Valid Quitclaim Deed Template for West Virginia State

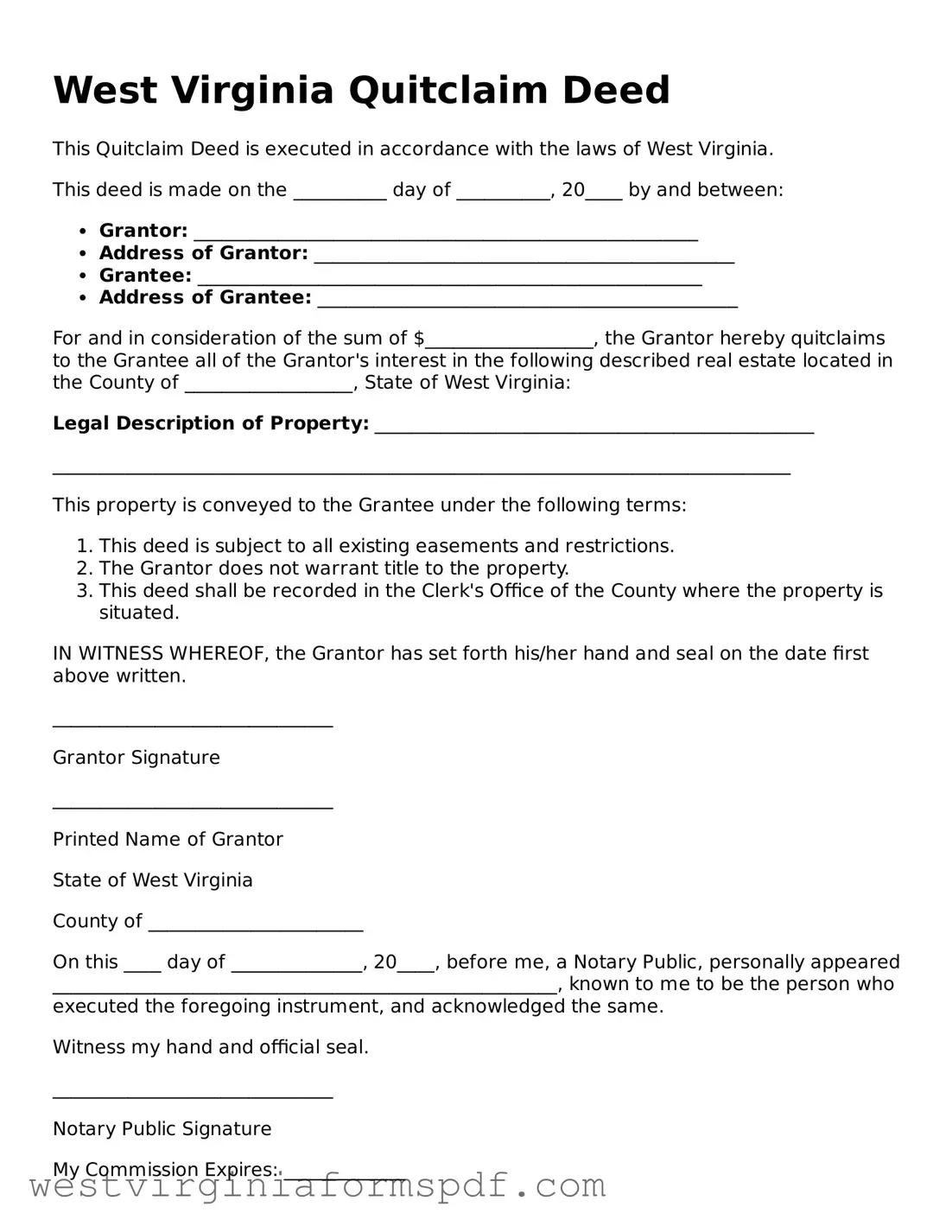

When it comes to transferring property ownership in West Virginia, the Quitclaim Deed form serves as a straightforward and effective tool. This document allows one party, known as the grantor, to convey their interest in a property to another party, the grantee, without making any guarantees about the title's validity. Essentially, it’s a way for individuals to relinquish their claim to a property, whether it’s a family member passing on a home or a business partner divesting their share. Importantly, the Quitclaim Deed does not provide any warranties; therefore, the grantee accepts the property “as-is.” This makes it particularly useful in situations where the parties know each other and trust one another, such as in familial transactions or when resolving disputes. In West Virginia, specific requirements must be met for the deed to be legally binding, including proper identification of the parties involved and a clear description of the property. Additionally, the document must be signed and notarized to ensure its validity. Understanding the Quitclaim Deed form is essential for anyone involved in property transactions, as it can streamline the process and clarify ownership rights without the complexities often associated with other types of deeds.

