Valid Promissory Note Template for West Virginia State

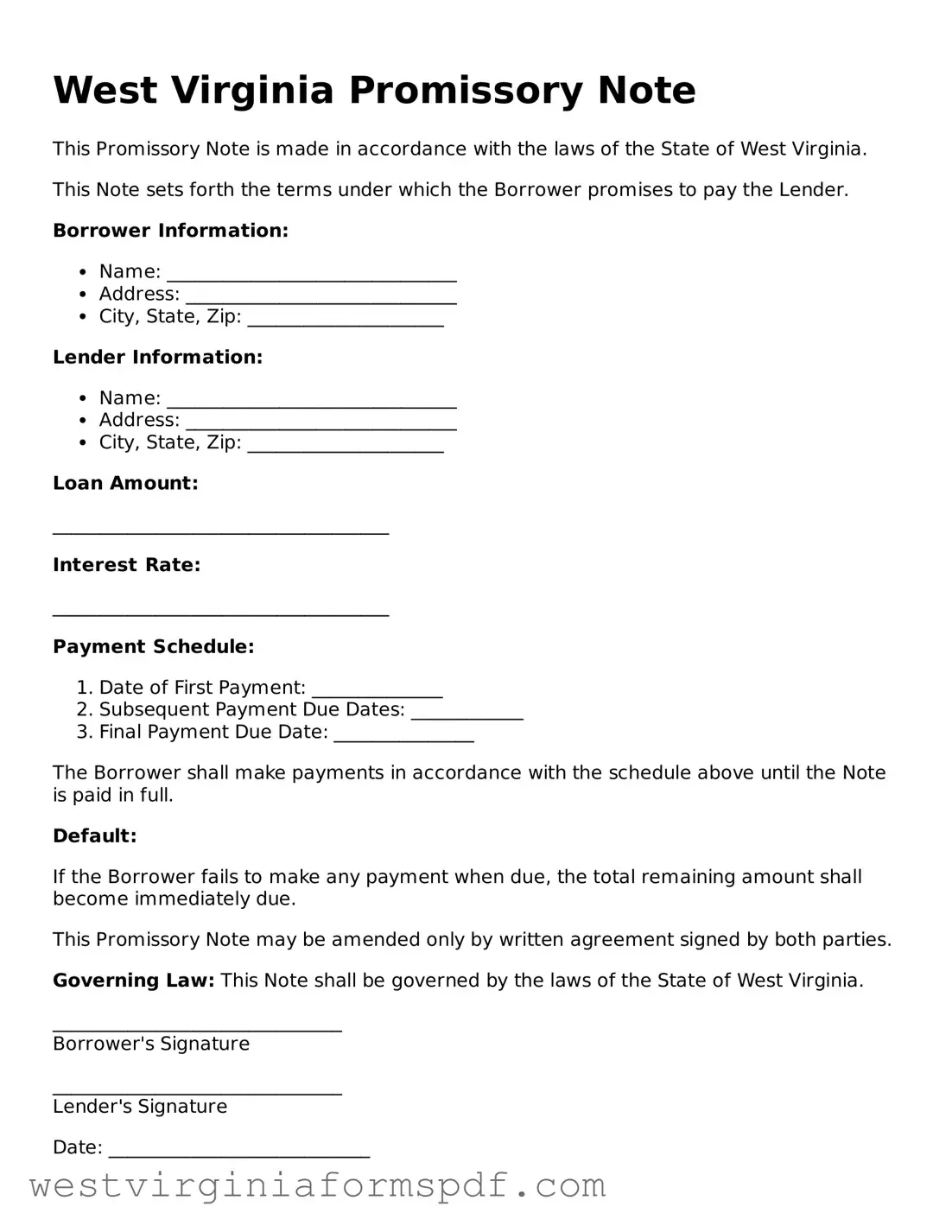

In West Virginia, a Promissory Note serves as a crucial financial document that outlines a borrower's promise to repay a loan under specified terms. This form typically includes essential details such as the amount borrowed, the interest rate, and the repayment schedule. It may also specify the consequences of default, providing both parties with clarity and protection. The document is often signed by the borrower and may require a witness or notary to ensure its validity. Understanding the components of the Promissory Note is vital for anyone engaging in a lending agreement, as it helps to establish trust and accountability between the lender and borrower. By laying out the terms clearly, this form can prevent misunderstandings and disputes, making it an important tool in personal and business finance within the state.

