent's financial holdings and may be required to access funds during the estate settlement process.

- Property Deeds: If real estate is involved, providing the property deeds can facilitate the transfer of ownership to the rightful heirs.

Having these documents prepared and organized can significantly streamline the process of settling a small estate in West Virginia. Each form plays a vital role in ensuring that the estate is handled in accordance with the law and the wishes of the deceased.

Dos and Don'ts

When filling out the West Virginia Small Estate Affidavit form, it is important to follow certain guidelines to ensure accuracy and compliance. Here are seven things you should and shouldn't do:

- Do read the entire form carefully before starting.

- Do gather all necessary documents, such as the deceased's will and financial statements.

- Do provide accurate information about the deceased and their assets.

- Do sign the affidavit in front of a notary public.

- Don't leave any sections of the form blank; fill in all required fields.

- Don't submit the form without checking for errors or omissions.

- Don't forget to include any relevant heirs or beneficiaries in the affidavit.