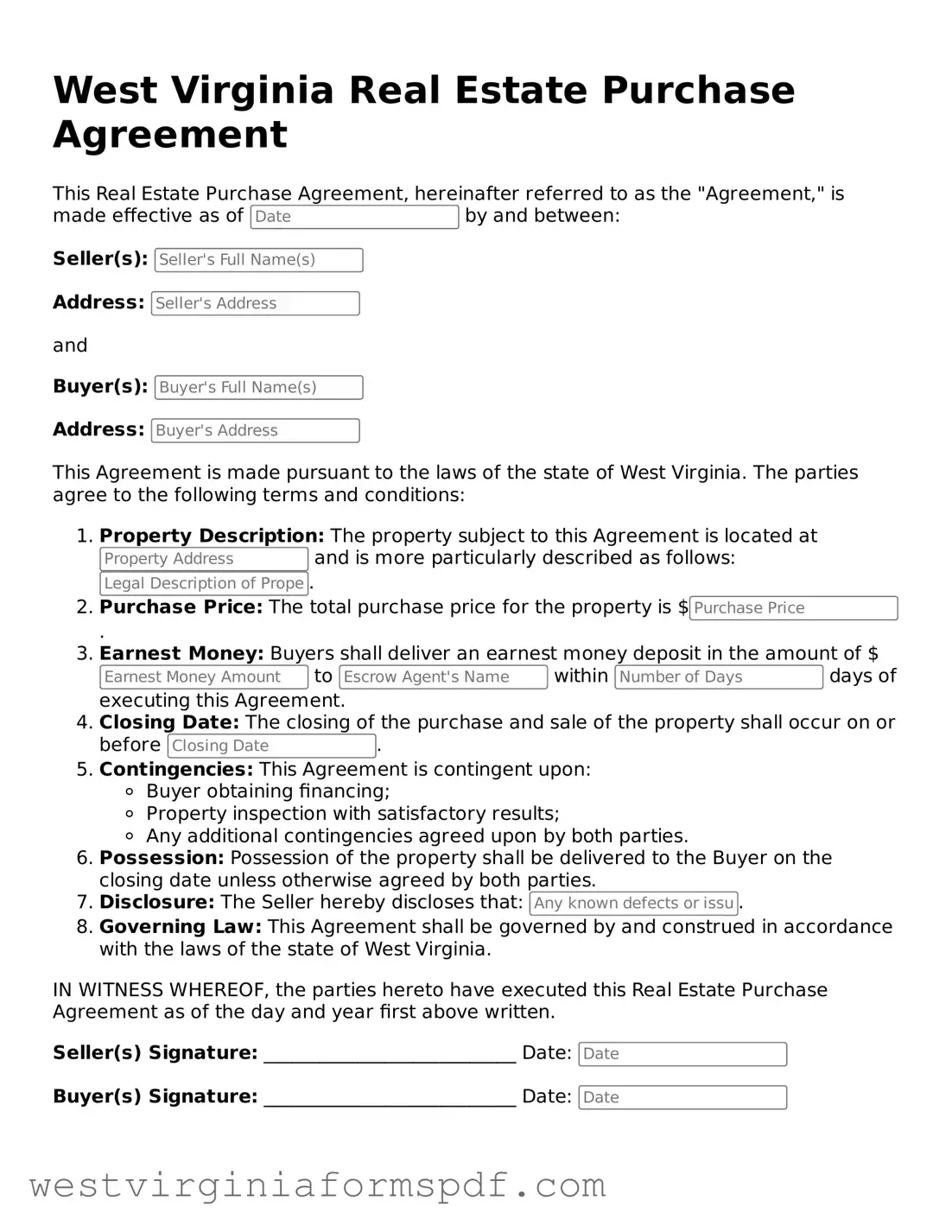

Valid Real Estate Purchase Agreement Template for West Virginia State

When buying or selling property in West Virginia, understanding the Real Estate Purchase Agreement form is essential. This document serves as a binding contract that outlines the terms and conditions of the sale. It typically includes crucial details such as the purchase price, property description, and the closing date. Additionally, the form addresses contingencies that may affect the transaction, like financing and inspections. Both parties must agree on these terms to ensure a smooth process. By clearly defining the responsibilities of the buyer and seller, this agreement helps prevent misunderstandings and disputes. Whether you’re a first-time homebuyer or a seasoned investor, knowing how to navigate this form can significantly impact your real estate experience in West Virginia.

Consider Other Common Templates for West Virginia

Wv Dmv Title Transfer - Often, the form will include a clause about the seller's disclosure of defects.

By utilizing the Free And Invoice Pdf form, users can streamline their invoicing system, making it an essential tool for efficient financial management. For those looking to explore more resources and templates, TopTemplates.info offers a variety of options to enhance your billing procedures.

Will West Virginia - Offers direction to those left behind during a challenging time.

Wv Dmv Title Lookup - Buyers can protect themselves by documenting the current condition of the boat on the form.