Consider Other Common Templates for West Virginia

How to Get a Power of Attorney in Virginia - This documentation is a critical part of older adults’ financial planning strategies.

West Virginia Power of Attorney Requirements - Submitting this form can help ensure your child's needs are prioritized.

The Aaa International Driving Permit Application form is a crucial document for travelers who wish to drive overseas. This permit allows you to legally operate a vehicle in countries that recognize it, making your adventures more accessible and enjoyable. To start your journey, fill out the form by clicking the button below, or visit the Cross-Border Driving License Request for more information.

Wv Divorce Property Settlement Agreement - Ultimately, the Divorce Settlement Agreement is a foundational document for a respectful separation.

File Attributes

| Fact Name | Details |

|---|---|

| Definition | A promissory note is a written promise to pay a specific amount of money at a specified time or on demand. |

| Governing Law | The West Virginia Uniform Commercial Code governs promissory notes. |

| Parties Involved | Typically, a promissory note involves a maker (borrower) and a payee (lender). |

| Interest Rate | The interest rate can be fixed or variable, as agreed upon by both parties. |

| Payment Terms | Payment terms must be clearly outlined, including due dates and payment methods. |

| Signature Requirement | The maker must sign the note for it to be legally binding. |

| Enforceability | A properly executed promissory note is enforceable in a court of law. |

| Default Consequences | If the maker defaults, the payee may pursue legal action to recover the owed amount. |

| Transferability | Promissory notes can be transferred to other parties unless otherwise stated. |

| State-Specific Considerations | West Virginia may have specific requirements regarding notarization and witness signatures. |

Similar forms

The West Virginia Promissory Note form shares similarities with a Loan Agreement. Both documents serve as a formal acknowledgment of a borrowed amount and outline the terms of repayment. A Loan Agreement typically details the interest rate, repayment schedule, and any collateral involved. While a promissory note may be simpler and more straightforward, both documents create a legal obligation for the borrower to repay the lender. They also provide a clear record of the transaction, which can be crucial in the event of disputes.

Another document akin to the Promissory Note is the Mortgage Agreement. This agreement is often used when a borrower secures a loan with real property as collateral. Like a promissory note, a Mortgage Agreement outlines the terms of the loan, including repayment terms and interest rates. However, it also includes specific details about the property being mortgaged and the lender's rights in the event of default. Both documents establish a borrower’s commitment to repay, but the Mortgage Agreement adds an additional layer of security for the lender.

A third document that resembles the Promissory Note is the IOU (I Owe You). An IOU is a more informal acknowledgment of a debt, typically lacking the detailed terms found in a promissory note. While an IOU may not always be legally enforceable, it still signifies a promise to repay a specific amount. Both documents indicate a borrower’s intent to repay, but the IOU is often used in casual situations, whereas a promissory note is more formal and structured.

In addition to these documents, you may also explore options to simplify your invoicing process with tools available at smarttemplates.net, where you can find customizable templates that cater to a variety of business needs, ensuring that your transaction records remain organized and efficient.

The West Virginia Promissory Note also bears a resemblance to a Personal Loan Agreement. This type of agreement outlines the terms under which an individual borrows money from another individual or institution. Like a promissory note, it specifies the loan amount, interest rate, and repayment schedule. However, a Personal Loan Agreement may include additional clauses regarding fees, penalties for late payments, and other specific terms tailored to the relationship between the parties involved. Both documents establish a clear framework for the borrowing process.

Lastly, the West Virginia Promissory Note is similar to a Business Loan Agreement. This document is utilized when a business borrows funds from a lender. Like a promissory note, it details the loan amount, interest rate, and repayment terms. However, a Business Loan Agreement may also address aspects unique to business operations, such as the purpose of the loan and potential impacts on business cash flow. Both documents create a binding obligation for repayment, yet a Business Loan Agreement often includes more complex terms reflecting the nature of business financing.

FAQ

What is a West Virginia Promissory Note?