Consider Other Common Templates for West Virginia

30 Day Notice to Vacate Wv - The tenant must receive the notice in a way that they can understand it.

Will West Virginia - Can include customized clauses specific to your family dynamics.

The Asurion F-017-08 MEN form is essential for policyholders looking to report claims for lost or damaged items insured under specific policies, and you can find the necessary documentation through the Asurion F-017-08 MEN form. This form streamlines the claims process, enabling efficient assessment and resolution, which ultimately makes navigating the claims experience much easier.

West Virginia Non-competition Contract - Parting ways with an employer who has a Non-compete can complicate future job opportunities.

File Attributes

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed transfers ownership interest in a property without guaranteeing that the title is clear. |

| Governing Law | The West Virginia Quitclaim Deed is governed by West Virginia Code § 36-3-1 through § 36-3-4. |

| Parties Involved | The form involves a grantor (seller) and a grantee (buyer). |

| Use Cases | Commonly used among family members or in divorce settlements to transfer property rights. |

| Consideration | While a monetary exchange is not required, a nominal amount is often stated to validate the deed. |

| Recording | To protect the grantee's rights, the deed should be recorded at the county clerk’s office where the property is located. |

| Legal Advice | Consulting a legal professional is recommended to understand the implications of using a quitclaim deed. |

Similar forms

The Warranty Deed is a document that, like the Quitclaim Deed, transfers ownership of real property. However, it provides a guarantee that the grantor holds clear title to the property and has the right to sell it. This assurance protects the grantee from any future claims against the property. Unlike the Quitclaim Deed, which makes no warranties, the Warranty Deed gives the buyer a higher level of security regarding their ownership rights.

The Bargain and Sale Deed serves a similar purpose to the Quitclaim Deed in that it transfers property ownership. However, it implies that the grantor has an interest in the property being sold, even if it does not guarantee a clear title. This type of deed is often used in transactions involving foreclosures or tax sales, where the seller may not have full knowledge of the property’s history.

The Special Warranty Deed is another document that shares similarities with the Quitclaim Deed. It conveys ownership but only guarantees that the grantor has not caused any title issues during their period of ownership. This means that while the grantor does not warrant against any prior claims, they do assure the buyer that they have not created new problems during their tenure.

The Grant Deed is also akin to the Quitclaim Deed in that it transfers property ownership. However, it includes two important warranties: that the property has not been sold to anyone else and that the grantor has not encumbered the property. This provides a bit more security for the grantee compared to the Quitclaim Deed, which offers no such assurances.

The Deed of Trust, while primarily a security instrument, shares a functional similarity with the Quitclaim Deed in that it involves the transfer of interest in property. It is used to secure a loan, with the property serving as collateral. The borrower (trustor) conveys the property to a third party (trustee) until the loan is paid off, at which point the property is returned to the borrower.

The Aaa International Driving Permit Application form is crucial for U.S. residents planning to drive abroad, ensuring they have legal permission to operate a vehicle in various countries. To further understand the application process, you can refer to the International Driving License Application, which provides helpful guidance and resources to streamline your travel preparations.

The Life Estate Deed is another document that resembles the Quitclaim Deed in its transfer of property. However, it grants ownership for the duration of a person's life, after which the property passes to a designated remainderman. This type of deed allows the original owner to retain some control over the property while also facilitating a future transfer of ownership.

The Transfer on Death Deed (TOD) allows an individual to transfer property upon their death without going through probate. While it does not function like a Quitclaim Deed during the owner's lifetime, it does allow for a straightforward transfer of ownership, similar to how a Quitclaim Deed facilitates the transfer of property rights.