File Attributes

| Fact Name | Description |

|---|---|

| Governing Law | The West Virginia Real Estate Purchase Agreement is governed by the laws of West Virginia. |

| Purpose | This form is used to outline the terms and conditions of a real estate transaction between a buyer and a seller. |

| Parties Involved | The agreement identifies the buyer and seller, specifying their legal names and contact information. |

| Property Description | A detailed description of the property being sold, including the address and any relevant parcel numbers, is included. |

| Purchase Price | The total purchase price of the property must be clearly stated in the agreement. |

| Earnest Money | The agreement typically requires an earnest money deposit, which shows the buyer's commitment to the purchase. |

| Contingencies | Buyers may include contingencies, such as financing or inspection requirements, to protect their interests. |

| Closing Date | A proposed closing date is included, which indicates when the ownership will officially transfer from the seller to the buyer. |

| Signatures | Both parties must sign the agreement to make it legally binding, indicating their acceptance of the terms. |

Similar forms

The West Virginia Real Estate Purchase Agreement form is similar to the Residential Purchase Agreement, commonly used across many states. Both documents outline the terms of a real estate transaction, including the purchase price, closing date, and contingencies. They serve as a binding contract between the buyer and seller, ensuring both parties are clear on their obligations. This document typically includes provisions for inspections and financing, mirroring the structure and purpose of the West Virginia form.

Another comparable document is the Commercial Purchase Agreement. This form is tailored for commercial properties and shares many elements with the West Virginia Real Estate Purchase Agreement. Both documents include essential details like the property description, purchase price, and closing conditions. However, the Commercial Purchase Agreement often contains additional clauses related to zoning, tenant leases, and business operations, reflecting the complexities of commercial transactions.

The Lease Purchase Agreement also bears similarities to the West Virginia Real Estate Purchase Agreement. This document allows a tenant to lease a property with the option to buy it later. Like the purchase agreement, it outlines terms such as the purchase price and timeline. However, it also includes rental terms and conditions, making it a hybrid of leasing and buying, which can appeal to those who may not be ready to purchase outright.

The EDD DE 2501 form, known as the Claim for Disability Insurance (DI) Benefits, is an essential tool for workers who need to maintain their income during times of disability. This document is critical for starting a claim that enables eligible employees to receive temporary financial assistance while they are unable to perform their work duties. For those who need more information, resources such as OnlineLawDocs.com can provide valuable guidance on understanding the form and the submission process.

The Option to Purchase Agreement is another document that shares characteristics with the West Virginia form. This agreement gives a buyer the right, but not the obligation, to purchase a property within a specified timeframe. While it serves a different purpose, it includes similar elements such as the purchase price and conditions under which the option can be exercised, providing flexibility for the buyer.

The Seller Financing Agreement is also relevant. This document allows the seller to finance the purchase for the buyer, rather than using a traditional mortgage. Like the West Virginia Real Estate Purchase Agreement, it details the purchase price and payment terms. However, it also includes specifics about interest rates and payment schedules, making it a crucial tool for buyers who may struggle to secure conventional financing.

The Real Estate Listing Agreement is another document that resembles the West Virginia Real Estate Purchase Agreement. While this agreement is typically between a seller and a real estate agent, it outlines the terms under which the property will be marketed and sold. Both documents emphasize the importance of clear terms and conditions, although the listing agreement focuses more on the agent’s responsibilities and commission structure.

The Purchase and Sale Agreement is widely used and shares many elements with the West Virginia form. This document serves as a comprehensive contract detailing the sale of real estate. It includes terms such as the purchase price, contingencies, and closing details, similar to the West Virginia Real Estate Purchase Agreement. However, it may also cover additional aspects like title insurance and property disclosures.

The Joint Venture Agreement can also be compared to the West Virginia Real Estate Purchase Agreement. In real estate, this document is used when two or more parties collaborate to purchase a property. It outlines each party's responsibilities and contributions, similar to how the purchase agreement specifies the obligations of the buyer and seller. Both documents emphasize clarity in terms to avoid misunderstandings.

The Real Estate Development Agreement is another relevant document. This agreement is often used when a buyer plans to develop property after purchase. It includes terms related to the purchase as well as development timelines and responsibilities. Like the West Virginia Real Estate Purchase Agreement, it requires clear terms to protect all parties involved, but it also incorporates additional details about zoning and construction.

Finally, the Land Contract is similar to the West Virginia Real Estate Purchase Agreement in that it allows a buyer to purchase property over time. It outlines the purchase price and payment terms, similar to a mortgage but without involving a bank. Both documents serve to protect the interests of both parties, ensuring that the buyer can acquire the property while the seller retains certain rights until the purchase is completed.

FAQ

What is a West Virginia Real Estate Purchase Agreement?

A West Virginia Real Estate Purchase Agreement is a legally binding document that outlines the terms and conditions under which a property is sold. This agreement serves as a roadmap for both the buyer and seller, detailing aspects such as the sale price, property description, and closing date. It protects the interests of both parties and ensures that everyone is on the same page throughout the transaction.

Who needs to use this agreement?

Both buyers and sellers involved in a real estate transaction in West Virginia should utilize this agreement. It is crucial for anyone looking to purchase or sell residential or commercial property. By using this form, parties can clarify their intentions and establish a formal contract that can be enforced in court if necessary.