A West Virginia Promissory Note is a written promise to pay a specific amount of money to a designated person or entity at a specified time or on demand. It serves as a legal document outlining the terms of the loan or debt agreement between the borrower and the lender. This note can be used for various types of loans, including personal loans, business loans, and real estate transactions.

What are the key components of a Promissory Note?

Typically, a Promissory Note includes several essential components:

- Principal Amount: The total amount of money being borrowed.

- Interest Rate: The rate at which interest will accrue on the borrowed amount.

- Payment Schedule: Details on when payments are due, including the frequency (monthly, quarterly, etc.).

- Maturity Date: The date by which the loan must be fully repaid.

- Signatures: Signatures of both the borrower and lender, which indicate agreement to the terms.

Is a Promissory Note legally binding in West Virginia?

Yes, a Promissory Note is legally binding in West Virginia, provided it meets certain criteria. The document must clearly outline the terms of the agreement and be signed by both parties. If one party fails to uphold their end of the agreement, the other party may seek legal remedies to enforce the terms of the note.

Do I need a lawyer to create a Promissory Note?

While it is not legally required to have a lawyer draft a Promissory Note, it is advisable in many cases. A lawyer can help ensure that the document is properly structured and that all necessary terms are included. This can help prevent misunderstandings or disputes in the future. If the transaction involves a significant amount of money or complex terms, consulting a lawyer may be particularly beneficial.

Can a Promissory Note be modified after it is signed?

Yes, a Promissory Note can be modified after it has been signed, but both parties must agree to the changes. It is important to document any modifications in writing and have both parties sign the updated agreement. This helps to avoid confusion and ensures that both parties are aware of the new terms.

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults on the Promissory Note, the lender has several options. The lender may initiate legal action to recover the owed amount. This could involve filing a lawsuit or seeking a judgment against the borrower. Additionally, the lender may pursue other remedies, such as garnishing wages or seizing collateral if the loan was secured. It is crucial for both parties to understand the implications of default before entering into the agreement.

Documents used along the form

A West Virginia Promissory Note is a crucial document for outlining the terms of a loan between a borrower and a lender. However, it is often accompanied by various other forms and documents that help clarify the terms of the agreement and protect the interests of both parties. Below is a list of related documents that are commonly used alongside a Promissory Note in West Virginia.

- Loan Agreement: This document details the terms and conditions of the loan, including the interest rate, repayment schedule, and any collateral involved.

- Security Agreement: If the loan is secured, this document specifies the collateral that the borrower offers to the lender as security for the loan.

- Asurion F-017-08 MEN Form: To streamline your claims process, refer to the important Asurion F-017-08 MEN documentation features that outline the essential components of consumer protection.

- Disclosure Statement: This statement provides the borrower with important information about the loan, such as fees, interest rates, and the total cost of borrowing.

- Personal Guarantee: This document is signed by a third party who agrees to be responsible for the loan if the borrower defaults.

- UCC Financing Statement: Filed with the state, this document gives public notice of the lender's security interest in the collateral provided by the borrower.

- Amortization Schedule: This table outlines each payment due over the life of the loan, showing how much of each payment goes toward principal and interest.

- Payment Receipt: A simple document acknowledging that a payment has been made by the borrower to the lender.

- Default Notice: This document informs the borrower of any missed payments and outlines the consequences of defaulting on the loan.

- Loan Modification Agreement: If the terms of the original loan need to be changed, this document outlines the new terms agreed upon by both parties.

- Release of Lien: Once the loan is paid off, this document is issued to confirm that the lender no longer has a claim on the collateral.

Using these documents alongside a West Virginia Promissory Note helps ensure that all parties understand their rights and obligations. Proper documentation can prevent misunderstandings and provide a clear framework for resolving disputes should they arise.

Dos and Don'ts

When filling out the West Virginia Promissory Note form, it is important to follow certain guidelines to ensure accuracy and compliance. Here is a list of things you should and shouldn't do:

- Do read the entire form carefully before starting.

- Do provide accurate information, including names and addresses.

- Do specify the loan amount clearly.

- Do include the interest rate if applicable.

- Do state the repayment terms clearly.

- Don't leave any required fields blank.

- Don't use unclear language or abbreviations.

- Don't forget to date the document.

- Don't sign the form until all parties are present.

- Don't ignore local laws that may affect the note.