Lastly, the Affidavit of Heirship is a document that can be used in conjunction with a Quitclaim Deed. It establishes the heirs of a deceased property owner, facilitating the transfer of property without a will. While the Quitclaim Deed transfers ownership, the Affidavit of Heirship clarifies who is entitled to receive that ownership, making it a useful tool in estate matters.

FAQ

What is a Quitclaim Deed in West Virginia?

A Quitclaim Deed is a legal document used to transfer ownership of real property from one party to another without any warranties or guarantees. In West Virginia, this type of deed is often used among family members or in situations where the parties know each other well. It allows the grantor to relinquish any claim they have to the property, but it does not guarantee that the grantor has clear title to the property. Buyers should conduct due diligence before accepting a Quitclaim Deed.

How do I complete a Quitclaim Deed in West Virginia?

To complete a Quitclaim Deed in West Virginia, follow these steps:

- Obtain the Quitclaim Deed form. You can find templates online or at local legal offices.

- Fill in the names of the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Provide a legal description of the property. This information is typically found on the property’s tax assessment records.

- Sign the document in the presence of a notary public to ensure its validity.

- File the completed Quitclaim Deed with the appropriate county clerk’s office to make the transfer official.

Are there any fees associated with filing a Quitclaim Deed in West Virginia?

Yes, there are fees associated with filing a Quitclaim Deed. The specific amount can vary by county, but typically, the filing fee ranges from $10 to $50. Additionally, some counties may require a transfer tax, which is based on the property’s value. It’s advisable to check with your local county clerk’s office for the most accurate and current fee structure.

Can I revoke a Quitclaim Deed once it has been executed?

Once a Quitclaim Deed has been executed and recorded, it cannot be unilaterally revoked. However, the grantor can create a new deed to transfer the property back or to another party. This process requires the same formalities as the original deed, including notarization and recording. It is important to consult with a real estate professional or attorney for guidance on how to proceed with revoking or altering a Quitclaim Deed.

Documents used along the form

The West Virginia Quitclaim Deed is a useful document for transferring property ownership. However, it is often accompanied by other forms and documents that facilitate the transfer process or address related matters. Below is a list of some common documents that may be used in conjunction with a Quitclaim Deed in West Virginia.

- Property Transfer Tax Form: This form is required to report the transfer of property and calculate any applicable transfer taxes. It ensures compliance with state tax regulations.

- Affidavit of Consideration: This document provides details about the consideration exchanged for the property. It may be necessary for tax purposes and to establish the legitimacy of the transaction.

- Title Search Report: A title search report outlines the history of the property’s ownership. It helps identify any liens, encumbrances, or claims against the property that may affect the transfer.

- Invoice PDF Form: Utilizing a reliable form like the smarttemplates.net is essential for accurately documenting services or goods provided during property transactions.

- Warranty Deed: In contrast to a Quitclaim Deed, a Warranty Deed provides a guarantee that the seller holds clear title to the property. It may be used if the seller wants to offer more protection to the buyer.

- Power of Attorney: This document allows one person to act on behalf of another in legal matters, including property transactions. It may be necessary if the property owner cannot be present during the transfer.

- Settlement Statement: Also known as a Closing Disclosure, this document outlines the financial details of the transaction, including costs and fees associated with the property transfer.

- Notice of Transfer: This document notifies relevant parties, such as local government offices or homeowners' associations, about the change in property ownership. It ensures that records are updated accordingly.

Each of these documents plays a significant role in the property transfer process. Understanding their purpose can help ensure a smooth transaction and protect the interests of all parties involved.

Dos and Don'ts

When filling out the West Virginia Quitclaim Deed form, it’s important to follow certain guidelines to ensure the process goes smoothly. Here’s a list of things you should and shouldn’t do.

- Do ensure all names are spelled correctly.

- Do provide accurate property descriptions.

- Do include the date of the transfer.

- Do sign the form in the presence of a notary public.

- Do check for any local filing requirements.

- Don’t leave any blank spaces on the form.

- Don’t use white-out to correct mistakes.

- Don’t forget to include any necessary attachments.

- Don’t submit the form without verifying all information.

Following these guidelines will help avoid complications during the transfer of property. Take your time and review everything carefully.