What are the key components of the agreement?

The West Virginia Real Estate Purchase Agreement typically includes the following key components:

- Property Description: A detailed description of the property being sold.

- Purchase Price: The agreed-upon price for the property.

- Earnest Money Deposit: A deposit made by the buyer to demonstrate their commitment to the purchase.

- Contingencies: Conditions that must be met for the sale to proceed, such as financing or inspections.

- Closing Date: The date when the property will officially change hands.

Are there any contingencies I should consider?

Yes, contingencies are an essential part of the agreement. Common contingencies include:

- Financing contingency: This allows the buyer to back out if they cannot secure a mortgage.

- Inspection contingency: This provides the buyer with the opportunity to conduct a home inspection and negotiate repairs.

- Appraisal contingency: This ensures that the property appraises for at least the purchase price.

Including contingencies can protect you from unexpected issues that may arise during the transaction.

How do I fill out the agreement?

Filling out the agreement requires careful attention to detail. Here are some steps to follow:

- Begin with the date and names of both the buyer and seller.

- Provide a clear description of the property, including the address and any relevant legal descriptions.

- Specify the purchase price and any deposit amounts.

- Outline any contingencies and conditions that must be met.

- Include the closing date and any other relevant terms.

Consider consulting a real estate professional or attorney to ensure accuracy and completeness.

What happens if one party breaches the agreement?

If one party fails to uphold their end of the agreement, it is considered a breach. The non-breaching party may have several options, including:

- Seeking damages: This involves pursuing compensation for any losses incurred.

- Enforcing the contract: The non-breaching party may choose to go to court to compel the other party to fulfill their obligations.

- Negotiating a settlement: Sometimes, parties can reach a mutual agreement to resolve the issue outside of court.

Understanding your rights and options in the event of a breach is crucial for protecting your investment.

Can I make changes to the agreement after it’s signed?

Yes, changes can be made to the agreement after it’s signed, but both parties must agree to the modifications. It’s essential to document any changes in writing and have both parties sign the updated agreement. This ensures that there is a clear record of the new terms and protects both parties’ interests.

Is it necessary to have a lawyer review the agreement?

While it is not legally required to have a lawyer review the agreement, it is highly advisable. A legal professional can help identify potential issues, clarify terms, and ensure that the agreement complies with state laws. Their expertise can provide peace of mind and help prevent costly mistakes down the line.

Where can I obtain a West Virginia Real Estate Purchase Agreement form?

You can obtain a West Virginia Real Estate Purchase Agreement form from various sources, including:

- Real estate agencies: Many agencies provide standardized forms for their clients.

- Online legal services: Websites specializing in real estate documents often offer downloadable forms.

- Local government offices: Some counties may provide forms for public use.

Always ensure you are using the most current version of the form to comply with state regulations.

Documents used along the form

When engaging in real estate transactions in West Virginia, several forms and documents are typically used alongside the Real Estate Purchase Agreement. Each document serves a specific purpose in ensuring a smooth process and protecting the interests of all parties involved. Below is a list of common forms that may accompany the purchase agreement.

- Property Disclosure Statement: This document provides buyers with important information about the condition of the property. Sellers must disclose any known issues, such as structural problems or past pest infestations.

- Power of Attorney for a Child Form: When preparing for temporary guardianship, utilize our practical Power of Attorney for a Child documentation to ensure responsible decision-making in the child's best interest.

- Lead-Based Paint Disclosure: Required for homes built before 1978, this form informs buyers about potential lead hazards. Sellers must provide this disclosure to ensure buyers are aware of the risks associated with lead paint.

- Financing Addendum: This document outlines the terms of any financing involved in the purchase. It details the loan type, amount, and any contingencies related to the buyer securing financing.

- Home Inspection Contingency: This form allows buyers to request a home inspection before finalizing the sale. It protects buyers by giving them the option to negotiate repairs or withdraw from the agreement if significant issues are discovered.

- Title Commitment: This document is issued by a title company and confirms the property's title status. It ensures that there are no liens or claims against the property that could affect ownership.

- Closing Disclosure: Provided to buyers at least three days before closing, this document outlines the final terms of the mortgage, including loan costs and other closing expenses. It helps buyers understand their financial obligations before finalizing the sale.

- Deed: This legal document transfers ownership of the property from the seller to the buyer. It must be signed and recorded with the county to be valid.

Each of these documents plays a crucial role in the real estate transaction process. By understanding their purposes and ensuring they are properly completed, both buyers and sellers can navigate the complexities of real estate transactions with greater confidence.

Dos and Don'ts

When filling out the West Virginia Real Estate Purchase Agreement form, it is crucial to approach the task with care. Here are five essential dos and don'ts to keep in mind:

- Do read the entire agreement thoroughly before filling it out.

- Do provide accurate and complete information about the property and parties involved.

- Do consult with a real estate professional if you have any questions.

- Don't rush through the form; take your time to ensure accuracy.

- Don't leave any sections blank; incomplete forms can lead to delays or issues.